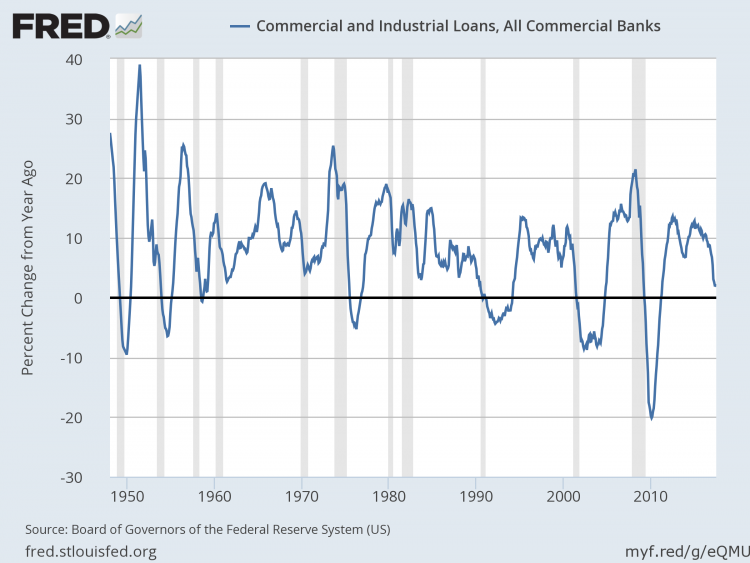

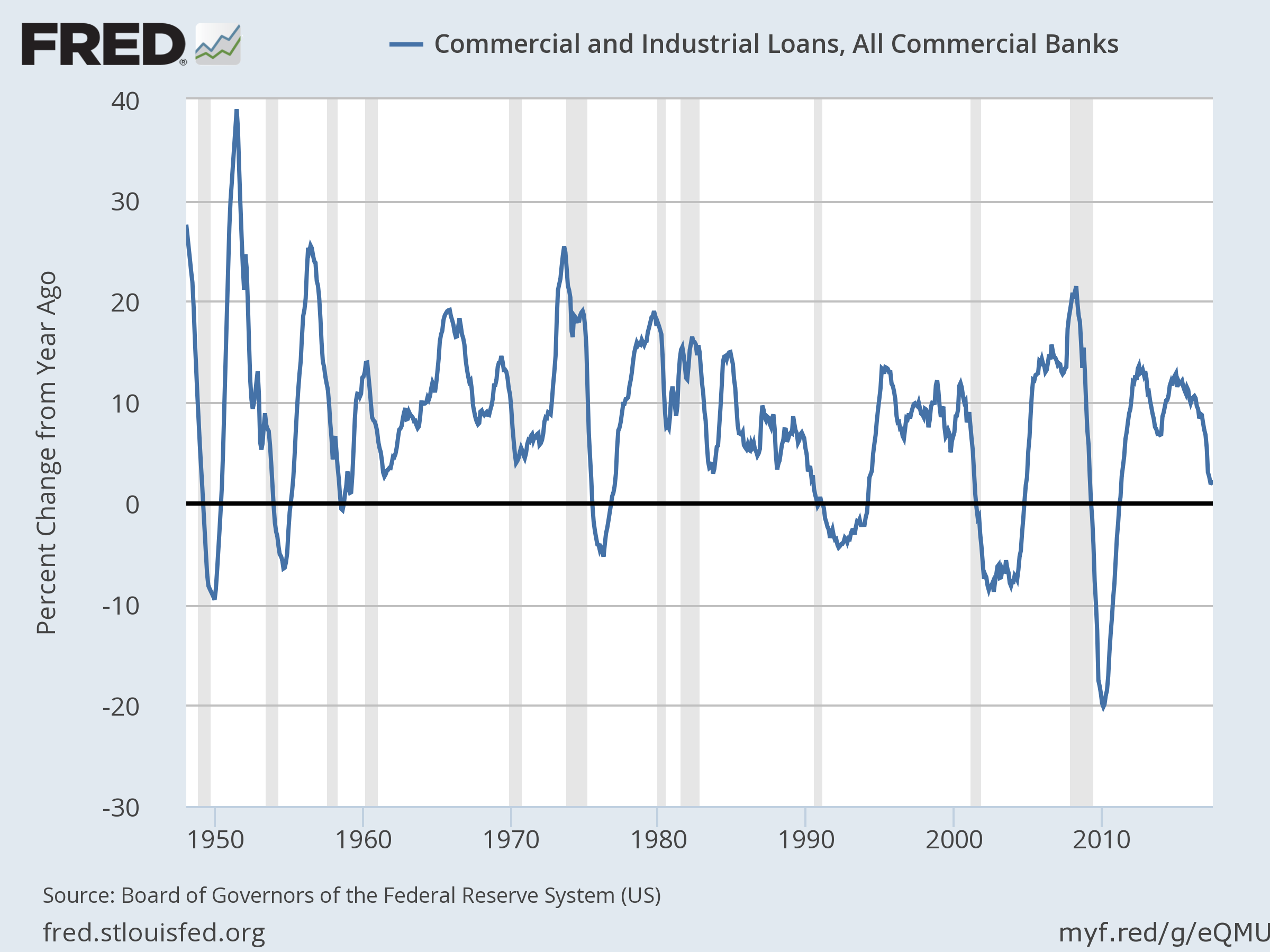

Focusing on one data set is always hazardous for analyzing the business cycle, but the ongoing decline in commercial and industrial (C&I) lending is drawing a crowd. The trend is worrisome, but it’s premature to draw broader conclusions for the US economy because most key indicators are still positively skewed.

Last month I noted that the year-over-year increase in C&I loans in the US in June slumped to a six-year low. The deceleration continued in the July update via the Federal Reserve, which reported that the annual pace of business lending edged down again, dipping to 1.8% — the softest advance since April 2011.

The decline isn’t encouraging, but I’m inclined to label the drop as an outlier for now because the broad measure of US economic activity remains moderately positive. That could change, of course, and perhaps quickly, which is why monitoring the incoming data is critical. But as discussed in last week’s business-cycle review, — and in this week’s edition of The US Business Cycle Risk Report — a growth bias is still conspicuous across a broad set of indicators.

That’s also the message in Monday’s July update of the Chicago Fed National Activity Index. Using the three-month average of the index points to growth that’s roughly in line with the historical trend.

Meanwhile, recent estimates for third-quarter GDP growth remain upbeat. The Atlanta Fed’s GDPNow model in especially bullish on the Q3 outlook, projecting a sharp acceleration in growth to 3.8%, well above the 2.6% pace in Q2. Wall Street economists, however, remain cautious, projecting that Q3 growth will tick up slightly to 2.8%, based on CNBC’s survey data (as of Aug. 17). But even assuming the lower estimate prevails still translates into enough forward momentum to keep the economy out of the business-cycle ditch.

Today’s weekly update on jobless claims is expected to reaffirm the growth bias for the labor market. Econoday.com’s consensus forecast calls for new filings for unemployment benefits to hold near the lowest level in more than 40 years – a signal that suggests that next week’s payrolls report for August will deliver another round of moderate growth.