There are three key scheduled events between now and the end of the year. In chronological order, this weekend G20 meeting is first. It will shape expectations for trade tensions between the US and China, with extensive secondary impact. Saudi Arabia and Russia’s meeting may help shape expectations for the price of oil, which has collapsed here in Q4 18.

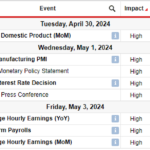

The ECB meets on December 13 with new staff forecasts (likely paring growth and price forecasts for 2019, and the hawks may not be able to resist a downside risk assessment. The ECB’s asset purchase program is set to end. The Federal Reserve meets on December 19. A rate hike is likely, but many are looking for some indication that some signs that slower growth, weaker housing market, volatility stocks or the drop in oil prices will prompt the Fed to signal a pause in the cycle earlier than previously. There is no date yet set for the UK’s parliament to vote on the Withdrawal Agreement but it promises to be high drama and spur a spike in sterling volatility.

US

In recent weeks, the market has grown more skeptical of the extent the Federal Reserve will raise rates next year. It never fully accepted the Fed’s forecasts that implied three rate hike would be appropriate in 2019. The fed funds futures strip suggests the market is confident of only one rate hike next year. The December 19 FOMC meeting is the last highlight of the year. A rate hike is widely expected, but to maintain its control on short-term rates, the Federal Reserve may repeat September’s exercise and increase the interest paid on reserves by slightly less (five basis points) than it raises the target range.

The outlook for fiscal policy has been complicated by the election results and increasing concern about the deficit. It is not clear if the Democrats are going to push for “fiscal responsibility” or support effort to make the middle-class tax cuts permanent and push an infrastructure initiative. Some reports are playing up the narrative that the tax cuts were the first of a two-prong strategy. The second are plans to reduce the resulting trillion-dollar deficits with substantial cuts in discretionary social spending.

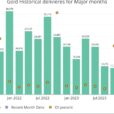

It is still prudent to expect trade tensions are set to escalate. The US will likely go forward with its plans to increase the 10% tariff on $200 bln of Chinese goods to 25% at the start of the New Year. There was a drive to front-load US imports to China before the tariffs went into effect and before the increase. This sets the stage for a potentially powerful correction in early 2019. Trade becomes less of a drag for the US, for example, and headwind for China.