With 40 straight years of dividend growth under its belt, Pentair (PNR) is a dividend aristocrat that is just a decade away from joining an even more elite club, the dividend kings.

Over the past three decades, Pentair shareholders have enjoyed dividend growth that’s not only been remarkably consistent, but strong as well (8.9% annual payout growth).

Let’s take a closer look at this industrial blue chip to see what makes its business model so successful.

More importantly, learn if Pentair and its upcoming spin off are likely to continue generating strong total returns and dividend growth for many years to come.

Business Overview

Founded in 1966 in London, England (with roots going back to 1859), Pentair is the world’s leading liquid pump, valve, and control system manufacturer with 19,000 employees operating in 40 countries across six continents.

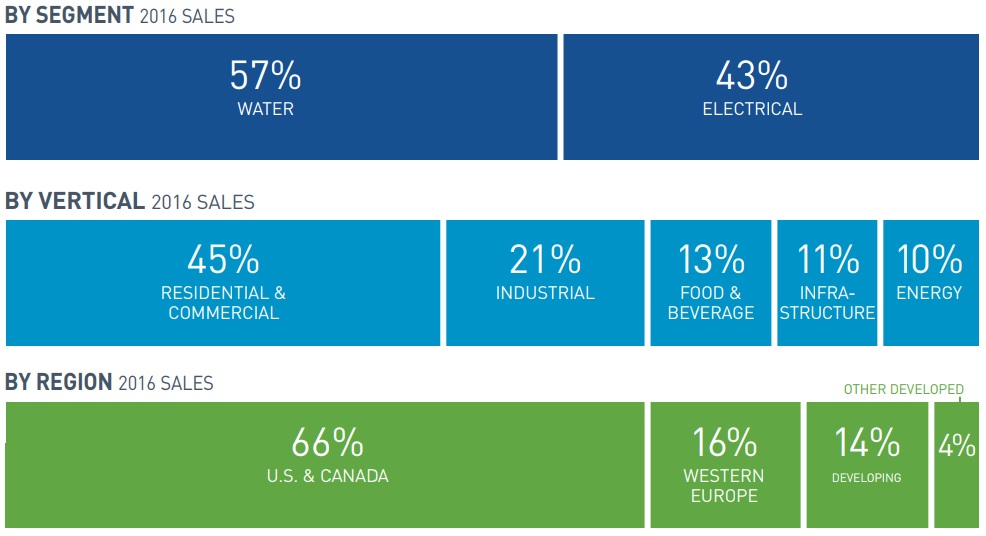

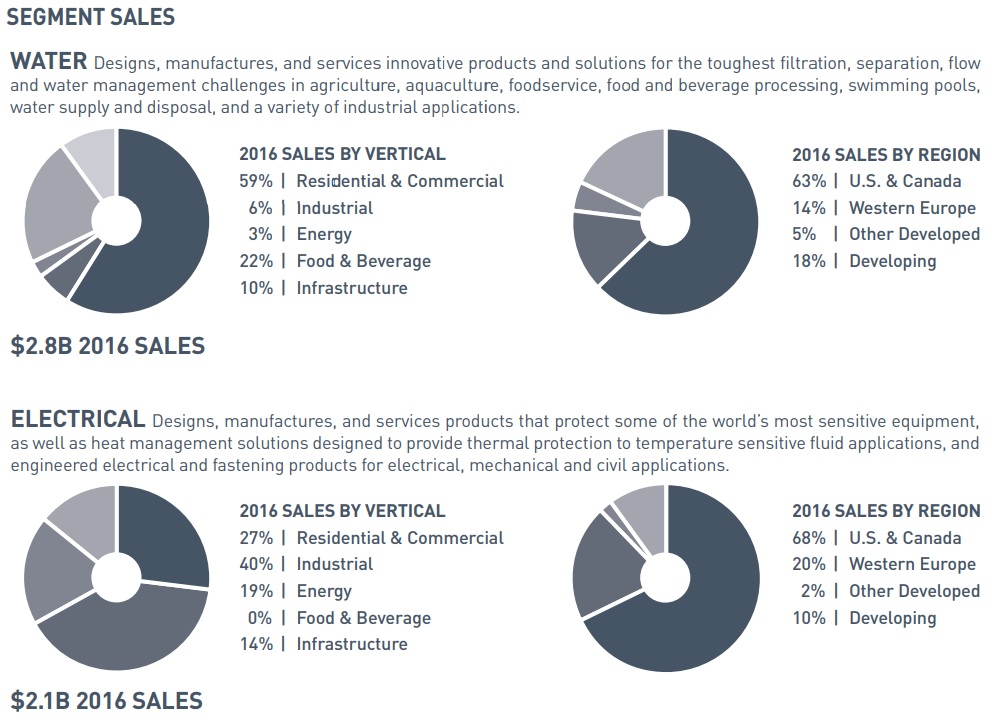

Pentair’s diversified product mix is placed in two main business segments, water and electrical.

Source: Annual Report

Source: Investor Presentation

The company derives the majority of its sales from North America, with a strong presence in Western Europe, and faster growing divisions in emerging markets such as China and Brazil.

Business Analysis

In order for any company to be able to consistently grow its dividend for decades, it must have several factors working to its advantage.

Pentair’s advantages primarily come from its long-standing customer relationships (Pentair has over 50 years of operating history), focus on profitable niches, reputation for quality, wide assortment of products, technical know-how, and sizable distribution network.

Pentair also has a large global installed base, which provides meaningful aftermarket revenue. This business generates less volatile cash flow that can be used for acquisitions. Pentair’s markets are highly fragmented, so it has plenty of opportunity to continue consolidating the industry.

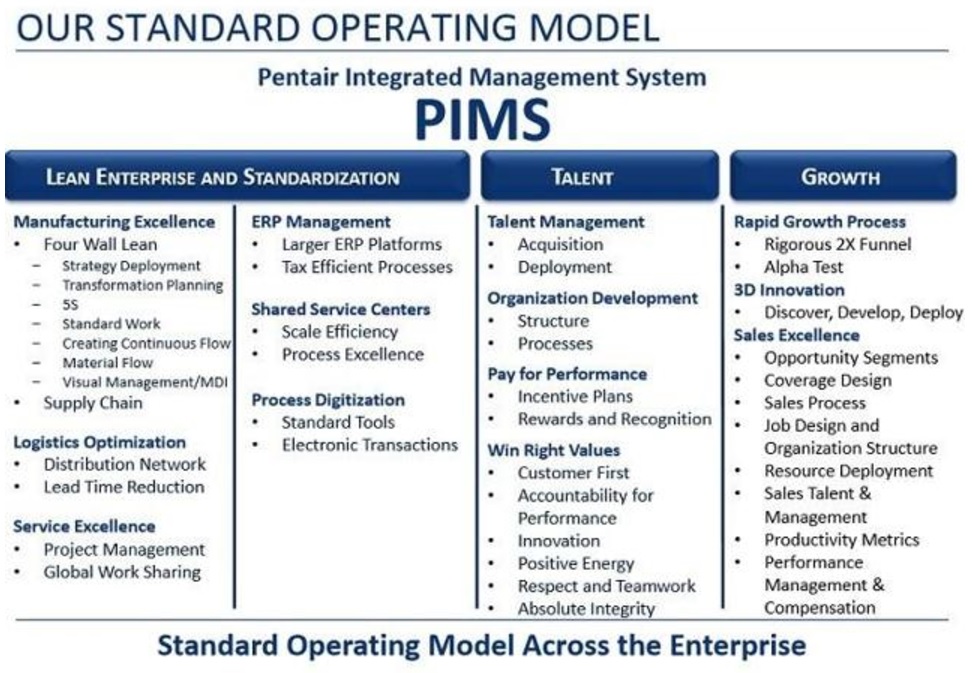

Like many other industrial companies, Pentair also has its own management system grounded in lean methodologies. Pentair began its initial lean deployments in 2005 and believes lean operations are now part of its DNA, driving productivity throughout the enterprise.

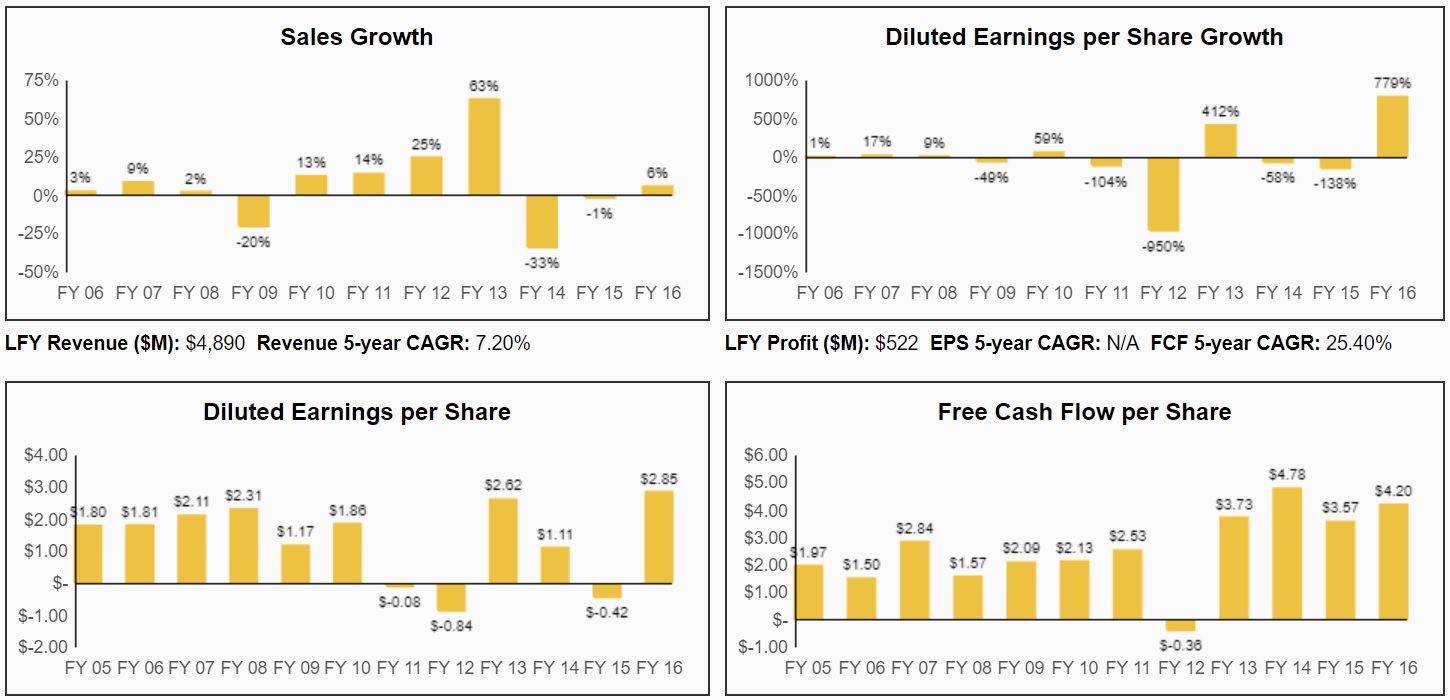

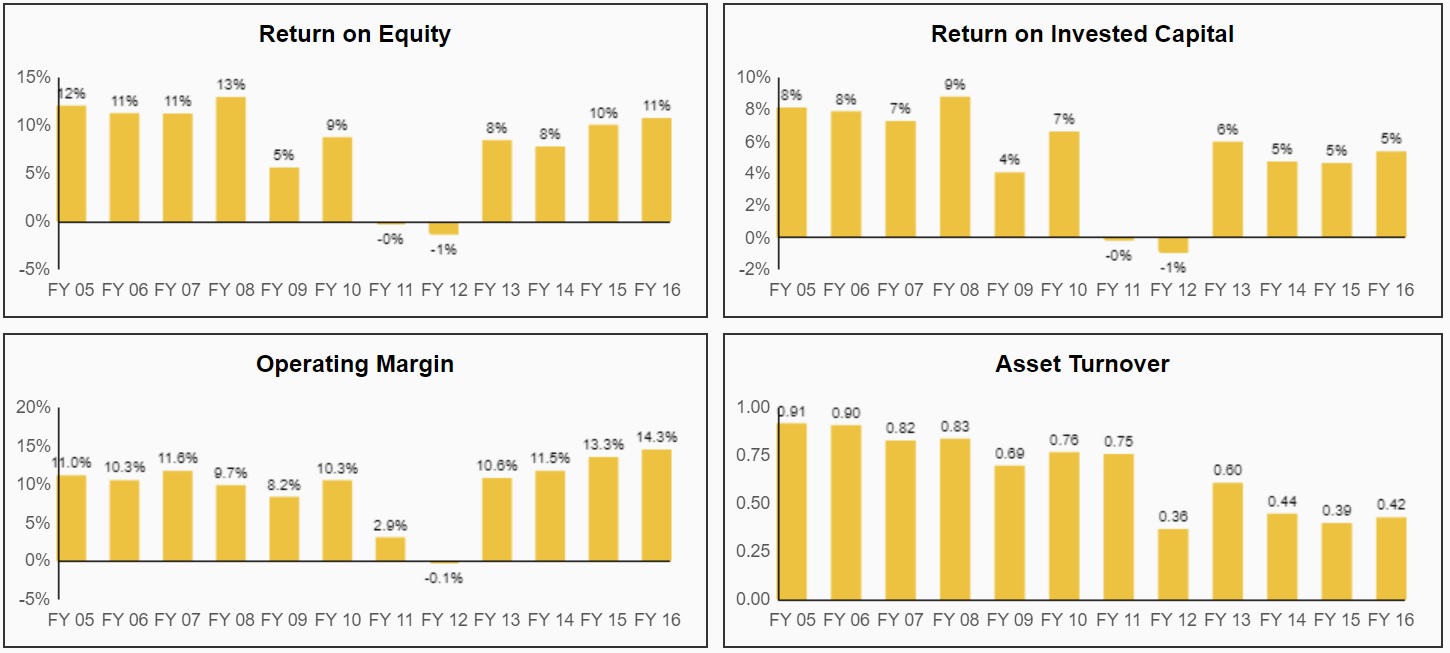

As a result, the company’s disciplined, long-term focused management team has found ways to grow sales, earnings, and cash flow over time while maintaining enough of a competitive advantage to keep margins and returns on capital stable.

While Pentair’s sales, like all industrial companies, are cyclical, notice that over time it has done a good job of growing its earnings and cash flow much faster, and more consistently.

Similarly, the margins and returns on capital have been making steadily progress in the right direction in recent years.

Source: Simply Safe Dividends

That’s largely thanks to Pentair’s internal cost management system, which it calls the Pentair Integrated Management System, or PIMS.

Specifically, PIMS aims to steadily improve the company’s profitability through a wide variety of methods, including: consolidating its factories (30% in the next five years), optimizing its supply chain sourcing (to minimize costs), and focusing on its fastest growing and most profitable niche businesses.

For example, in August of 2016 the company announced it was selling its valves & control business, which mainly served the oil & gas industry, to Emerson Electric (EMR) for $3.15 billion in cash. This was a major restructuring for Pentair because valves & control was its single largest business unit in 2015, representing 27% of its sales.

The reason for this sale was to help Pentair minimize future sales and earnings volatility by focusing on high margin but more steadily growing units, specifically in the $37 billion and $58 billion global water and electrical industries, respectively.