…If you polled a handful of investors and asked them which stocks in the aerospace defense industry are most noteworthy for dividend payouts, it is likely you would get two answers: Boeing Co. (NYSE: BA) and Lockheed Martin Corporation (NYSE: LMT). Both of these stocks are solid picks for dividend investors, as they are well established and offer excellent yields. Let’s see how the two stack up.

Written by TheDividendManager.com

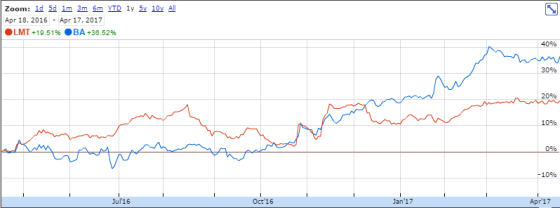

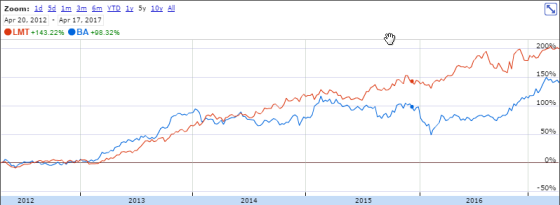

Stock Performance

In the last twelve months (shown below), both stocks have outperformed the S&P 500, which has increased 13% in the same time period. Boeing’s strong performance occurred during early 2017 due to positive earnings.

Lockheed has Boeing beat on the five-year chart, though. Boeing was hit hard by the January 2016 correction but was also hurt when it announced that it expected to deliver fewer planes in 2016 than it did in 2015, which would lower earnings estimates.

Dividend History

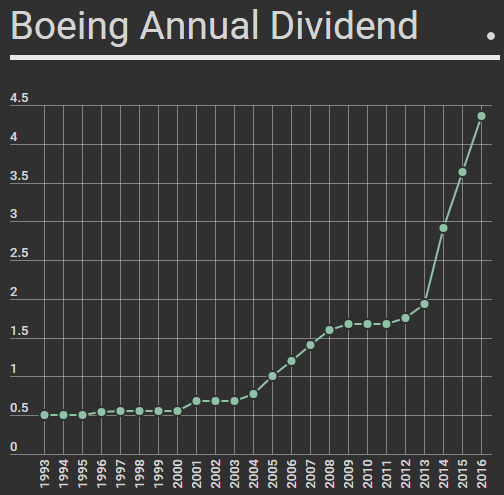

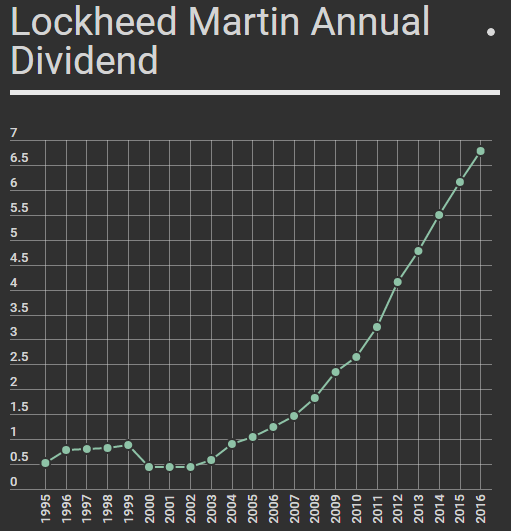

Neither of the companies are dividend aristocrats, but they both have pretty solid dividend histories.

Boeing has been paying a dividend since the 1940’s but has only been increasing its dividend consecutively on an annual basis since 2012. On average, the increases have been 10% a year.

Lockheed has been increasing its dividend every year since 2003. On average, its increases have been 22% annually. The company has paid a dividend since 2005.

Dividend Yield

Both stocks have great dividend yield, but Boeing is currently winning for best yield. On average, the industry offers a dividend yield of about 1%.

Earnings

Most companies have been (mostly) higher earnings since 2012. Lockheed Martin, however, surged last year, exceeding the earnings of Boeing.