We’ve all heard a steady drumbeat of negative developments about oil, bad debt, sluggish economies, blah, blah for well over a year now. And we’ve seen some unsettling rallies in the VIX associated with all this, but now the AAII Sentiment Survey has just a 24% bearish reading. The mean is about 30% with one standard deviation from the mean being 21%. So we are nearing this extreme level of lack of fear in the stock markets right now. The last time it was one standard deviation or more too low was back in November – when we should have been very afraid.

Have all these problems that have gradually edged the average value of the VIX up for many months now, magically gone away? No, if you bother to check, they are actually getting worse, as I have discussed in some of my recent articles. Are we in denial? Are we inebriated? Just what is our mental state?

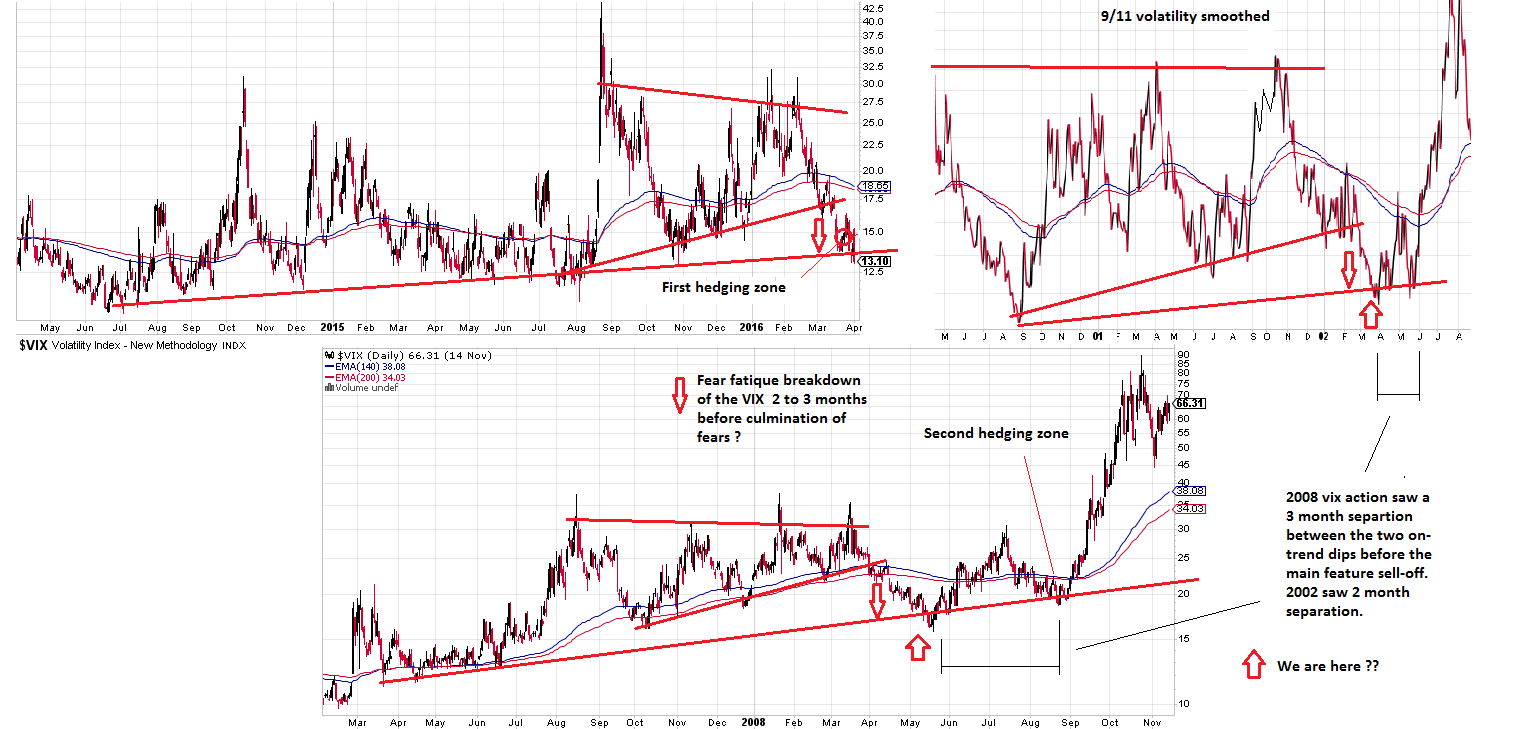

The only thing I can figure is a kind of fear fatigue where investors know there are serious problems for the market, but they are just tired of hearing about them. They maybe just start viewing it all as the wall of worry that seems to permeate markets most of the time. That justifies investing in bull markets, which climb the proverbial wall of worry, but it also seems to be a repeating pattern in approaching bear markets. We are seeing a repeat of the VIX reaction to the approach of the 2002 market collapse and the 2008 episode:

The upward sloping support line shows a gradually increasing unease with investors over a period of many months, then a massive VIX spike into the classic pennant formation. Then there follows a break of the pennant back down to the more gradual encroachment of fear.Here the market becomes tranquil, sentiment is rosy, and investors are tired of hearing “wolf”.

But this appears to be the danger point when a turn back up in fear begins.In 2002 and 2008, there is one more fade of VIX back to the support trend before the major collapse begins. We are at the first touch of the trend line now in the 2016 version of this pattern. There is certainly no guarantee of a repeat of the past, but markets do tend to move in repeating patterns controlled by human psychology. And the fear index is certainly one of the most psychological of them all.