Calgary, Alberta-based Encana Corporation (ECA – Free Report) reported second-quarter 2017 operating earnings of 18 cents per share, ahead of the Zacks Consensus Estimate of 4 cents. Further, the bottom line improved from the year-ago period earnings of 10 cents per share. Improvement in the top line, higher realized prices, and reduction in the costs lead to better results.

Quarterly revenues of $1,083 million came above the Zacks Consensus Estimate of $773 million. Moreover, revenues were 197.5% higher than the prior-year figure of $364 million.

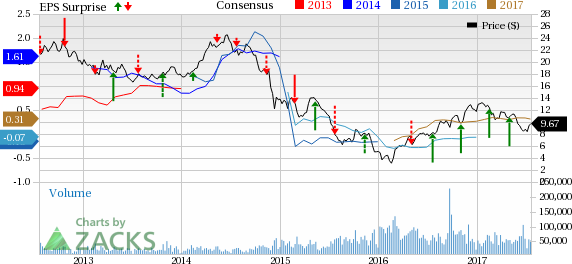

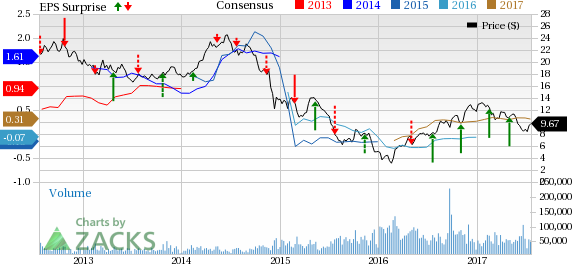

Encana Corporation Price, Consensus and EPS Surprise

Encana Corporation Price, Consensus and EPS Surprise | Encana Corporation Quote

Production & Prices

Quarterly natural gas production declined approximately 19% year over year to 1,146 million cubic feet per day, while liquids production fell 5% year over year to 124.9 thousand barrels per day.

Encana’s realized natural gas price were $2.56 per thousand cubic feet, up 37.6% from the year-ago quarter level of $1.86. Meanwhile, liquids price rose to $41.97 per barrel from $38.47 in the second quarter of 2016, reflecting an increase of 9%.

Costs & Expenses

Total operating expenses reduced by 40.3% from second-quarter 2016 to $762 million. The decline is primarily attributed to the reduction in impairment charges.

Specifically, Encana reported operating costs of $113 million for the reported quarter, 16% lower than the year-ago quarter level. Also, transportation and processing expenses fell 15% to $206 million. Administration and depreciation charges were down by 60% and 16%, respectively.

Capital Spending and Balance Sheet

Encana’s capital investments during the quarter were $415 million. As of Jun 31, 2017, cash and cash equivalent was $395 million and long-term debt was $4,198 million. This, in turn, represents a debt-to-capitalization ratio of 38.2%.

Zacks Rank & Stocks to Consider