In this article, we will discuss some of the countervailing trends which are occurring to help you formulate a balanced outlook on the markets and the economy. It’s easy to cherry pick data to fit an agenda, but that doesn’t do you much service. There’s always valid counter arguments that need to be discussed no matter how great the thesis is. Two brilliant investors can look at the same data and come to completely different conclusions, and both be right, though not at the same time.

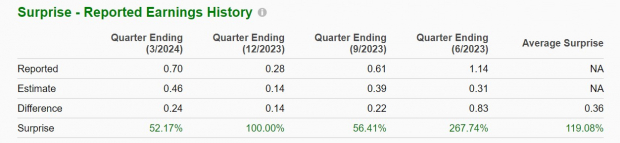

Peak Earnings Growth?

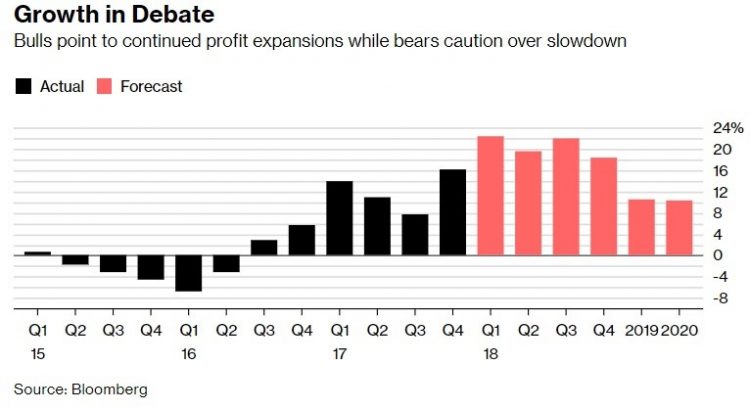

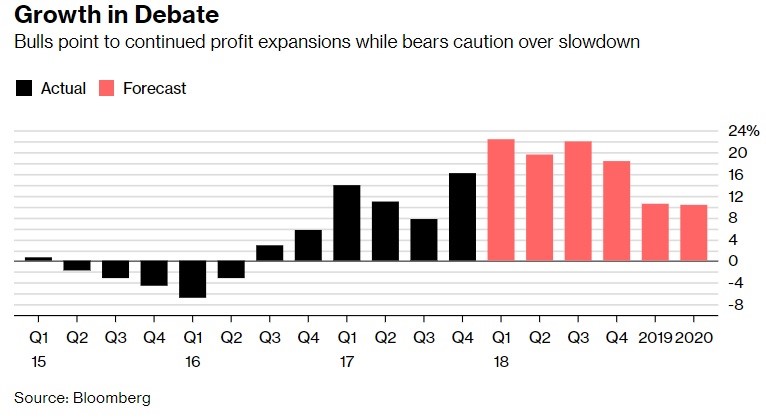

Earnings growth in Q1 looks so great investors are wondering if the cycle peak is here. The chart below shows the growth in Q1 is 22.4% which is higher than the other forecasts which don’t include any actual results.

Source: The chart below

However, comparing actual results to forecasts isn’t an ‘apples to apples’ comparison because earnings reports usually beat estimates. Heading into Q1 earnings growth was expected to be 17.1%. To be clear, Q1 is shaping up to be a better than average earnings season. The point here is that the 19.6% growth expected in Q2 doesn’t signal earnings growth peaked because the results will be beaten. Earnings growth is expected to be great for the rest of this year. Only in 2019 is the growth rate expected to fall significantly.

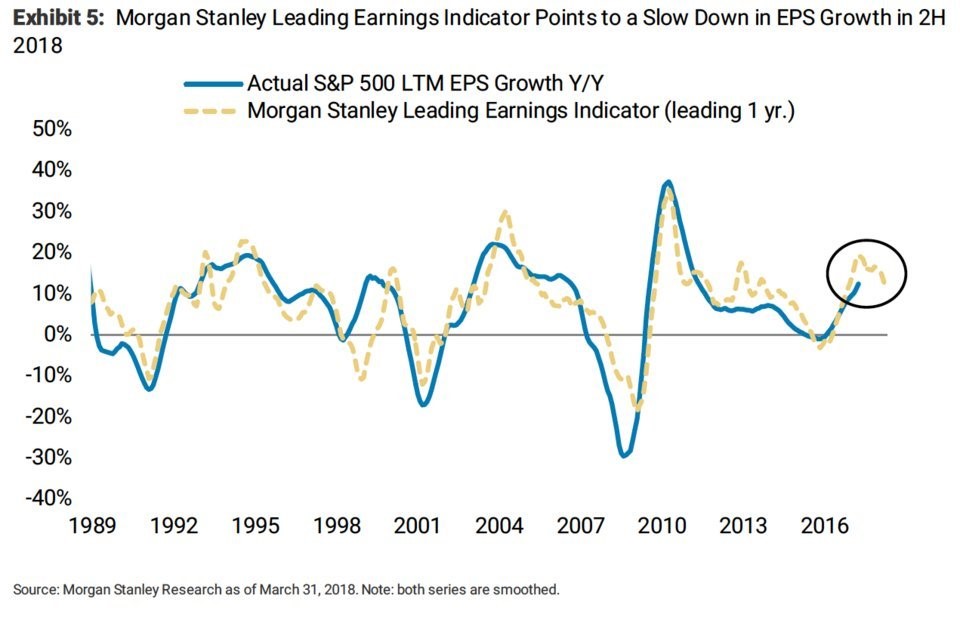

The chart below shows a more negative picture.

Source: The chart below

The chart shows the Morgan Stanley Leading Earnings Indicator pushed ahead one year compared to the actual trailing 12 months of EPS growth. These two indicators have had a high correlation in the past 30 years. The circled yellow dotted line shows the EPS growth is expected to slowdown in the 2nd half of 2018. Earnings growth in the second half will depend on the strength of the economy and strength of the dollar. 2017 priced in the great earnings growth for 2018. If 2018 trading is pricing in next year’s earnings growth, it explains why stocks haven’t rallied on current great results.