Photo Credit: Mike Mozart

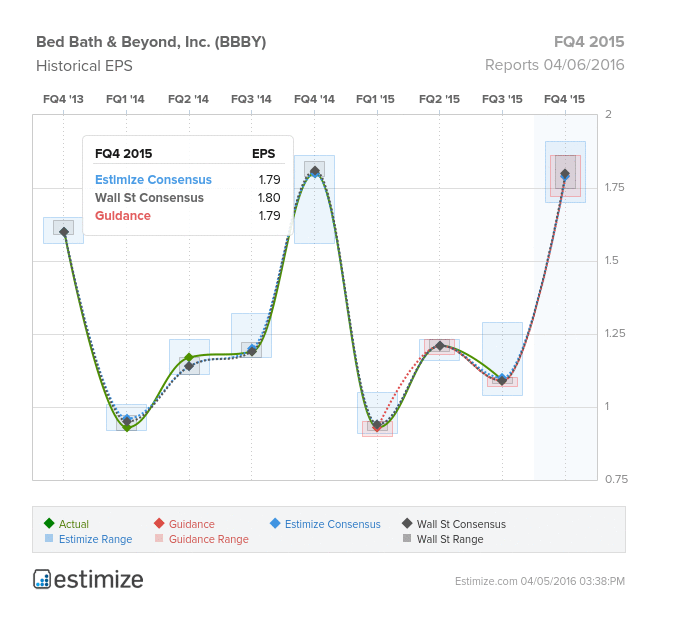

Bed Bath & Beyond, Inc (BBBY) Consumer Discretionary – Specialty Retail | Reports April 6, After Market Closes

Key Takeaways

Specialty retail chain, Bed Bath & Beyond, is scheduled to report Q4 2015 earnings Wednesday, after the market closes. The home retailer is coming off a weaker than expected third quarter where it missed revenue guidance by $50 million. In fact, Bed Bath & Beyond has missed on the top line in each of the past 5 quarters and expects to do so again tomorrow. The Estimize community is calling for EPS of $1.80 on revenue $3.38 billion, right in line with the Wall Street consensus. Our Select Consensus, on the other hand, is expecting a modest loss of 1 cent and almost $10 million. Compared to the same period last year, EPS and revenue are forecasting relatively flat growth. Given Bed Bath & Beyond’s track record, it is not surprising that they only beat the Estimize community in 41% of reported quarters.

After a weak holiday season, BBBY indicated that comp sales increased a meager 1%. Higher inventory acquisition expenses, combined with increased coupon redemptions have weighed down revenue and margins. Unlike its peers, BBBY has found little success in its omni channel networks which have been stagnant in recent quarters. That said, the company is still expected to continue its growth strategy throughout 2016 which encompasses lowering its free shipping threshold. Additional investments in brick and mortar and online growth will continue to put pressure on earnings for fiscal 2016.