Apple (AAPL), Microsoft (MSFT), Alphabet (Google’s parent – GOOG), Facebook (FB), and Amazon (AMZN) are all consumer as well as investor favorites. As consumers, we might respect a product or service and get excited about the company’s stock.

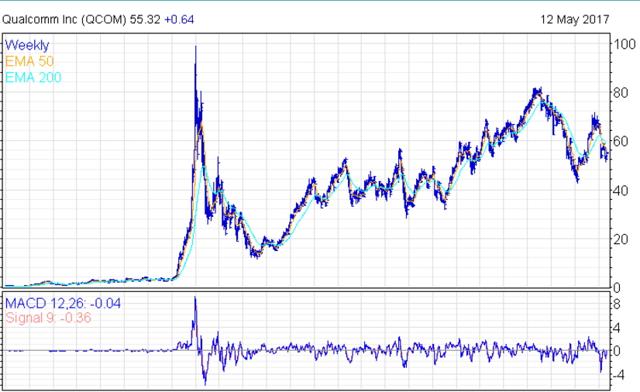

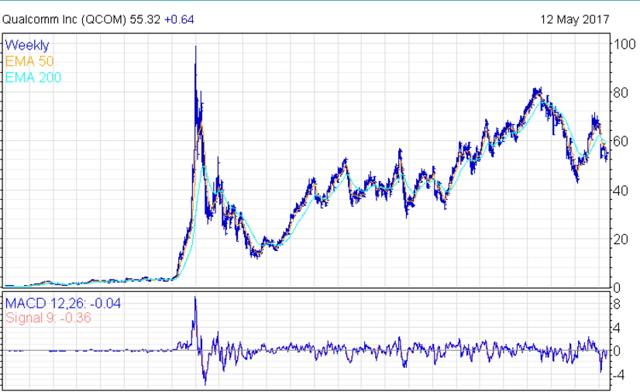

When a company supplies the backbone for what other companies do, however, we can’t simply use the Peter Lynch sniff test and say, “Gee, everybody’s using Facebook. I’ll look into it.” Maybe that partially explains why Qualcomm is languishing right now. Take a look at QCOM’s stock chart since its IPO in 1992:

Notice the company’s stock was a Steady Eddie until January of 1999. That’s when Pets.com’s sock puppet and anything that aided, was sold on, or even appeared on the Internet sold at hope times greed times infinity. Qualcomm met the description. Even though it wasn’t nearly as exciting as sock puppets, institutional buyers realized what the company really did and bid its price from 3 up to 99 in less than a year. (All prices are post-splits. There have been four of them – three 2-for-1s and one 4-for-1.)

Parabolic rises seldom simply plateau, of course. A year and a half later, QCOM was selling under 14. Since then, however, even through a tough Oct 2007 to March 2009 bloodbath, Qualcomm’s stock has advanced steadily. It was 82 in 2014, fell on problems with China not paying licensing fees for Qualcomm technology, rose again to 71 as recently as October 28 of last year, and now sells around 55. At this price, this tech leader sells for 18 times earnings, 2.6 times book and 3.5 times sales.

What is it exactly that Qualcomm does and what are the risk factors in buying at this price?

If you visit the company’s website, you might find a clue as to why the average investor doesn’t cotton to Qualcomm right out of the box. Here’s the kind of thing you’ll see as you scroll down their homepage:

Designing 5G NR.

To meet the expanding global connectivity needs—in the next decade and beyond—we are designing a new OFDM-based 5G unified air interface. We are delivering OFDM-based waveforms and multiple access optimized for different use cases. The 5G NR flexible framework is also designed to efficiently multiplex 5G services and features with built-in forward compatibility.

Or how about this one:

Accelerating the path to 5G.

Qualcomm is leading the technology innovations designed to make 5G a reality. We’ve spent years working on new 5G designs, building on our long-standing expertise in 3G, 4G and Wi-Fi. We’re also collaborating with industry leaders across the mobile ecosystem to drive 3GPP 5G New Radio (NR) standardization along with impactful trials that will lead to timely commercial network launches.

Pretty exciting stuff, huh?!! For those who have already dozed off, I’m certain this stuff fires the imagination of the PhDs that Qualcomm wants to recruit from elite universities and the B2B corporate clients they want to attract. But to fire the imagination of those who might invest in the company’s future? Not so much.