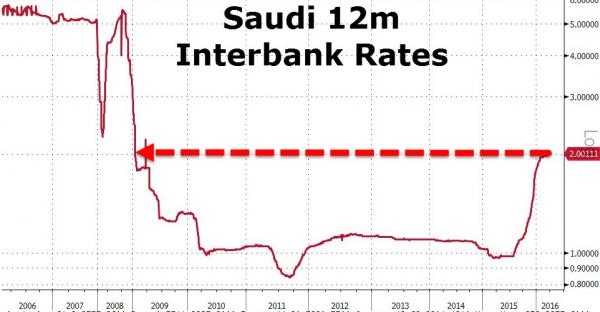

For the first time since January 2009, 12-month Saudi Interbank rates have breached 2.00% – double the 1% lows of August.

This ‘stress’ is also evident in the record pace of collapse of Saudi money-supply.

While Riyal forwards have rallied back from extreme bets on devaluation, they remain concerning for Saudi officials who to undertake some deep and fundamental changes to their economy, reforms that no amount of browbeating from organizations like the IMF could induce.

As OilPrice.com’s Nick Cunningham details, a new report from The Atlantic Council finds that the extensive decline in oil revenues is focusing minds in Riyadh. The fiscal pressure is forcing “the kingdom’s leadership to modernize the economy,” the report concludes.

Saudi Arabia ran a fiscal deficit of about $98 billion in 2015, a figure that will decline only slightly to $87 billion this year. That deficit total is also probably closer to $120 billion in reality though, given that the costs from the war in Yemen were not included.

The fiscal squeeze is forcing some changes. First, the Saudi government is looking at new taxes, including a 5 percent value added tax (VAT). That may seem like a run-of-the-mill austerity measure, but for Saudi Arabia it is a novel proposal: it will be the first tax imposed in the country.

More to the point, the VAT is illustrative of where Saudi Arabia is heading. The Atlantic Council argues that the kingdom is starting to reform its economy in fundamentally positive ways. Low oil prices are forcing it to rely more upon taxes and less on oil revenues. That would start to make Saudi Arabia less of a “rentier state,” a country that has no need to build much of an economy because resource extraction is so lucrative. Rentier states often suffer from greater corruption and a deeper lack of responsiveness to the needs of the public, since abundant oil revenues mean that the government does not need revenue from its populace.