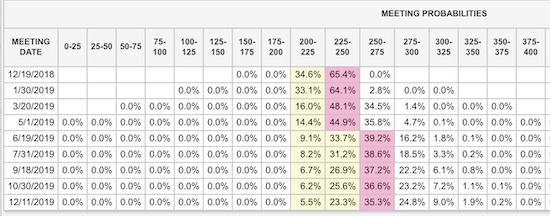

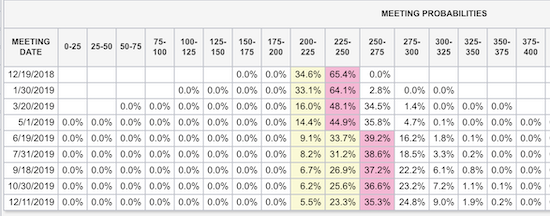

An ongoing debate rages about whether or how fast the Fed should hike rates in 2019. Some even question the need for a rate hike in December. Indeed, the market has priced in a “only” a 65% chance of a rate hike next month. I say only because before the October sell-off and November’s weakness, a December rate hike was treated like a 100% done deal. In fact, the odds for another rate hike in March, assuming 25 basis point moves, is well under 50%, currently at 35.9% (34.5% + 1.4%).

Source: CME Group FedWatch Tool

The market is pretty sure that the next rate hike will happen by January. The odds of the Fed taking a rest after that are pretty high.

President Trump raised the stakes with persistent complaints about what he sees as rates rising too fast. The Fed is in a no-win situation as a halt to rate hikes will either be interpreted as the Fed’s loss of independence and/or an acknowledgement that the economy is not quite as strong as the Fed has claimed. These dynamics are important because the history of rate hikes and recessions is pretty clear: recessions happen after the Fed drives rates to a high for the cycle. So they are either in the middle of a rate hike cycle or in the middle of a pause after driving rates to their high of the cycle. The 1990-91 recession is the one exception since 1967.

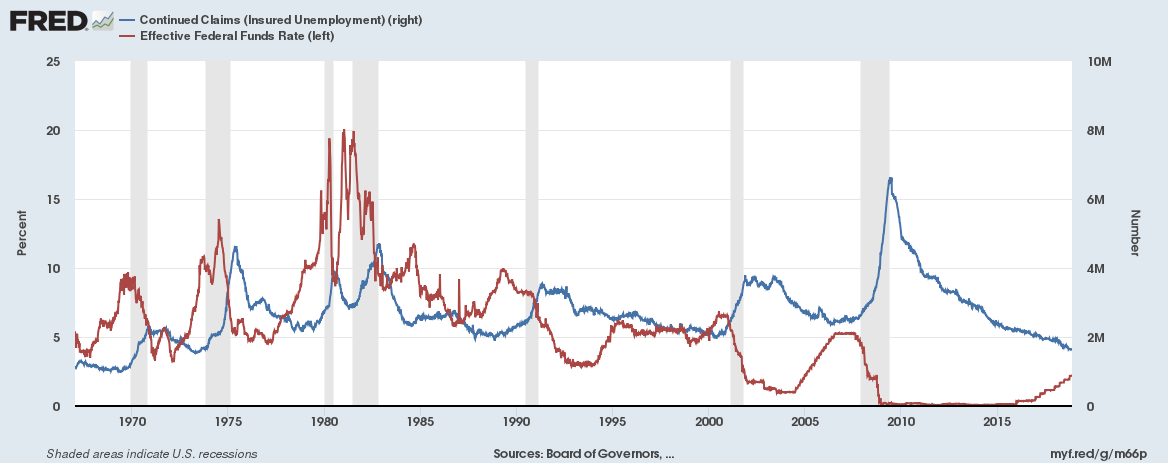

As the Fed focuses on hiking rates along with an improving employment picture in a battle against inflation or in an effort to stave off future inflationary pressures, the Fed invariably pushes the economy closer and closer to a slowdown. The chart below juxtaposes the effective Fed funds rate versus continued claims for unemployment insurance, a traditional measure of the health of the job market. Claims are currently at a 45-year low – an incredible feat given the expansion of the labor force since then – while the Fed funds rate is nowhere near even its pre-recession high.

Source: U.S. Employment and Training Administration, Continued Claims (Insured Unemployment) [CCSA], retrieved from FRED, Federal Reserve Bank of St. Louis, November 17, 2018.