Over the past several decades, human energy consumption has grown exponentially. For this reason, it is very unsurprising that there exist many high-quality energy businesses in our blue chip stocks database.

To be a member of the Sure Dividend blue chip stocks database, a company must:

Unlike the game of poker – where the term ‘blue chip stock’ originated from – investing in blue chip stocks is far from gambling.

In fact, the blue chip stocks list contains some of the safest, most conservative investments around. You can see the full list of blue chip stocks here.

Chevron (CVX) is one of the most notable energy blue chip stocks. The company stands out among this list of businesses because of its exceptional dividend history.

Chevron has increased its annual dividend payments for 29 consecutive years. Chevron’s dividend history is extremely rare in the energy industry, primarily because the sector is so cyclical.

Chevron and Exxon Mobil (XOM) are the only two energy companies to be Dividend Aristocrats, companies with 25+ consecutive dividend increases. You can see the list of all 51 Dividend Aristocrats here.

Chevron’s blue chip reputation, remarkable dividend history and its very high dividend yield of 4.2% are all reasons why this security appeals to investors.

This article will analyze the investment prospects of Chevron in detail.

Business Overview

Chevron is one of the international oil & gas supermajors along with:

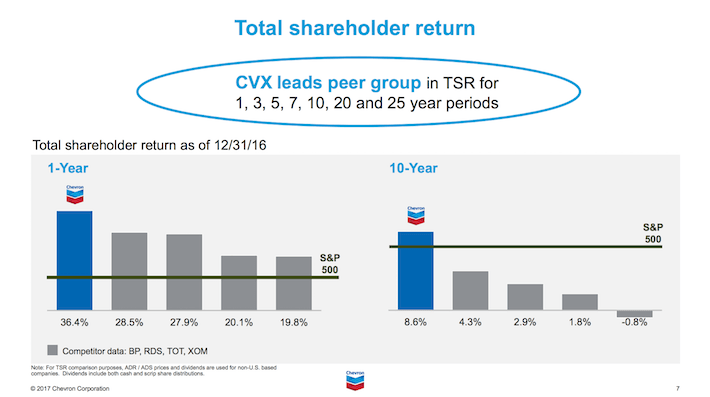

Among this group of energy conglomerates, Chevron stands out as the company with the strongest track record of delivering market-beating total returns. In fact, Chevron leads its peer group in total return for every meaningful investment time period.

Source: Chevron 2017 Security Analyst Meeting, Corporate Overview section, slide 7

Despite Chevron’s commendable track record, 2016 was a difficult year for this company.

Over the past several years, oil prices have plunged from above $100 per barrel to ~$27 per barrel, before recovering some of that loss. This has not been easy for Chevron – the company reported a net loss of $0.5 billion in fiscal 2016.

Source: Chevron 2017 Security Analyst Meeting, Corporate Overview section, slide 4

Fortunately, Chevron has remained laser-focused on acting in the best interests of its shareholders.

The company is very shareholder-friendly, with 29 years of consecutive dividend increases and $45 billion of share repurchases in the ten-year period ending in 2014.