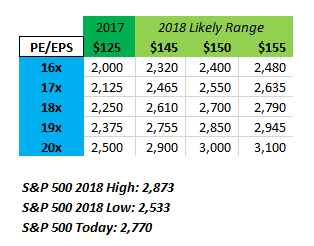

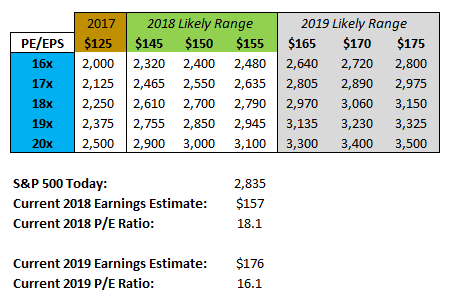

Back in February I published the table below to show investors where the S&P 500 index would likely trade if interest rates normalized (10-year bond between 3% and 5% is how I defined it):

Published 2/27/18

The point of that post was to show what the typical equity valuation multiple was during such conditions (the answer is 16x-17x and we don’t have to go back too far to find such conditions). Now that 2018 is coming to an end and earnings are likely to come in at the high end of the range shown in that table ($157 is the current consensus forecast), let’s look ahead to 2019.

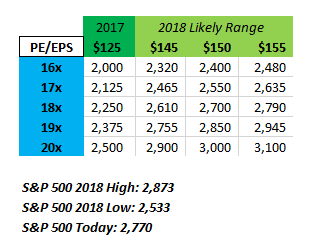

I have added a gray section to the chart (see below) to include a range of profit outcomes for 2019. The current forecast is $176 but I believe there is more downside risk to that than upside, so I did not add any outcome in the $180+ area.

As you can see, the equity market today is adjusting rationally to higher rates, with a current 16.1x multiple on consensus 2019 profit projections. The big question for 2019, therefore, is not huge valuation contraction. Rather, it comes down to whether earnings can grow impressively again after a tax cut-powered 26% increase in 2018. If the current consensus forecast for earnings comes to fruition, the market does not appear to be headed for a material fall from today’s levels.

Given that the long-run historical average for annual earnings growth is just 6%, assuming that in the face of rising rates the S&P 500 can post a 12% jump in 2019 seems quite optimistic to me. Frankly, even getting that 6% long-term mean next year – resulting in$166 of earnings – would be solid.

For perspective, at that profit level, a 16x-17x P/E would translate into 2,650-2,825 on the S&P 500, or 3% lower than current quotes at the midpoint. Add in about 2% in dividends and a flattish equity market overall seems possible over coming quarters if earnings fall to post double-digit gains next year and valuations retreat to more normal levels.