Archives by Month:

- April 2024

- March 2024

- January 2024

- December 2023

- November 2023

- October 2023

- August 2023

- July 2023

- June 2023

- May 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- July 2016

- June 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- November 2012

- October 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- June 2009

- April 2009

- February 2009

- December 2008

- November 2008

- October 2008

- August 2008

- June 2008

- May 2008

Archives by Year:

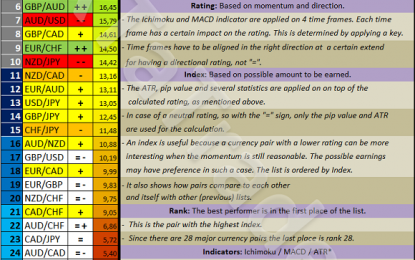

Forex Metrics And Chart Week 44 / 2017

Oct 29, 2017 Jeremy Parkinson Finance 0

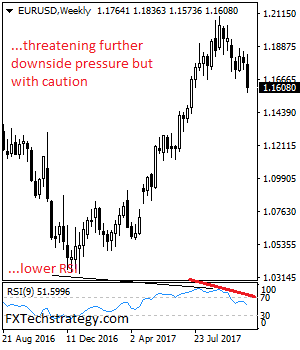

Is EUR/USD Set To Fall Towards 1.15?

Oct 29, 2017 Jeremy Parkinson Finance 0

EUR/USD Bearish, Vulnerable But With Caution

Oct 29, 2017 Jeremy Parkinson Finance 0

Weekly Forex Forecast – Sunday, October 29

Oct 29, 2017 Jeremy Parkinson Finance 0

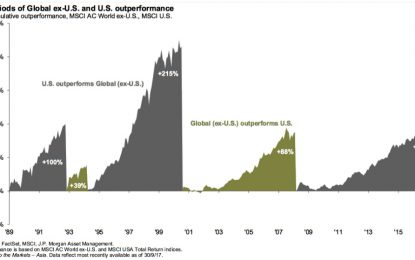

A Shift From US To Emerging Stocks?

Oct 29, 2017 Jeremy Parkinson Finance 0

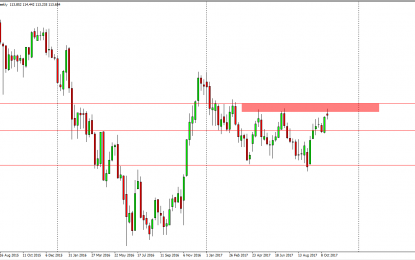

GBP/USD Weekly Analysis – Sunday, October 29

Oct 29, 2017 Jeremy Parkinson Finance 0

Major Long Term Opportunities Brewing In The Canadian Market

Oct 29, 2017 Jeremy Parkinson Finance 0

Norway’s $1 Trillion Wealth Fund Gains 3.2% In Q3 As 70% Equity Allocation Pays Off

Oct 29, 2017 Jeremy Parkinson Finance 0

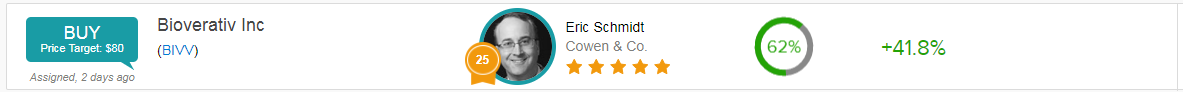

5 Hot Stocks From Wall Street’s Top 25 Analysts

Oct 29, 2017 Jeremy Parkinson Finance 0

Weekly Economic & Political Timeline – Sunday, October 29

Oct 29, 2017 Jeremy Parkinson Finance 0