Forecast for the EUR/USD currency pair

Technical indicators of the currency pair:

Prev Opening: 1.09276

Opening: 1.09032

Chg. % Of the last day: -0.21

Daily range: 1.08955 – 1.09209

52-week range: 1.0366 – 1.1616

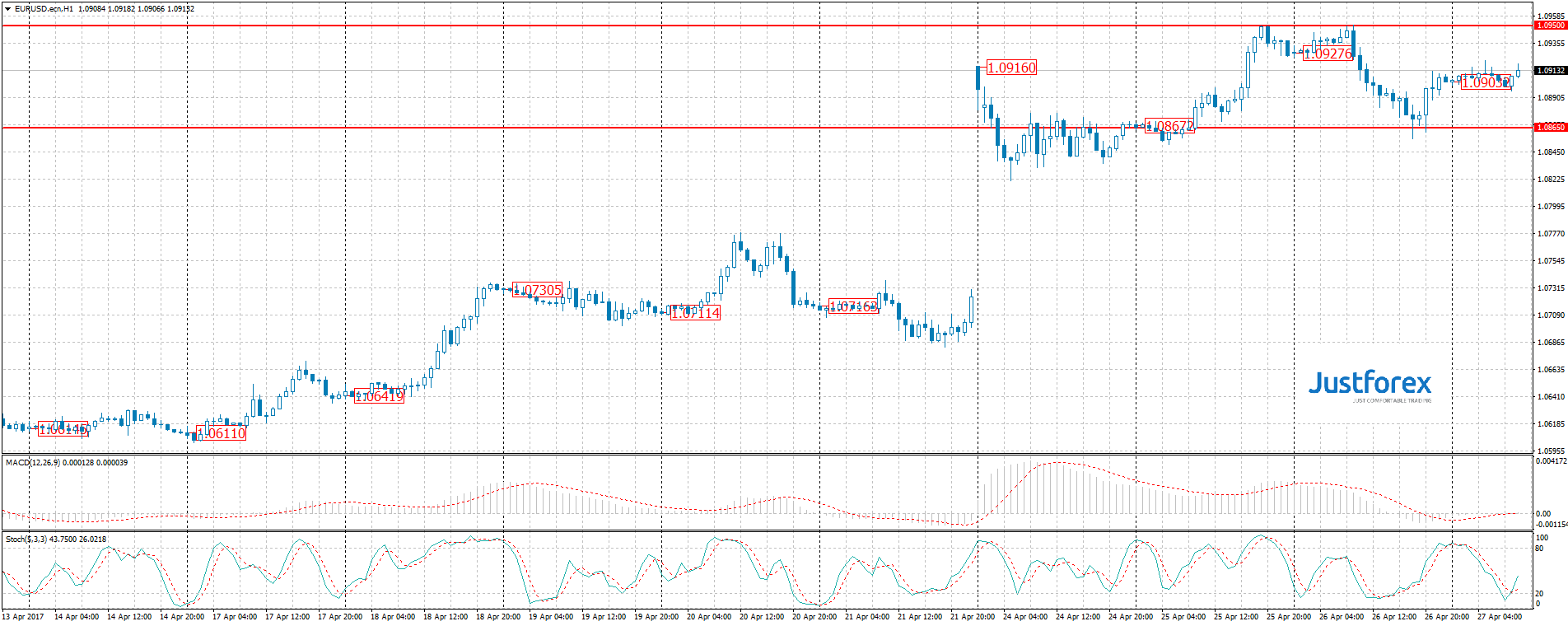

Yesterday, the correction was observed on EUR/USD. In the Asian trading session, the trading was calm. The ECB meeting will take place today. Most experts believe that the regulator will leave interest rates unchanged. It is necessary to pay attention to the comments of representatives of the Central Bank. At the moment, the key trading range is 1.08650-1.09500.

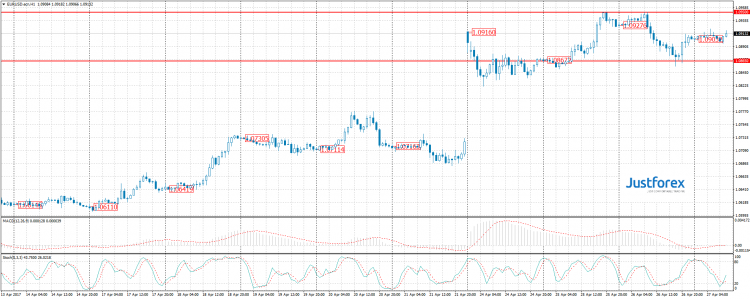

Indicators point to the strength of buyers. The MACD histogram began to rise and passed into the positive zone.

Stochastic Oscillator went out of the oversold zone, the %K line is above the %D line, which indicates bullish sentiment on EUR/USD.

At 14:45 (GMT+3:00), a decision will be taken on the interest rates of the ECB.

We also recommend you to pay attention to the following events:

– basic orders for durable goods in the US (15:30 GMT+3:00);

– the balance of foreign trade in goods in the US (15:30 GMT+3:00);

– the ECB press conference (15:30 GMT+3:00);

– the index of unfinished sales in the real estate market in the US (17:00 GMT+3:00).

Trading recommendations

Support levels: 1.08650

Resistance levels: 1.09500

We recommend waiting for the decision of the ECB. It is better to open positions from key levels.

If the price consolidates above the resistance level 1.09500, the growth of the EUR/USD currency pair may continue. The target level of movement is the round level of 1.10000.

An alternative may be the correctional movement. If the price consolidates below the level of 1.08650, we recommend considering sales. The movement is tending potentially to 1.08000.

Confirmations and entry points to the market should be looked for on the younger timeframes.

Forecast for the GBP/USD currency pair