Zymeworks (Pending:ZYME) filed an F-1 with the Securities and Exchange Commission.

The company plans to sell 4.5 million shares at a marketed price range of $13 to $16 in both the U.S. and Canada. The company has an additional 675,000 shares as an overallotment option for its underwriters. The joint book-running managers for the offering are Citigroup Global Markets Inc., Barclays Capital Inc. and Wells Fargo Securities LLC. The lead manager is Canaccord Genuity and the co-manager is Cormark Securities.

For our premium subscribers we previewed the deal here.

Business overview

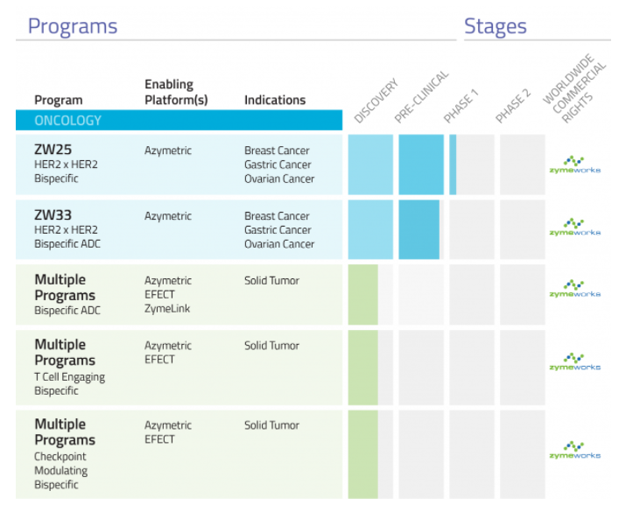

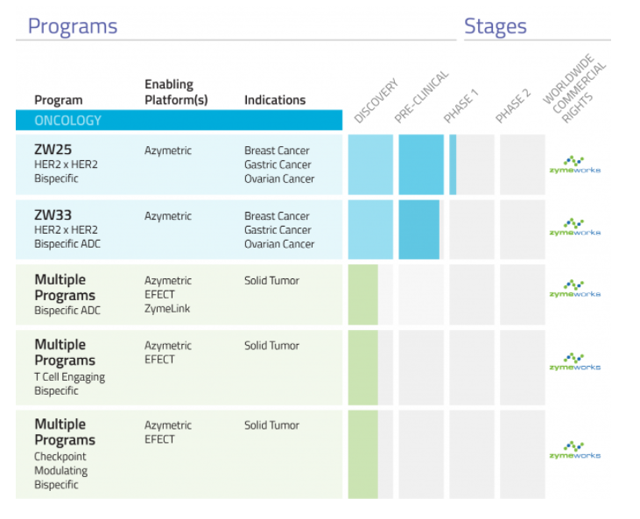

Zymeworks Inc. is a biopharmaceutical company that is based in Vancouver, British Columbia. The company is in clinical stage and focused on developing biotherapeutics for the treatment of cancer. It was founded in 2003 and is venture-capital backed. Recently, Zymeworks completed a $61.5 million funding round and is backed by $150 million from multiple venture capital firms.

(Source)

Executive management

Ali Tehrani is the chief executive officer, president and a co-founder of Zymeworks. He has played a central role in obtaining angel financing for Zymeworks. Tehrani holds a Ph.D. in microbiology and immunology from the University of British Columbia. He also holds a Master of Science and Bachelor of Science in biochemistry from the University of Massachusetts.

Neil Klompas is the chief financial officer of Zymeworks and has served in that role since joining the company in March 2007. Previously, Klompas worked for KPMG LLP in both the U.S. and Canada from 2000 until 2007 in a variety of different executive roles. Klompas has more than 20 years of experience in the biotechnology and healthcare industries. Klompas has an undergraduate degree in microbiology and immunology from the University of British Columbia and is a chartered public accountant.

Financial highlights and risks

Zymeworks reported total revenues of $11,009,000 for the year that ended on Dec. 31, 2016. It also reported a net loss of $33,809,000 for that year. For the year that ended on Dec. 31, 2015, the company reported total revenues of $9,660,000 and a net loss of $19,170,000.