Over the past week or so, gold and associated assets have rallied quite nicely.

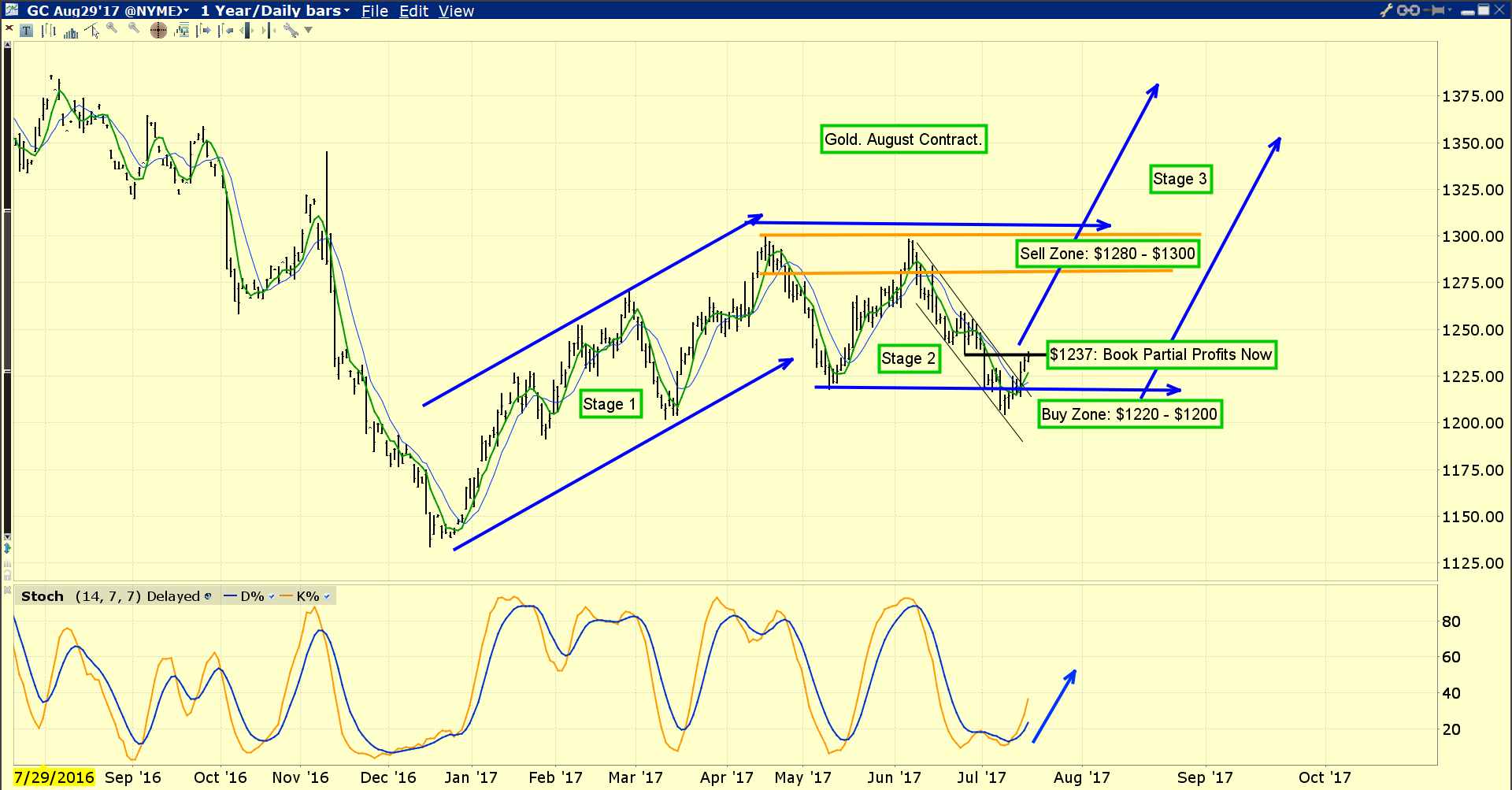

The $1237 price area is a good place to book partial profits on positions bought in my $1220 – $1200 buy zone.

Gold feels quite solid here. The five and ten day moving averages have turned up. The 14,7,7 Stochastics oscillator is also flashing a buy signal and moving higher.

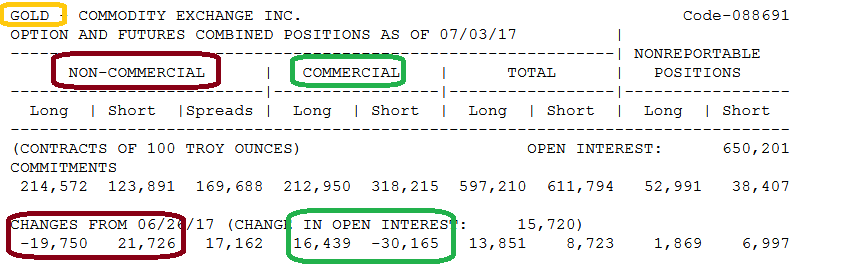

The latest COT report was also very positive.

While the rally can continue, smart investors book profit systematically into strength and good news. So, I’m adamant that some profit should be booked here. Gold has rallied more than $30 from the $1205 area low.

If the rally accelerates, the wise investor books even more profit. If it stalls, investors should get a chance to buy again at lower prices… using some of the market’s money rather than theirs!

Gold stocks are not likely to reverse their multi-decade bear cycle against bullion until US money velocity stages a new bull run, but they still outperform bullion on rallies.

My focus in the precious metals market in 2017 has been GDX and individual gold stocks, mainly to prepare for that bullish reversal in money velocity. The reversal should produce a multi-decade cycle of gold stock outperformance against bullion.

I’ve been an aggressive buyer of GDX into the recent $21 area lows, and partial profits definitely need to be booked now. This chart shows that GDX is bumping up against a significant supply-side trendline.

If the price moves back below $21, that capital can be re-deployed into GDX even more aggressively. I’m a buyer on every ten cents decline, and a partial seller on 50 cents rallies from my buy points.

This isn’t so much “trading” as it is pruning. As they grow, lawns must be mowed and hedges must be pruned. As the price of GDX increases, some profit must also be pruned. Investors can use my pyramid generator to do that systematically.