WTI Crude Oil

While it was Thanksgiving Day in the United States, there are a lot of traders around the world that have been involved during the day. Volume may not be that high, but it does suggest that a trader still believe that the $55 level is going to be resistance. That was an area that was previous support, so it makes sense that the sellers come back in. The candle stick from the Tuesday session is also major resistance, and a break above the top of that candlestick could send this market towards the gap just below the $60 level. I think that it’s only a matter time before the sellers come back in though, perhaps reaching towards the $52.50 level, and then the $50 level after that. We are still in a very bearish market.

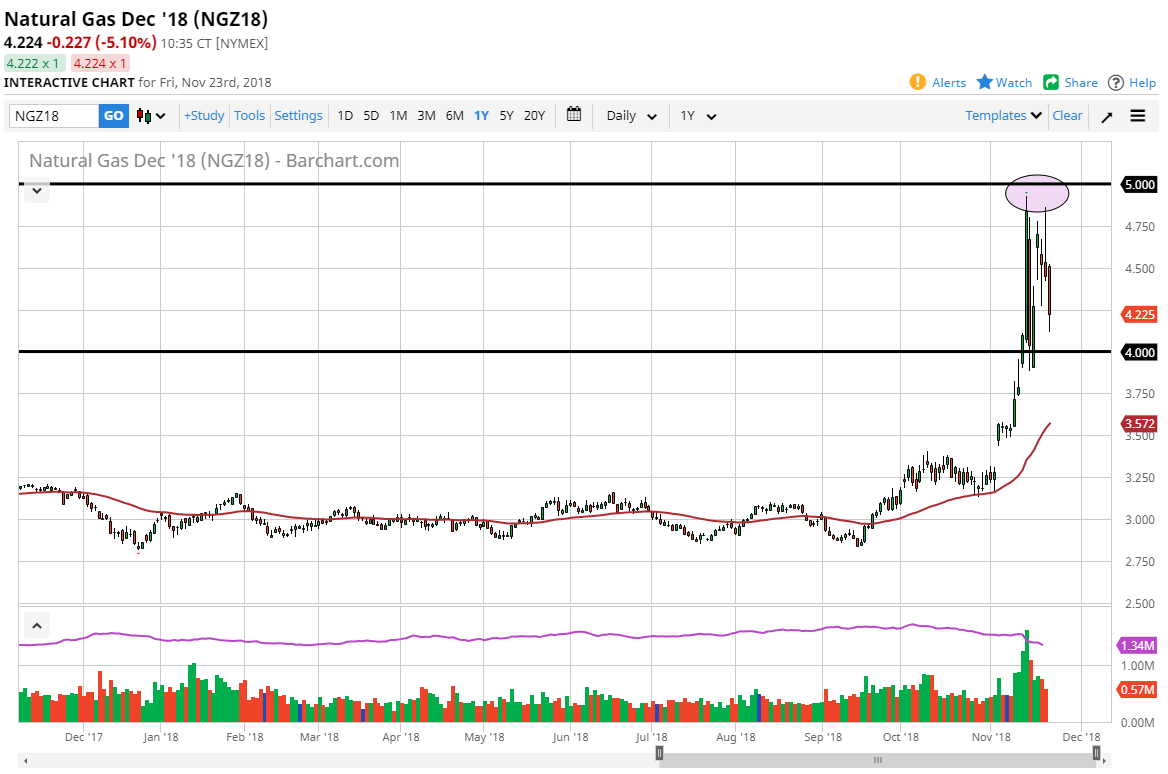

Natural Gas

Natural gas markets rolled over a bit during the session on Thursday, reaching down towards the $4.10 level before bouncing slightly. I think that the $4.00 level underneath there should be supportive, and I think that the market continues to be very overbought in this area. I think that every time this market rallies, you should be looking to fade those rallies because we have been sent through the roof. The $5.00 level should be massive resistance, and then I think that the large amounts of natural gas that will undoubtedly hit the market with these higher prices should continue to put bearish pressure. If we can break down below the $4.00 level, then it’s likely that we will go looking to fill the gaps underneath. I fully anticipate that happening as we get closer to spring. In the meantime, shorting rallies for small trades is my strategy.