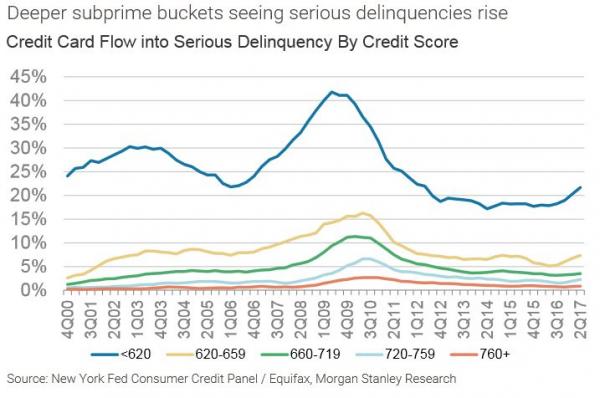

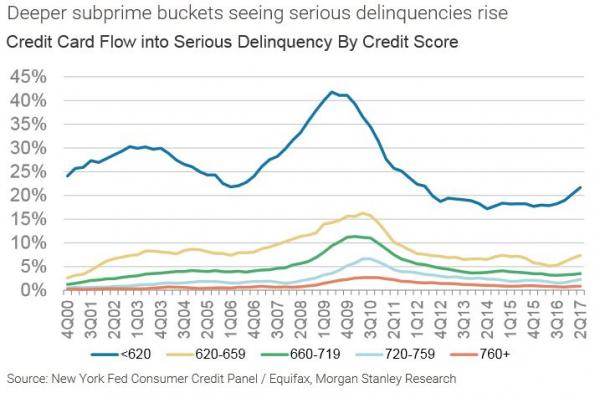

In a new downgrade of subprime lenders Capital One and Synchrony, Morgan Stanley sought to answer the nagging question of why subprime credit card losses are suddenly soaring, per the chart below, “if employment is so good.”

After reportedly spending the entire month of August analyzing that question, Morgan Stanley came to many of the same conclusions that we note on a regular, recurring basis. Apparently, those soaring delinquencies have something to do with stagnant wages in the face of soaring healthcare costs, rising rents and a pullback in consumer credit extension…who could have guessed that?

Investors ask, “Why are card losses rising if employment is so good?” Our deep dive & quant work shows subprime is stretched from higher rent, healthcare costs & low wage growth, with lower credit availability a coming drag.

A Tale of Two Consumers, with the subprime consumer increasingly at risk, driving up net charge-offs (NCO) and lowering EPS: The economy is solid and unemployment is very low, but credit card delinquencies have been increasing… so we spent the month of August delving into what is really going on with the US consumer. We found that the average consumer is in good shape but the financial pressures on subprime consumers are high and, critically, rising

1. Banks arepulling back on subprime card loan growth. For the past 3 years, bank lending to subprime card posted an 8% CAGR, faster than prime’s 5% growth. But banks are now beginning to put on the brakes.Subprime loan growth has slowed over the past two quarters to 10% y/y in 2Q17, down from 13% y/y peak in 4Q16. Our quant work shows a negative correlation between change in loan growth and change in losses.Result? Expect declining subprime loan growth to drive up subprime losses over the next 12 months.

2. Rent and healthcare costs a bigger burden for lower income consumers… and rising.Consumers in the lowest income quintile spend 38% of after-tax income on rent and another 18% on healthcare costs, a combined 56%.This is well above the average consumer’s 40%.Pressures are building on both.Our REIT colleagues expect rental rates on mid- to low income apartments, Classes B & C,will continue to rise from already high levels, but at a decelerating pace.Our healthcare colleagues expect healthcare costs to rise ~5% annually over the next few years. These costs put more pressure on lower income consumers, who have lower wage growth.

3. Discretionary income not keeping up with debt service burden growth. Debt service burden (interest and principal repayment) is growing 2%, faster than the 1% growth in discretionary income for the average consumer. That means, after paying for basic needs like shelter, food, healthcare, and utilities, there is less left over to pay back lenders. Middle income renters are in the toughest spot as it looks like their borrowing has accelerated in auto, student, and personal loans, while their disposable income growth has been below average.The lowest income quintile is burdened by high and rising rent and healthcare costs.