Well, I’ll say this for Wells Fargo (whose research I maligned on Thursday prompting an amusing response from the bank’s help desk): they are dead on when it comes to explaining how US operators didn’t seem to learn jack sh*t from the downturn in crude prices.

Here’s what the bank said in a great note out last month:

Right. This entire model is a deflationary charade that revolves (quite literally when you count revolvers as a means of plugging funding gaps) around easy access to capital to fund outspend. More than a few of these companies aren’t really viable and when the going gets tough, they’ve got three options as delineated last year by Ali al-Naimi:

Lower costs, borrow cash or liquidate.

Assuming US shale has reached a near-term limit in terms of exploring option number one, and assuming option number two is only viable until capital markets get sick of funding this farce, then option three is probably where this is headed. And ironically, the more US operators produce, the quicker they’ll get there.

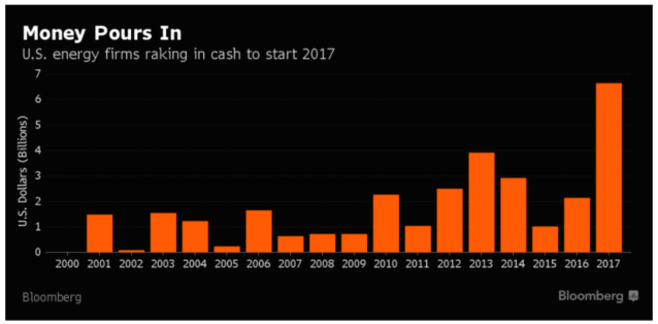

That assessment was underscored “bigly” this week as crude plunged to pre-OPEC-cut levels. But if we learned anything from January’s string of equity offerings…

… it’s that capital markets haven’t slammed shut quite yet, although I’d imagine that this week’s price action might be making some folks think twice about all those shares they bought in January.

Folks like the gullible idiots who didn’t realize that an IPO from a company with the ticker “FRAC” probably signaled that the market had gone full retard…

But you know, f*ck it, right? Let’s just keep acting like the writing isn’t on the wall.

Right, Citi? ….

Right, Goldman?….

Speaking of Goldman, the bank that said yesterday it’s best to “shake off” crude’s collapse (only to watch as crude collapsed-er-er on Friday) is out with a new note entitled “What Oil CEOs Are Saying: Confidence Is Back.” Below, find excerpts and do try not to laugh too hard as you compare and contrast with this: