“Financial markets think the only realistic option for the U.S. and North Korea will be to sit down and talk at some point because other options are too costly for everyone involved. But no one can rule out the risk of accidents. Markets think the chicken game will continue for now and North Korea will remain a risk.”

– Masayoshi Kichikawa, chief strategist at Sumitomo Mitsui.

Following last night’s “unprecedented” North Korea missile launch over Japan, which was a clear taunt to Donald Trump, the biggest moves this morning are not to be found in South Korea, where the Kospi index closed Tuesday just 0.2% lower after falling as much as 1.6% as local BTFD spirits were ignited late in the session, or in Japan where the Nikkei pared much of its losses to end down 0.5% as the BOJ bought a few billion more in ETFs (but not before hitting a 4 month low), but across developed markets where the Euro finally surged above the “profit crushing” psychological barrier of 1.20, sending European stocks reeling to 6 month lows as exporters, mostly in Germany, were slammed. The VIX was up over 20% in early trading, jumping 2.42 vols to 13.74.

None other than Chancellor Angela Merkel commented on the Euro this morning, and when asked about the impact of the euro’s rise on Germany’s trade surplus, says it’s a simple fact that the euro’s exchange rate has an impact on terms of trade. “I don’t decide about the euro’s exchange rate”: Merkel says at news conference in Berlin. Clearly, that’s Mario Draghi’s responsibility. “Personally, I don’t see the trade surplus as so dramatic” she added. We’ll see if German investors agree.

“The market is still digesting Draghi’s comments from Jackson Hole and the U.S. outlook is looking difficult with concerns around the budget and a looming shutdown,” said Esther Maria Reichelt, an FX strategist at Commerzbank in Frankfurt.

Meanwhile, in a broader move, world stocks tumbled and safe-haven assets jumped on Tuesday on worries the North Korea situation could devolve into an all out military conflict. S&P futures fell as much as 0.7% to the lowest in more than seven weeks. The European STOXX 600 index fell more than 1% to a six-month low.

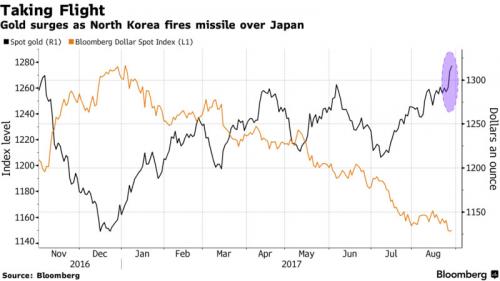

North Korea military tensions also sent both European, Japanese and US Treasury yields tumbling, with the 10Y Bund down to 0.33%, the lowest in two months, the 10Y Treasury tumbling as much as 2.10%, the lowest in 10 months, and the benchmark JGB sliding back to Japan’s target of 0.0%. The risk off tone has spurred a broad flight into other safe-havens, with JPY, CHF, and gold surging higher.

Some, of course, tried to spin the overnight news: “the North Korean escalation has triggered a significant risk-off move,” Alessandro Balsotti, head of asset management at JCI Capital Limited, said in his daily note to clients. “However … observers believe it won’t be enough to trigger a material reaction from the United States-South Korea axis. It wouldn’t be surprising, then, if investors take advantage of this geopolitical fear to buy the dips.”

Meanwhile, equities dropped and volatility surged across the globe in classic risk-off moves, with U.S. stock futures also tumbling, down 17 at pixel time. Japan called Kim Jong Un’s latest provocation an “unprecedented, grave and serious threat.” Gold surged to the highest this year, while the Swiss franc and the yen were the best-performing major currencies.

In Europe, the Stoxx Europe 600 Index sank 1.5% to the lowest in almost seven months, as the EUR/USD crossing 1.20 has spooked investors, worried that exporter profits are about to be wiped out. In the UK, the U.K.’s FTSE 100 Index declined 1.3% to the lowest in 16 weeks on a closing basis ahead of grueling, and chaotic, Brexit negotiations. Germany’s DAX Index decreased 1.7% to the lowest in more than five months, led by sliding exporters.

As unprecedented,

Tuesday’s launch thrust the confrontation between the U.S. and North Korea back to the fore after the hermit kingdom had been praised by Secretary of State Rex Tillerson last week for its “restraint.” Tillerson said that North Korea hadn’t carried out “provocative acts” since the UN Security Council imposed new sanctions earlier this month, and that Pyongyang’s temperance might lead to negotiations “in the near future.” Kim Jong Un last tested a missile on July 28.

Oops.

“Some observers had thought the U.S. and North Korea were pursuing discussions behind closed doors, but it turns out North Korea continues to pursue missile development,” said Chihiro Ohta, a Tokyo-based senior strategist at SMBC Nikko Securities. “The risk-off stance is likely to continue even if the U.S. responds calmly.”

The dollar was down 0.6 percent at 108.63 yen after hitting its lowest level since mid-April despite Japan’s proximity to North Korea. Also, the safe-haven Swiss franc strengthened, with the dollar falling 0.6 percent to a one-month low against the Swiss currency. Across EM, Predictably, Russia’s ruble (due to ongoing Harvey-related oil price woes) and South Korea’s won (for obvious reasons) led losses among emerging-market currencies after North Korea fired a ballistic missile over Japan on Tuesday, damping appetite for riskier assets. The Ruble falls 0.6% against dollar, most among 24 major peers tracked by Bloomberg as oil price weakens 2nd day. The South Korean won fell the most in 2 weeks, even as the Kospi wiped out most trading losses to close only 0.2%.