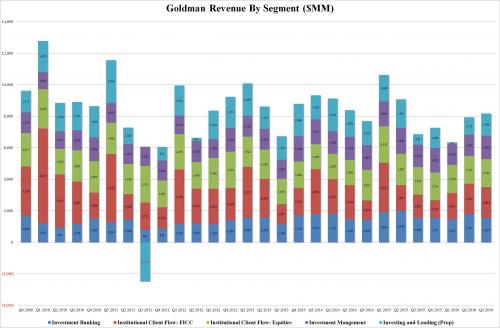

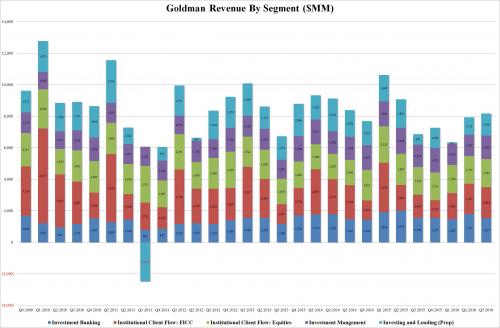

After the rest of the major US banks posted solid beats, mostly on the back of a strong rebound in markets-driven revenue, there was little concern that Goldman Sachs (GS) – the pure-play trading powerhouse (at least until the recent launch of a retail lending and deposit operation) would likewise surpass Wall Street’s expectations, and moments ago that was confirmed when Goldman reported EPS of $4.88, smashing expectations of $3.86, as profit jumped 47% from a year ago to $2.1 billion. The profit beat was driven by a 19% spike in revenue which rose from $6.9 billion to $8.2 billion, beating consensus estimates of $7.6 billion.

Goldman said its return on equity stood at 11.2% in the third quarter. It was 7% in the year-earlier quarter and hadn’t exceeded 10%—the firm’ theoretical cost of capital—since early 2015.

The main reason for the rebound was a 34% surge in FICC revenue, which jumped from $1.461 billion to $1.784 billion, as well as surge in the firm’s prop trading aka “Investing and Lending” revenue, soaring by 109% to $1.398 billion in Q3. A notable outlier on an otherwise pristeen report was the 12% decline in Commissions and Fees, which declined to $719 million, and suggested that traditional methods of generating trading revenue continue to fade.

Also notable is that Investment Banking revenue dipped by 1% to $1.5 billion as a result of the recent scarcity in blockbuster M&A deals.

Some other details from the report: