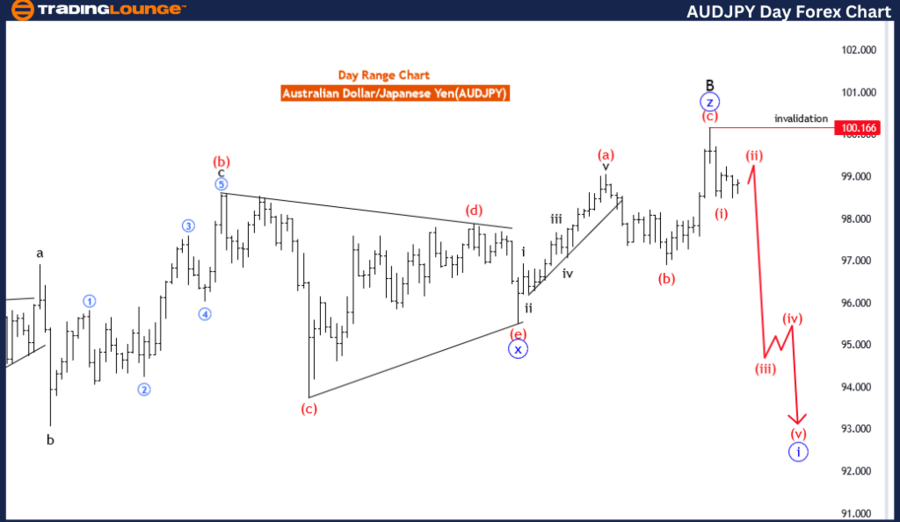

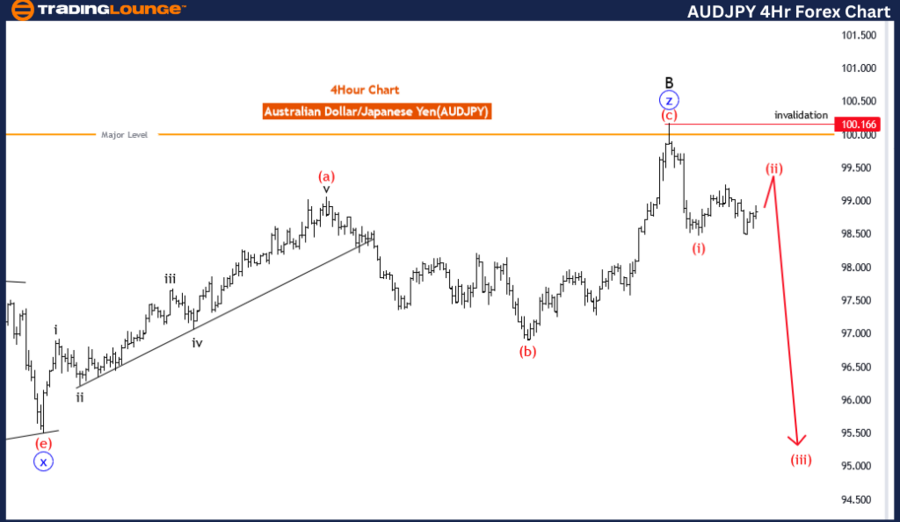

AUDJPY Elliott Wave Analysis Trading Lounge Day Chart, Australian Dollar / Japanese Yen (AUDJPY) Day Chart AUDJPY Elliott Wave Technical AnalysisFUNCTION: Counter Trend MODE: impulsive STRUCTURE: blue wave 1 POSITION: Black wave C DIRECTION NEXT HIGHER DEGREES: blue wave 2 DETAILS: black wave B completed at 100.166. Now blue wave 1 of C is in play. Wave Cancel invalid level:100.166 The AUDJPY Elliott Wave Analysis for the day chart provides insights into the potential price movements of the Australian Dollar against the Japanese Yen, utilizing Elliott Wave principles for technical analysis.Identified as a “Counter Trend” scenario, the analysis suggests that the current market direction opposes the prevailing trend, indicating a potential reversal or corrective movement against the broader price trend. This implies that traders may anticipate a temporary deviation from the primary trend before a potential resumption or reversal.Described as “impulsive” in mode, the analysis indicates that the current market movement exhibits characteristics of impulsive price action, suggesting strong and decisive movements in the direction of the current trend or counter trend move.The “STRUCTURE” is identified as “blue wave 1,” providing clarity on the current wave count within the Elliott Wave cycle. This aids traders in understanding the ongoing counter trend move and its relation to the broader Elliott Wave pattern.Positioned as “Black wave C,” the analysis highlights the current wave count within the counter trend move, indicating the specific phase of the corrective pattern within the broader Elliott Wave cycle.The “DIRECTION NEXT HIGHER DEGREES” is stated as “blue wave 2,” suggesting the anticipated direction for the subsequent higher-degree wave. This implies that once the current counter trend move completes, the market may resume its upward movement within the broader Elliott Wave structure.In the “DETAILS” section, it is noted that “black wave B completed at 100.166. Now blue wave 1 of C is in play.” This indicates that the current counter trend move is ongoing, with the expectation of further upside movement before a potential reversal or continuation of the broader trend.In summary, the AUDJPY Elliott Wave Analysis for the day chart offers traders valuable insights into potential counter trend movements, corrective phases, and critical levels to monitor within the broader Elliott Wave structure, aiding in informed trading decisions. AUDJPY Elliott Wave Analysis Trading Lounge 4 Hour Chart, Australian Dollar / Japanese Yen (AUDJPY) 4 Hour Chart AUDJPY Elliott Wave Technical AnalysisFUNCTION: Trend MODE: corrective STRUCTURE: Red wave 2 POSITION: Blue wave 1 DIRECTION NEXT LOWER DEGREES: red wave 3 DETAILS red wave 1 of 1 looking completed at 98.500, now red wave 2 of 1 is in play. Wave Cancel invalid level:100.166 The AUDJPY Elliott Wave Analysis for the 4-hour chart provides insights into the potential price movements of the Australian Dollar against the Japanese Yen, employing Elliott Wave principles for technical analysis.Identified as a “Trend” scenario, the analysis suggests that the current market direction aligns with the prevailing trend, indicating a potential continuation of the broader price movement. This implies that traders may anticipate further movements in the direction of the established trend.Described as “corrective” in mode, the analysis indicates that the current market movement represents a corrective phase within the broader price action. This suggests that the current movement may serve to correct the preceding impulse wave, potentially leading to a temporary deviation from the primary trend before a potential resumption.The “STRUCTURE” is identified as “Red wave 2,” providing clarity on the current wave count within the Elliott Wave cycle. This aids traders in understanding the ongoing corrective phase and its relation to the broader Elliott Wave pattern.Positioned as “Blue wave 1,” the analysis highlights the current wave count within the corrective phase, indicating the specific phase of the corrective pattern within the broader Elliott Wave cycle.The “DIRECTION NEXT LOWER DEGREES” is stated as “red wave 3,” suggesting the anticipated direction for the subsequent lower-degree wave. This implies that once the current corrective phase completes, the market may resume its downward movement within the broader Elliott Wave structure.In the “DETAILS” section, it is noted that “red wave 1 of 1 looking completed at 98.500, now red wave 2 of 1 is in play.” This indicates that the current corrective phase is ongoing, with the expectation of further downside movement before a potential reversal and the start of a new trend.In summary, the AUDJPY Elliott Wave Analysis for the 4-hour chart offers traders valuable insights into potential price movements, corrective phases, and critical levels to monitor within the broader Elliott Wave structure, aiding in informed trading decisions.Technical Analyst: Malik Awais

AUDJPY Elliott Wave Analysis Trading Lounge 4 Hour Chart, Australian Dollar / Japanese Yen (AUDJPY) 4 Hour Chart AUDJPY Elliott Wave Technical AnalysisFUNCTION: Trend MODE: corrective STRUCTURE: Red wave 2 POSITION: Blue wave 1 DIRECTION NEXT LOWER DEGREES: red wave 3 DETAILS red wave 1 of 1 looking completed at 98.500, now red wave 2 of 1 is in play. Wave Cancel invalid level:100.166 The AUDJPY Elliott Wave Analysis for the 4-hour chart provides insights into the potential price movements of the Australian Dollar against the Japanese Yen, employing Elliott Wave principles for technical analysis.Identified as a “Trend” scenario, the analysis suggests that the current market direction aligns with the prevailing trend, indicating a potential continuation of the broader price movement. This implies that traders may anticipate further movements in the direction of the established trend.Described as “corrective” in mode, the analysis indicates that the current market movement represents a corrective phase within the broader price action. This suggests that the current movement may serve to correct the preceding impulse wave, potentially leading to a temporary deviation from the primary trend before a potential resumption.The “STRUCTURE” is identified as “Red wave 2,” providing clarity on the current wave count within the Elliott Wave cycle. This aids traders in understanding the ongoing corrective phase and its relation to the broader Elliott Wave pattern.Positioned as “Blue wave 1,” the analysis highlights the current wave count within the corrective phase, indicating the specific phase of the corrective pattern within the broader Elliott Wave cycle.The “DIRECTION NEXT LOWER DEGREES” is stated as “red wave 3,” suggesting the anticipated direction for the subsequent lower-degree wave. This implies that once the current corrective phase completes, the market may resume its downward movement within the broader Elliott Wave structure.In the “DETAILS” section, it is noted that “red wave 1 of 1 looking completed at 98.500, now red wave 2 of 1 is in play.” This indicates that the current corrective phase is ongoing, with the expectation of further downside movement before a potential reversal and the start of a new trend.In summary, the AUDJPY Elliott Wave Analysis for the 4-hour chart offers traders valuable insights into potential price movements, corrective phases, and critical levels to monitor within the broader Elliott Wave structure, aiding in informed trading decisions.Technical Analyst: Malik Awais More By This Author:Elliott Wave Technical Analysis: NEOUSD Crypto Price News

More By This Author:Elliott Wave Technical Analysis: NEOUSD Crypto Price News

S&P 500, Nasdaq 100, Russell 2000 Predictions And Trading Strategies

Elliott Wave Technical Analysis: The Walt Disney Company – Wednesday, March 27