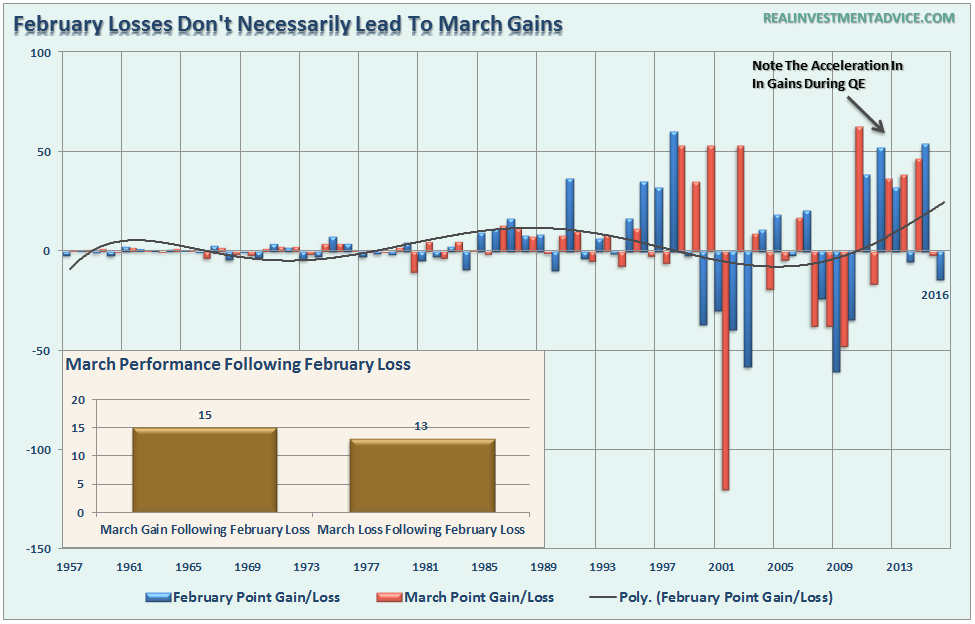

At the beginning of this month, I discussed the monthly statistics for March. To wit:

“It is often the case that the month following a negative return month will post a positive return as markets bounce from oversold conditions. However, as shown below, this is not always the case.

The chart below shows both February and March returns going back to 1957. During that period, the month of March has posted gains following a February loss 15 times, and losses following a February decline 13 times. Again, at 53.6%, the odds aren’t much better than a coin toss at best.”

One interesting note about the chart above is the sharp increase in monthly market volatility since the turn of the century as computers, online-trading, and algorithms took over the markets. Also, QE programs accelerated returns during the post-financial crisis period which has positively skewed the statistical analysis.

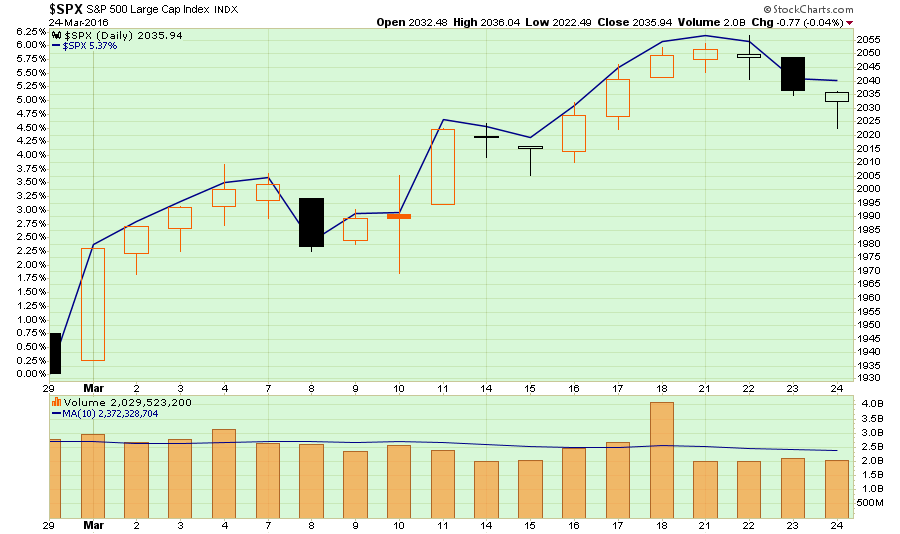

While the month is not over as of yet, the current 5.37% advance is within the context of previous market rallies since 1997.

With the majority of short-covering appearing to be complete, and volume on a steady decline, we may have seen a bulk of the reflexive bull rally already. As noted by Dana Lyons earlier today:

Always useful to observe behavior on days like yest: e.g. Rydex traders covered signif % of shorts;bear assets not low, but lowest since 2/1

— Dana Lyons (@JLyonsFundMgmt) March 24, 2016

With April wrapping up the seasonally strong period of the year, the seasonal adjustment boost to economic data coming to an end, and earnings growth remaining elusive – the summer months could prove to be problematic. For now, we will have to wait and see what develops.

With that, I just want to wish you all a very happy, safe and joyful Easter weekend.

CENTRAL BANKING