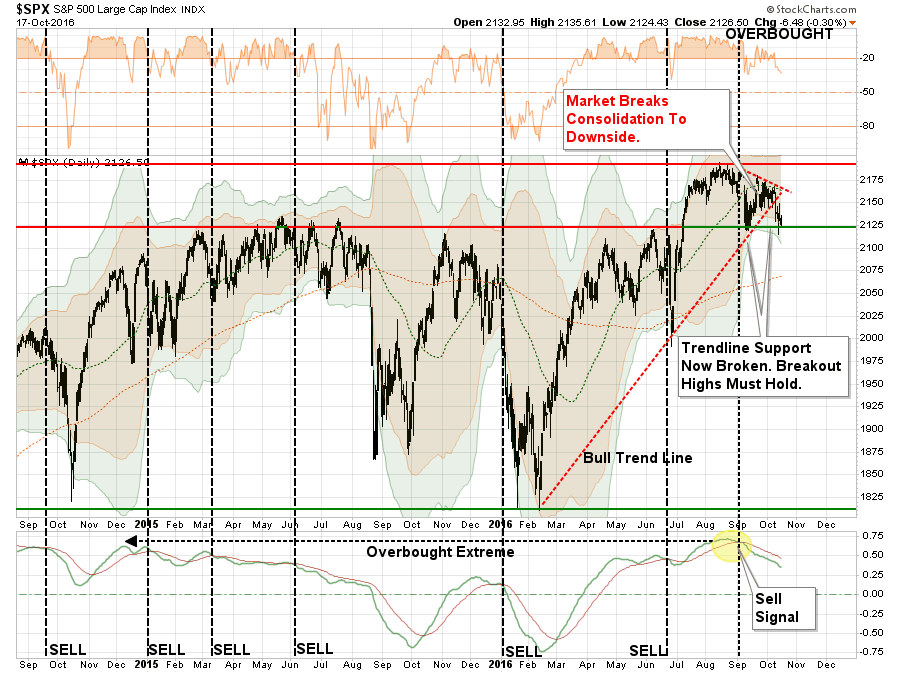

Last Tuesday, I noted that a market decision was coming soon. It came sooner than I anticipated with a sell-off that broke the bullish trend line from the February lows. To wit:

“A major decision point is rapidly approaching which will decide the fate of the market for the rest of the year.”

In the daily price chart below, the break of that bullish trend line is clearly evident.

“Notice in the bottom part of the chart the market currently remains on a sell signal. That sell signal is problematic for two reasons:

1) ‘Sell signals’ combined with overbought conditions tend to lead to at least short-term corrections.

2) ‘Sell signals’ formed at very high levels, such as currently, suggests limited upside and larger correction probabilities.”

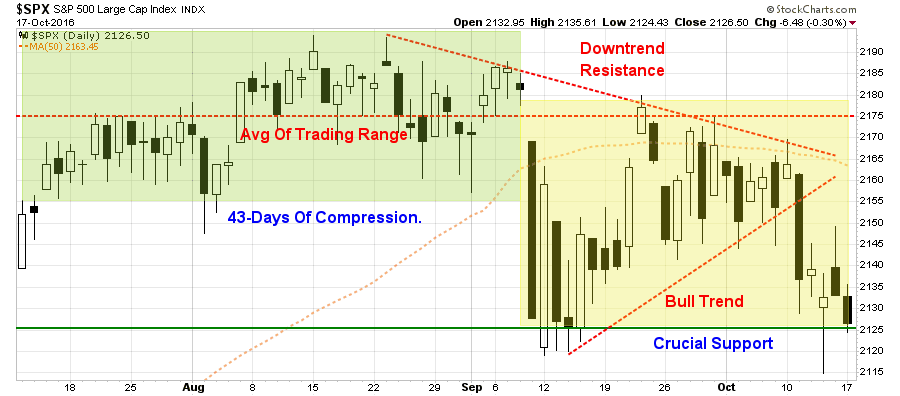

Let’s zoom in on the recent price action in the chart above. The chart below is the last 3-months of daily price movement. As you will see, while prices have been quite volatile, there has been virtually no progress in the market during the period.

The most critical aspect of the breakdown currently is the very critical support line that is running at 2125 currently. That support line is, as shown in the next chart below, is the breakout of the market from the May 2015 closing highs.

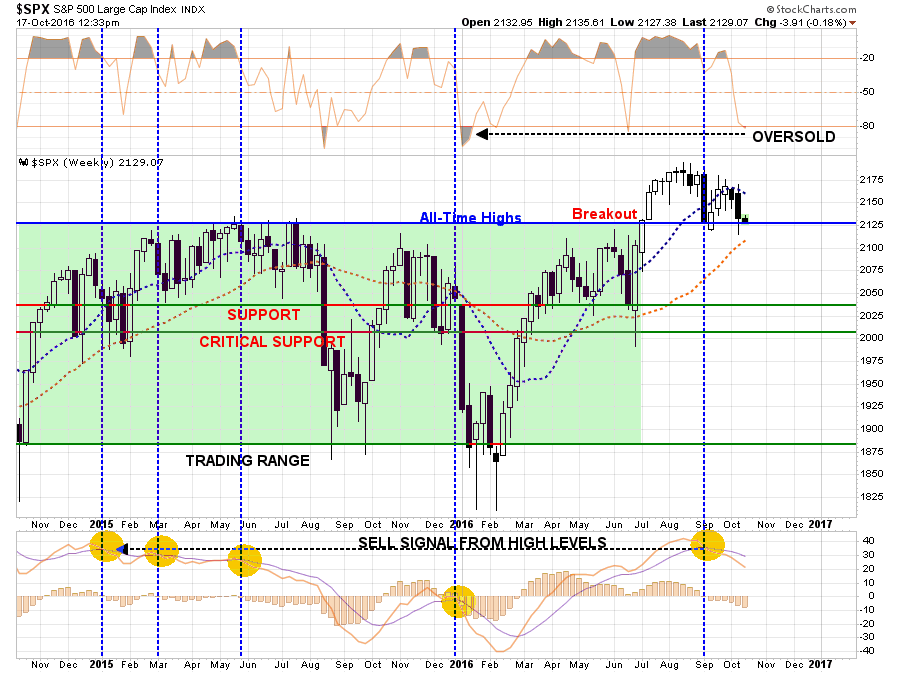

Again, you will notice in the bottom part of the chart, a “sell signal” has been triggered from very high levels. This signal alone suggests the market will have trouble making a significant advance from current levels until this condition is resolved.

Also notice, in the top part of the chart, the market is oversold on a weekly basis currently. However, when that oversold condition existed in conjunction with a “sell signal” previously, there was further downside left in the corrective process.

With that being said, it is critical for the markets to “hang on” to current support at the previous breakout highs. A failure to do so will put the markets back into the previous trading range that has existed going back to 2014.