Photo Credit: Yukiko Matsuoka

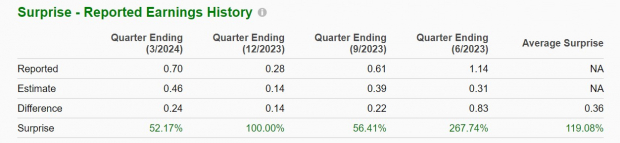

To say that European banks’ performance has been disappointing, is an understatement. Since the European debt crisis started, the S&P 500 appreciated more than 100%, while Santander (SAN) and Deutsche Bank (DB) lost more than 50%. The difference in relative performance is brutal.

Graph 1 – S&P vs Deutsche Bank, Santander and BNP Paribas

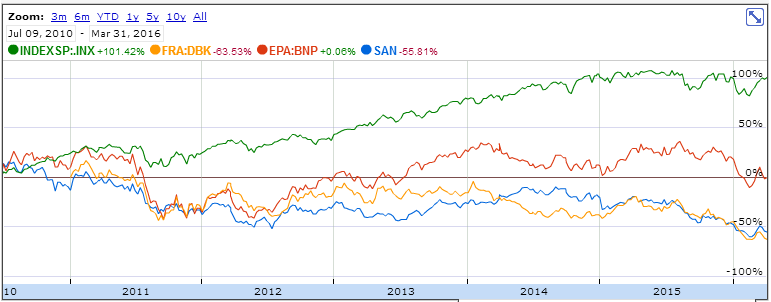

The first intriguing sign, however, lies on the fact that US banks didn’t perform that bad. For instance, Wells Fargo (WFC) performed just slightly below the S&P 500. Based on this, we can conclude that the severe under-performance is not a systemic phenomenon common to the whole industry.

Graph 2 – S&P vs JP Morgan, Wells Fargo and Bank of America

Therefore, the root cause must lie elsewhere. To dissect this, I’ll use two banks from the previous analysis: Santander and Wells Fargo. Both are conservative commercial banks that provide a good representation of the economies where they operate while at the same time they are in the opposite sides in terms of stock market performance.

The Santander case

Several analysts have pointed to a deterioration in the Brazilian economy and the recurrent woes about Spain as threats to healthy capital ratios and, therefore, the main cause for under-performance. Even Ana Botín has stated on Santander’s 2015 Annual Report:

“(…) our market valuation has fallen by 36%. This is probably related to a different perception of the strength of our capital and the extent of our regulatory capital buffers and to the concern about our presence in certain emerging markets.”