With establishment pollsters panicking at the closeness of the first round of the French elections, it appears investors in every market – stocks, bonds, and FX – are just as concerned with hedges and risk premia at (or near) record highs across the board.

With just a few days to go before Sunday’s first round of voting, every poll for the past month has shown independent Emmanuel Macron and the National Front’s Marine Le Pen taking the top two spots. Macron would then easily win the May 7 runoff, polls show. Yet both front-runners have been steadily slipping over the past two weeks, and Republican Francois Fillon and Communist-backed Jean-Luc Melenchon are now within striking distance.

“This situation is totally unprecedented,” said Emmanuel Riviere, managing director of Kantar Public France. “The fact that there are four potential finalists makes the situation very complex.”

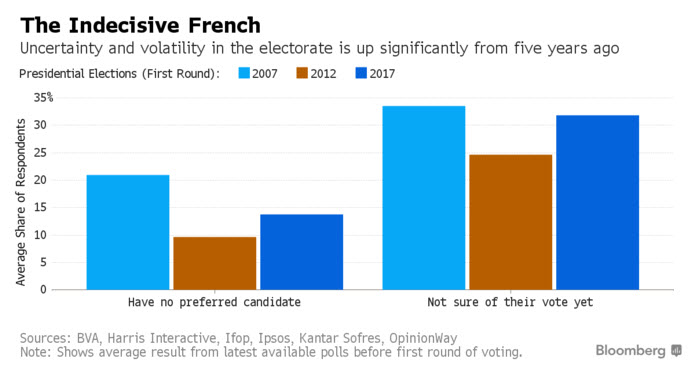

Most worrying for pollsters is the level of indecision among French voters

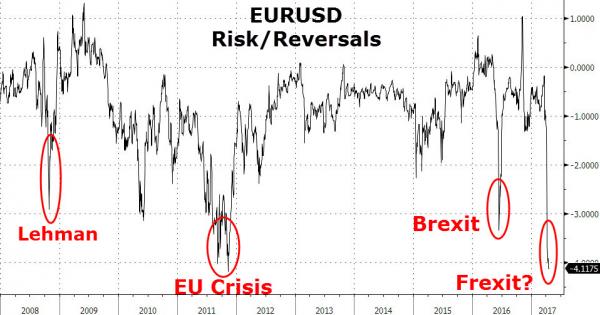

Which perhaps explains the record high hedges in EUR/USD (options to hedge against a collapse in the currency)…

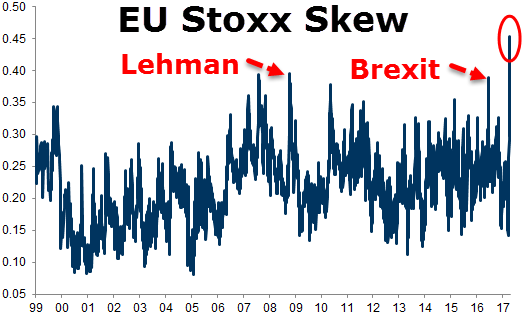

Equity investors have never been so hedged against downside – more than Lehman and Brexit…

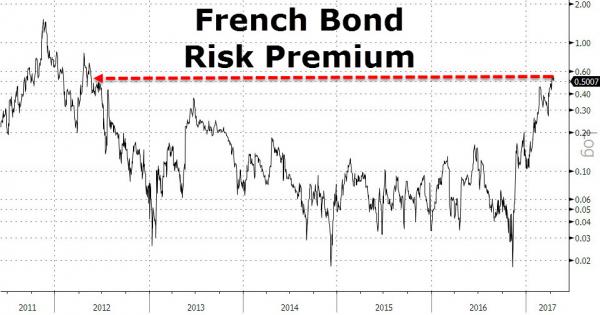

And bond investors have dumped OATs with both hands and feet…

With all these hedges on, BofA notes however, in hindsight, a large part of the risk premium in the run up to last year’s events could perhaps be attributed to uncertainty, the ‘unknown unknowns’. Once the event came to pass and investors overcame the initial shock of unexpected outcomes, focus shifted to the longer term strategic impact for which the market was happy to give the benefit of the doubt.

By nature, such events have consequences reaching far beyond the market’s time-horizon and it is difficult to pinpoint their price impact with any degree of confidence given the number of moving parts. It is perhaps fair then to expect a similar reaction this time around should the market get caught off guard once again – immediate volatility lasting a few days, followed by some calm as the market awaits clarity on actual policy.

Our European Strategists expect stocks in the region to rally in the event of a Macron or Fillon win and fall by 13-23% if Le Pen wins due to higher risk of France leaving the currency union/EU. They view financials and peripherals as particularly vulnerable to a Le Pen victory. This would imply significant widening in European credit spreads. And US credit is likely to take its cue from EU spreads.