Image Source: Pixabay

Image Source: Pixabay

On Wednesday, most Asian stock markets are trading lower due to negative cues from Wall Street and cautiousness among traders. They are also awaiting key U.S. and European inflation readings and comments from central bank officials for insight into the interest rate outlook. Meanwhile, concerns are also rising about the economic impact of the indefinite suspension of vessel traffic at the Port of Baltimore, following a cargo ship’s collision with the Francis Scott Key Bridge, resulting in its collapse. The Japanese stock market is showing significant gains, recovering from losses in the previous two sessions, despite the negative signals from Wall Street. The Nikkei 225 is currently above the 40.7k handle, with most sectors experiencing gains, particularly in the exporter and financial sectors. Stocks dropped in China and Hong Kong, primarily due to the decline in technology companies. The decrease was influenced by the drop in Nvidia’s shares and Alibaba’s announcement of postponing the IPO of its logistics subsidiary, impacting the morale of AI-related firms in the region.In the Eurozone, the European Commission’s monthly economic confidence survey for March is expected to indicate an increase in the headline index, rising from 95.4 to 96.2. Consumer confidence data, already released, revealed a rise to 14.9, marking the highest level since the invasion of Ukraine by Putin two years ago. Additionally, there is anticipation for a rebound in services confidence following last month’s decline.Meanwhile, there are no significant data releases expected Stateside today. However, the Fed’s Waller is set to deliver a speech on the economic outlook at the Economic Club of New York. Last week’s updated Fed dot plot maintained its signal for three interest rate cuts this year, although the number of projected cuts for 2025 was reduced.

Overnight Newswire Updates of Note

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 22/03/24

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5200

EURUSD Bullish Above Bearish Below 1.09

EURUSD Bullish Above Bearish Below 1.09

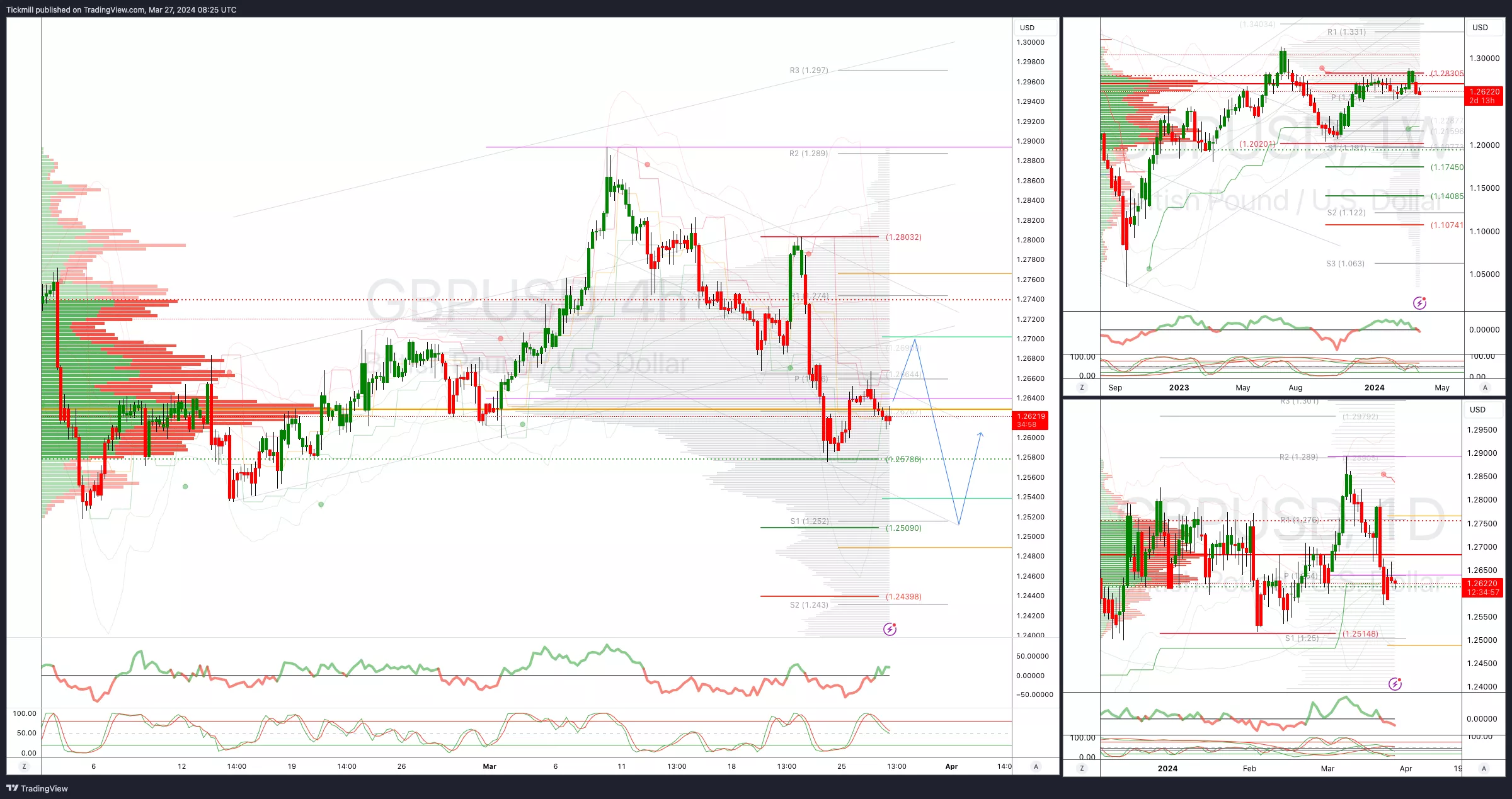

GBPUSD Bullish Above Bearish Below 1.27

GBPUSD Bullish Above Bearish Below 1.27

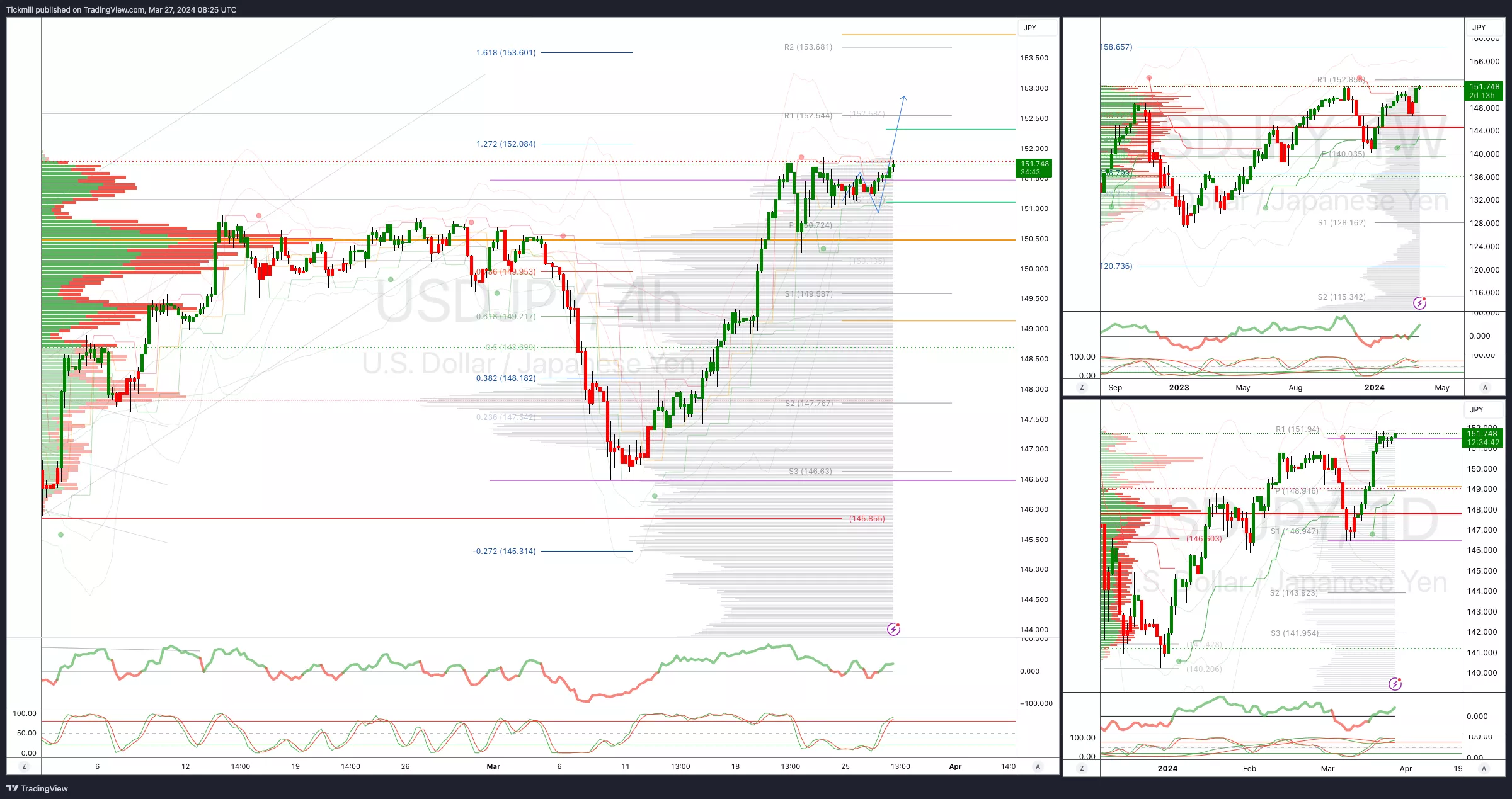

USDJPY Bullish Above Bearish Below 150.25

USDJPY Bullish Above Bearish Below 150.25

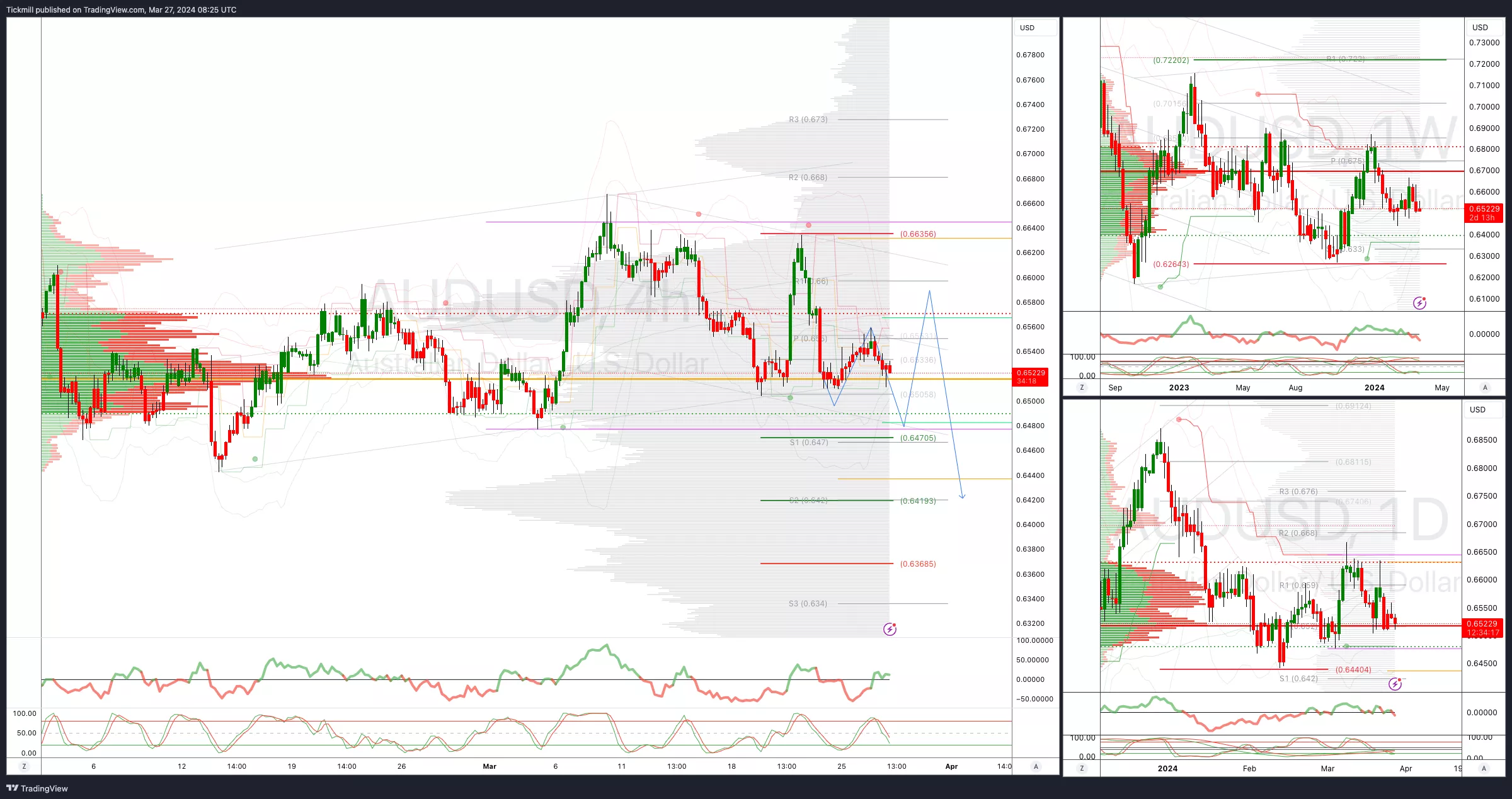

AUDUSD Bullish Above Bearish Below .6570

AUDUSD Bullish Above Bearish Below .6570

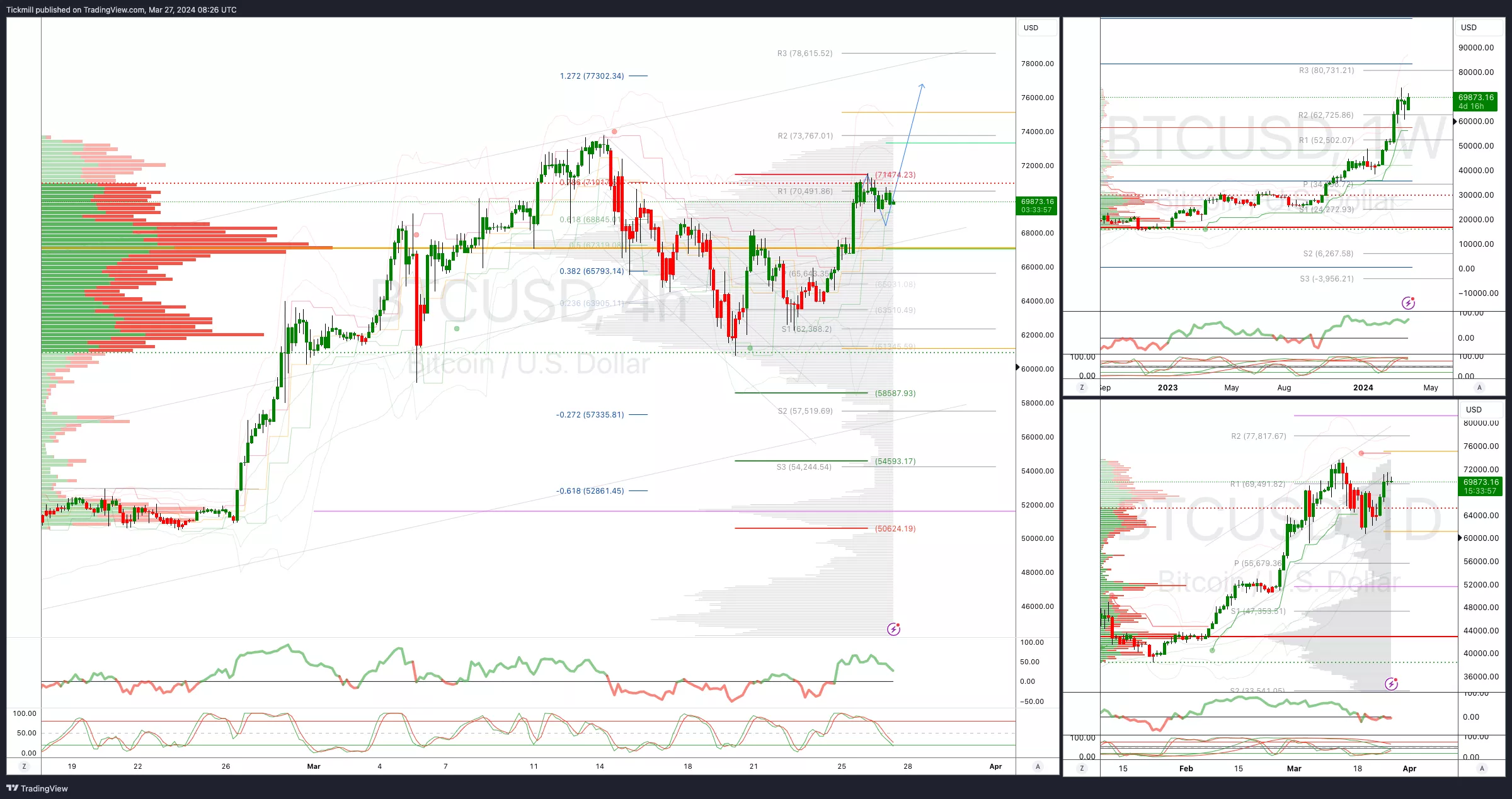

BTCUSD Bullish Above Bearish below 68300

BTCUSD Bullish Above Bearish below 68300

More By This Author:FTSE Inches Higher After A Soft Start In A Slow Session

More By This Author:FTSE Inches Higher After A Soft Start In A Slow Session

Daily Market Outlook – Tuesday, March 26

FTSE Hovering Around The Flatline, After A Stellar Week