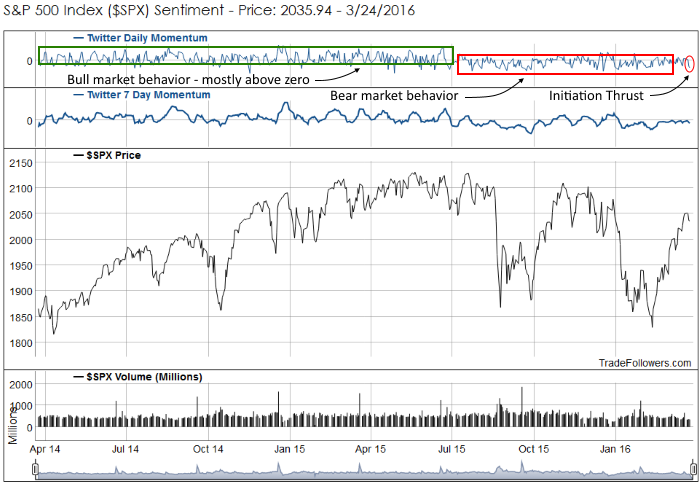

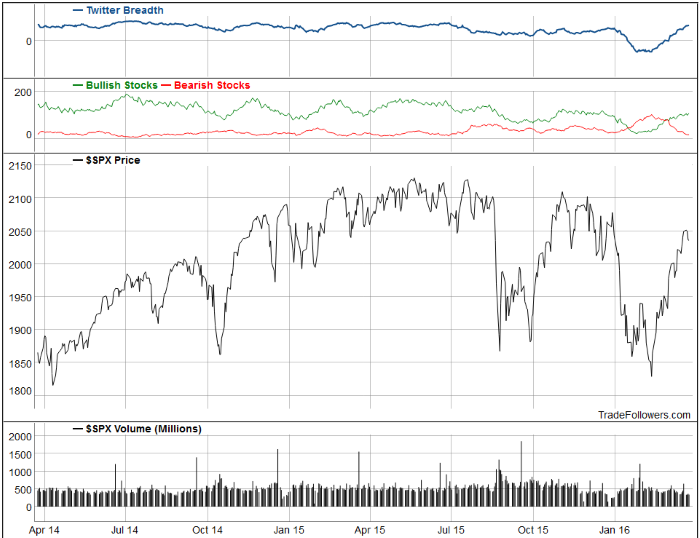

Over the past two weeks I’ve been expecting a short term top (at the least). It appears that the selling has started. The first evidence comes from daily momentum and sentiment for the S&P 500 Index (SPX) generated from the Twitter stream. It printed a -21 on Thursday, which I consider an initiation thrust. When large negative prints occur near a market peak it usually results in at least a few more days of selling. That’s during a long term uptrend. If we’re in a long term downtrend then the selling could last much longer. Notice the daily indicator is spending a lot more time below zero than above, which is clearly bear market behavior.

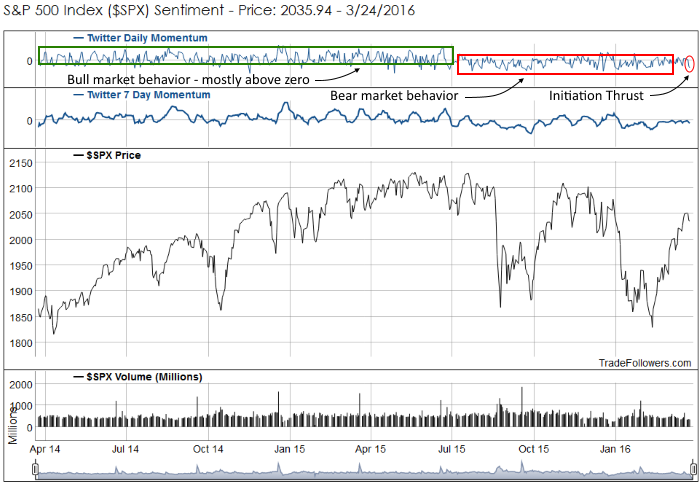

Another sign that selling has started is negative weekly readings for a majority of sectors after two weeks of all positive readings. The buying across all sectors has stopped, which should result in a market wide dip.

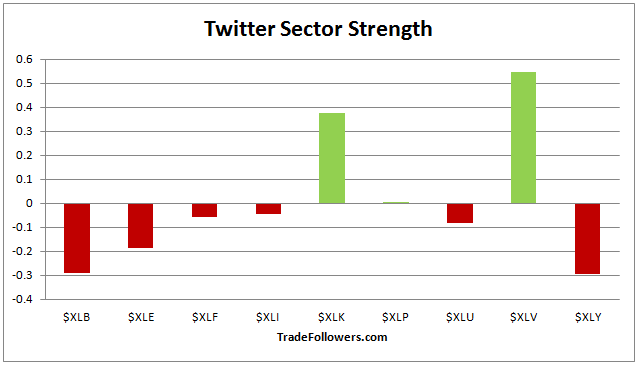

From a price perspective, traders are tweeting the 200 dma as support, but not much below that. If 2025 on SPX breaks there is a tiny bit of support at 2000 then lots of white space all the way to 1810. When traders aren’t tweeting support it indicates indecision, which often results in steep declines.

Breadth continues to improve. This is one of the few signs that we may not be in a bear market.

Conclusion

The short term top is likely behind us and some consolidation is in order. The initiation thrust from daily sentiment and lack of buying in a majority of sectors suggests the selling has started. Bulls want to see traders tweeting support closer to current levels (rather than way down at 1810 on SPX) or we risk a waterfall decline.