After opening the day marginally higher, share markets in India have continued the momentum and are trading above the dotted line. All sectoral indices are trading on a negative note with stocks in the power sector and stocks in the consumer durables sector leading the losses.

The BSE Sensex is trading down by 290 points (down 0.9%), and the NSE Nifty is trading down by 92 points (down 0.9%). Meanwhile, the BSE Mid Cap index is trading down by 0.3%, while the BSE Small Cap index is trading down by 0.4%. The rupee is trading at 64.02 to the US$.

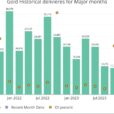

In news about the economy, according to a leading financial daily, India’s steel sector witnessed growth in the January-July period of 2017.

Domestic steel production increased by 5.4% in the period under review according to the report from World Steel Association (WSA), which compiles global steel production data from 67 countries reporting to it.

For the first seven months of 2017, global steel production went up to 977.3 mt, up 4.6% from 933.97 mt in the same period of 2016. In July 2017, global steel production stood at 143.4 mt, showing a rise of 6.3% over 134.8 mt in July 2016. Out of this China, the world’s leading steel producer reported an output of 74 mt last month, up 10.3% over July 2016, when the country had produced 67.1 mt.

India’s crude steel production grew 3.5% to 8.4 million tonnes. India’s steel output stood at 8.1 mt in the same month last year. With this development, India strode past the US to become the third largest steel producer and is on track to replace Japan as the second largest steel producer in the world.

The growth in the steel sector is the core reason why the Index of Industrial Production (IIP) registered a growth in June this year.

Steel Sector Softens Slowdown in Manufacturing

The output of eight core industries slowed down in June as the total output moved up marginally by 0.4% as against an increase of 4.1% in May 2017.