US stock indexes remain at record highs, and volatility near its lows, despite signs that their record setting run is losing steam as it becomes increasingly dependent on a narrow band of stocks. Indeed, signs that the rally is running on fumes have convinced portfolio managers and Wall Street strategists that the second-longest bull market of all time will be over in less than 18 months, while a similarly longstanding rally in bonds is also nearly ready to roll over, according to a Bloomberg survey of fund managers and strategists.

“The poll of 30 finance professionals on four continents showed a lack of consensus on the asset judged as most vulnerable now, with answers ranging from European high yield to local-currency emerging-market debt – though they were mostly in the bond world. Among 25 responding to a question on the next U.S. recession, the median answer was the first half of 2019.”

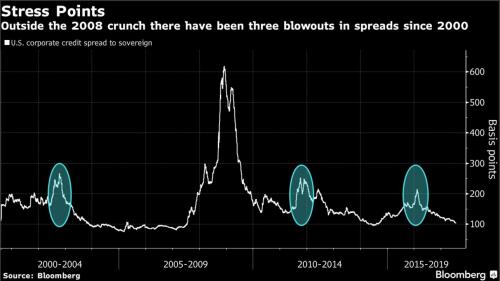

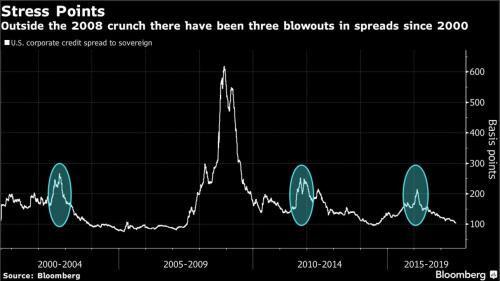

Of the 21 participants who responded to Bloomberg question of when they see a slide of more than 20 percent for the S&P 500 Index, the median response was the fourth quarter of 2018. Two forecast that the bear market would begin during the final three months of this year. Of the 21 respondents who forecast a bear market for credit, defined as a 1 percentage point jump in the premiums of US investment-grade corporate bond yields over comparable government-debt yields, the median pick was the third quarter of 2018.

According to Bloomberg many of these strategists and portfolio managers see central bank policy as the lynchpin of their thesis, believing that years of easy-money policies have artificially inflated stock and bond valuations. By the beginning of 2019, US interest rates will have risen another 1.5 to 2 percentage points, and the central bank will have unwound at least part of the $4.5 trillion in Treasuries and MBS that the Fed purchased during the recession. Of course, this is hardly a coincidence, as Remi Olu-Pitan, who manages a multi-asset fund at Schroder Investment Management Ltd. in London, explains.