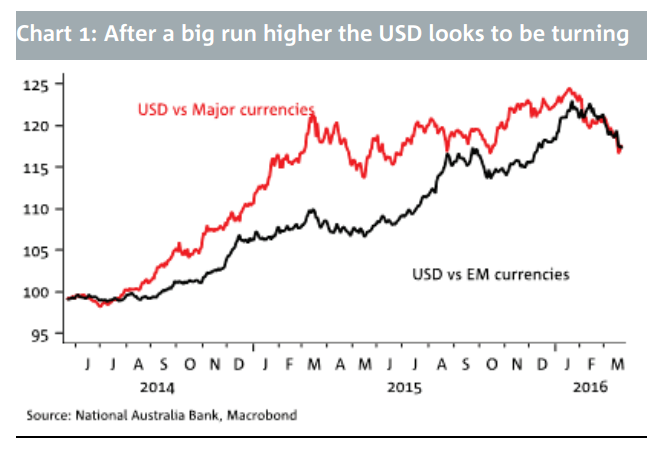

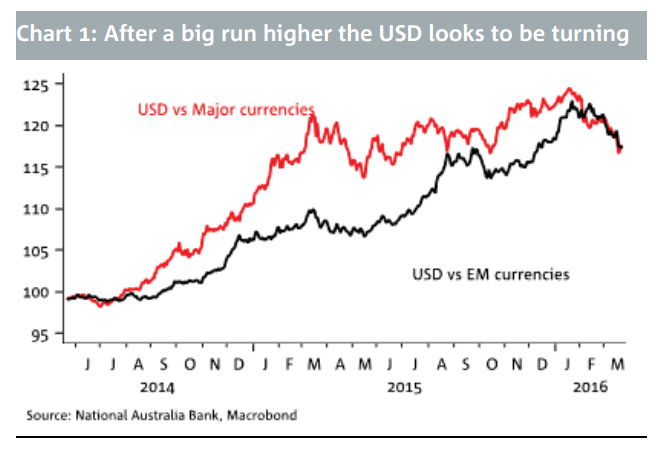

The US dollar is not looking as strong as it used to be. The team at NAB analyzes:

Here is their view, courtesy of eFXnews:

Policy announcements from the ECB and the Fed in the last few weeks go some way to support the theory that G20 Central Bank governors came to a tacit agreement at their February Shanghai gathering that policy pronouncements in recent months had not been conducive to financial stability and instead exacerbated the ‘global economic and financial developments’ the FOMC talked of in its March Statement.

To this end and to the extent that Central Banks are able, the theory is that going forward they will attempt to be more coordinated in future policy initiatives and will consider the global economic and financial impact of policy shifts rather than just their own domestic backdrop.

Is this view credible? If it is it could signal a USD top is in, allowing for a period of renewed risk-seeking behaviour that sees the USD fall a little further, only for it to recover some ground ahead of a potential June Fed hike.

Were that to be the case, however, we’d suspect any USD recovery into June and maybe out the other side would be reasonably modest and not sufficient to recapture its highs of January where it peaked after a 25% broad gain, marking multi-year highs against major and EM currencies. The thinking here is if the Fed and others in G20 are genuine about co-operation then there’s an argument for the Fed at least to keep any Fed policy-driven USD gains limited by emphasising the downside risks to the economy. This plays to a gradualist approach to any further tightening to limit risks of a ‘wash, rinse, repeat’ of last August’s and this January’s ructions.

Accordingly we make minor adjustments to our G3 USD forecasts to take account of this view. If our language however seems slightly evasive it is because central banks are making a frustrating habit of wrong footing observers and investors. Whether this is by design or the result of having little clear idea themselves and thus being at the mercy of markets is not clear – we have our suspicions.