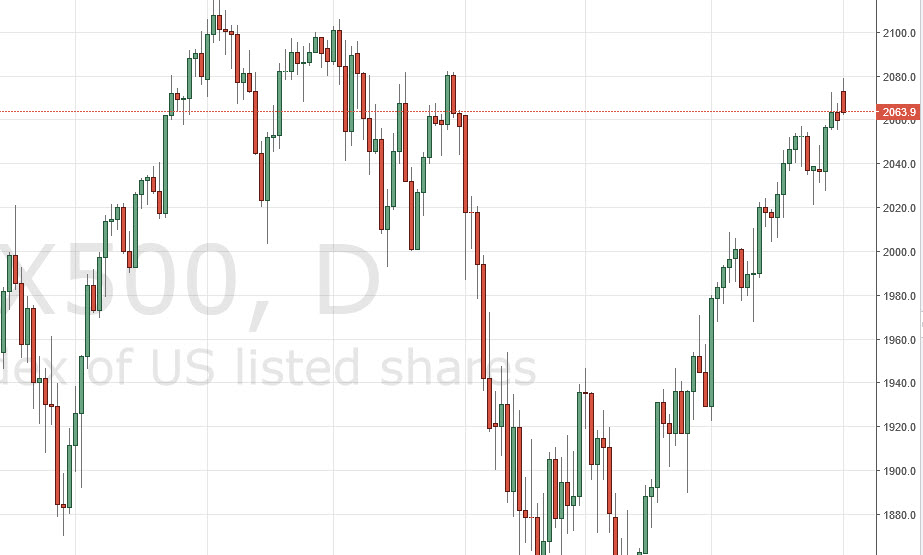

S&P 500

The S&P 500 initially rose during the course of the day on Monday but found the 2080 handle to be a bit too resistive. However, it should be noted that the initial move higher was a gap, and that typically means an impulsive move that will get followed. With that, it’s very likely that the buyers will return to this market sooner or later, and I’m looking at a couple of areas for potential value and support.

I believe that the 2060 level could offer support, but I also believe that the 2040, 2020, and most certainly the 2000 level will also be very supportive. In fact, I believe that as long as we stay above the 2000 handle, you have to believe that we are still in an uptrend. We are getting towards the top of a very noisy area though, so we may see pullbacks from time to time in order to build up momentum.

Nasdaq 100

The Nasdaq 100 did gap higher at the open on Monday, and then spent the rest the day falling. We’ve not completely filled the gap though, so we may get a little bit more negativity but I believe that eventually the buyers will step in and push this market higher. That should send this market looking for the 4725 level given enough time but I think that there is a lot of noise between here and there. Quite frankly, the easiest way to trade this market is probably going to be buying dips on short-term charts as although it is a very positive market, it is going to be very noisy and choppy between here and there.

I believe that the 4400 level will continue to be the floor in the market, and that as long as the Federal Reserve looks likely to step away from some interest-rate hikes this year, it should keep the bond markets rather unattractive and will force money into the Nasdaq 100.