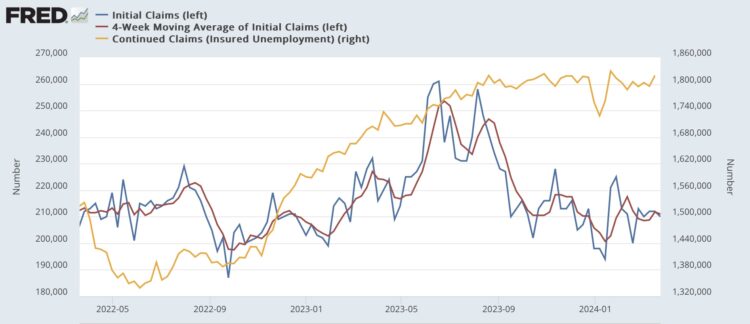

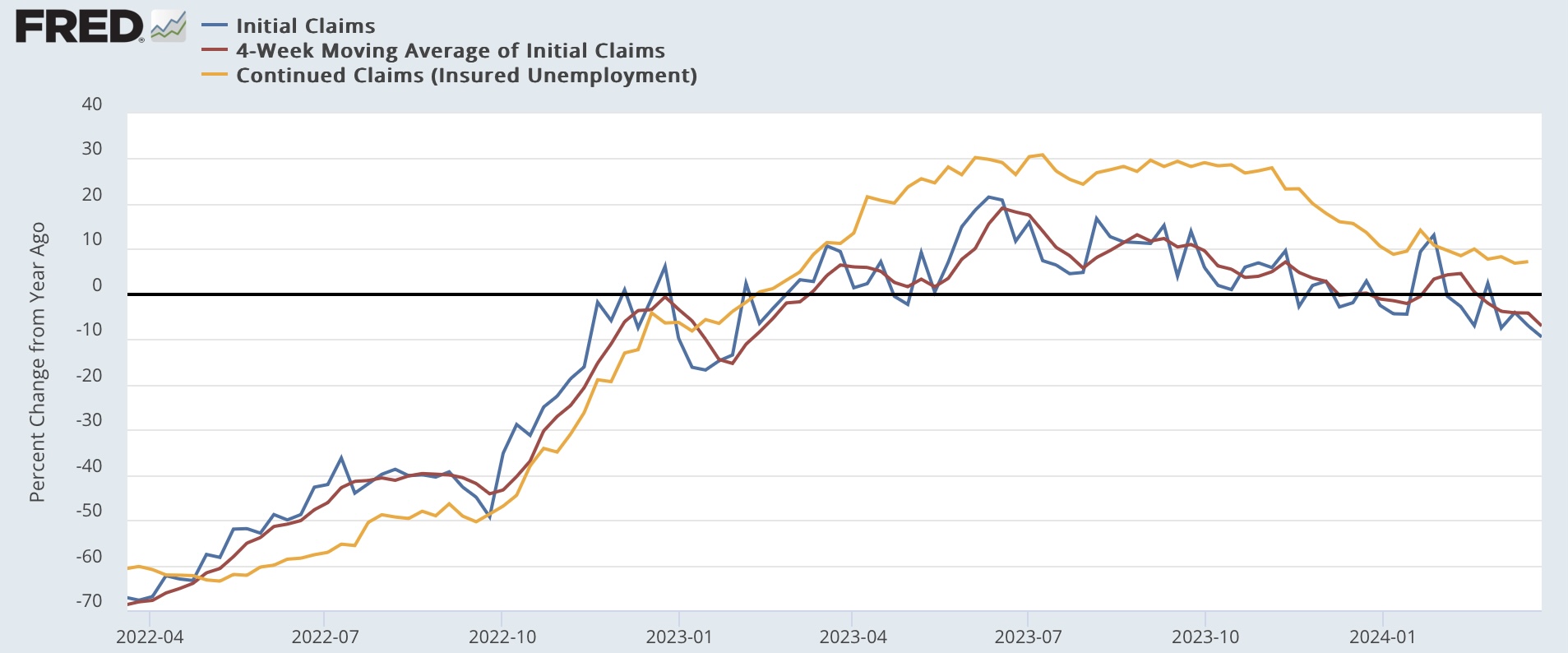

The divergence in the trends between initial and continuing claims continued this week, as the former continued their somnolent good news, while the latter had a slightly disconcerting pop.Initial claims declined -2,000 to 210,000, and the four-week average declined from -750 to 211,000. On the other hand, with the usual one-week delay, continuing claims rose 24,000 to 1.819 million: The first two are in the same range they have been in for the past 4 to 6 months while continuing claims are at their highest number but for 2 weeks in the past two years.On the more important YoY basis for forecasting purposes, initial claims are down -9.5%, and the four-week average is down -7.0%, the best YoY comparison in the past 12 months. Continuing claims are up 7.2%, but this is the second lowest YoY comparison in the past 12 months:

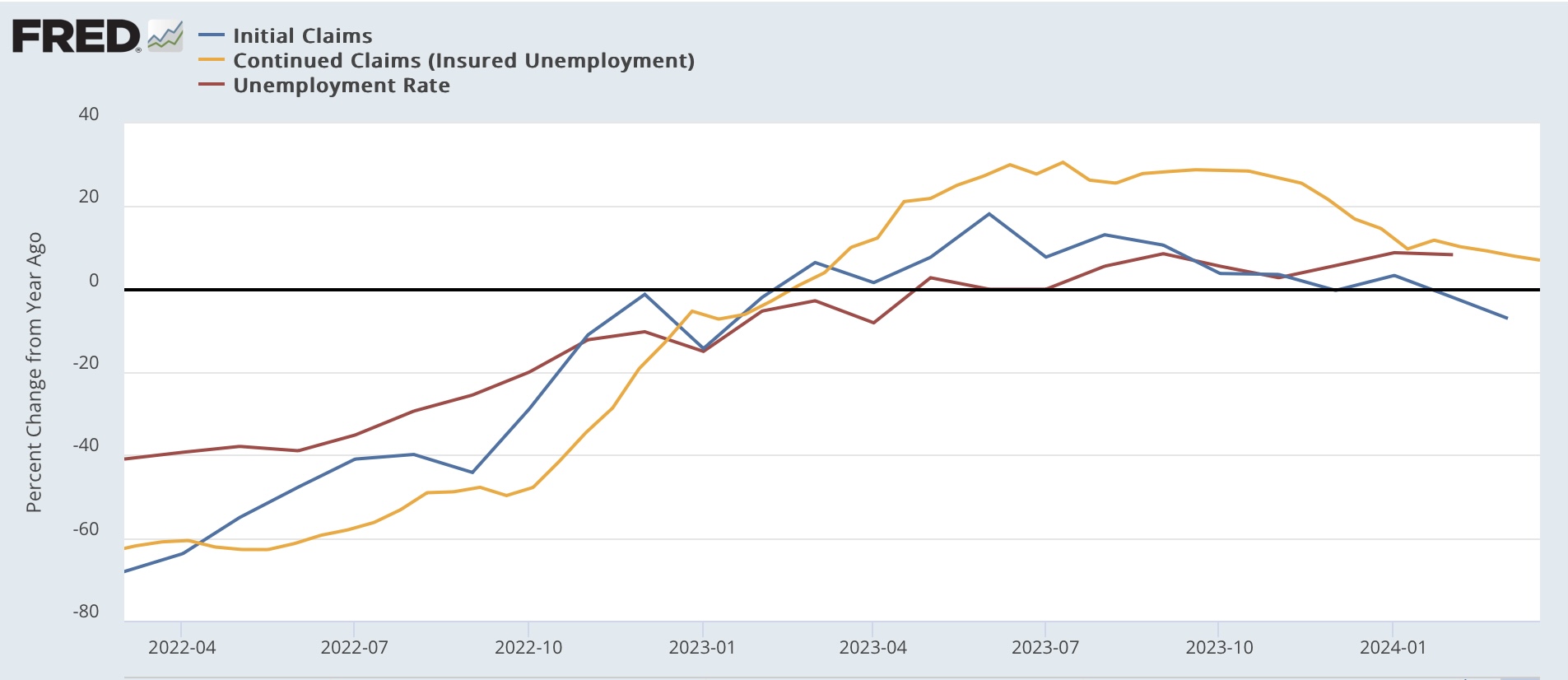

The first two are in the same range they have been in for the past 4 to 6 months while continuing claims are at their highest number but for 2 weeks in the past two years.On the more important YoY basis for forecasting purposes, initial claims are down -9.5%, and the four-week average is down -7.0%, the best YoY comparison in the past 12 months. Continuing claims are up 7.2%, but this is the second lowest YoY comparison in the past 12 months: .Now let’s update the forecast of the Sahm rule. With last month’s 2 year high in the unemployment rate, I’ve been wondering whether, because unemployment includes both new and existing job losses, it followed continuing claims more than initial claims (although initial claims lead both). The historical graphs, which I posted two weeks ago so I won’t repeat now, indicated that continuing claims also lead to the unemployment rate, although with much less of a lead time.With that in mind, here is this week’s update of the post-pandemic record for the past two years on a monthly YoY% basis (unemployment rate YoY shown in red):

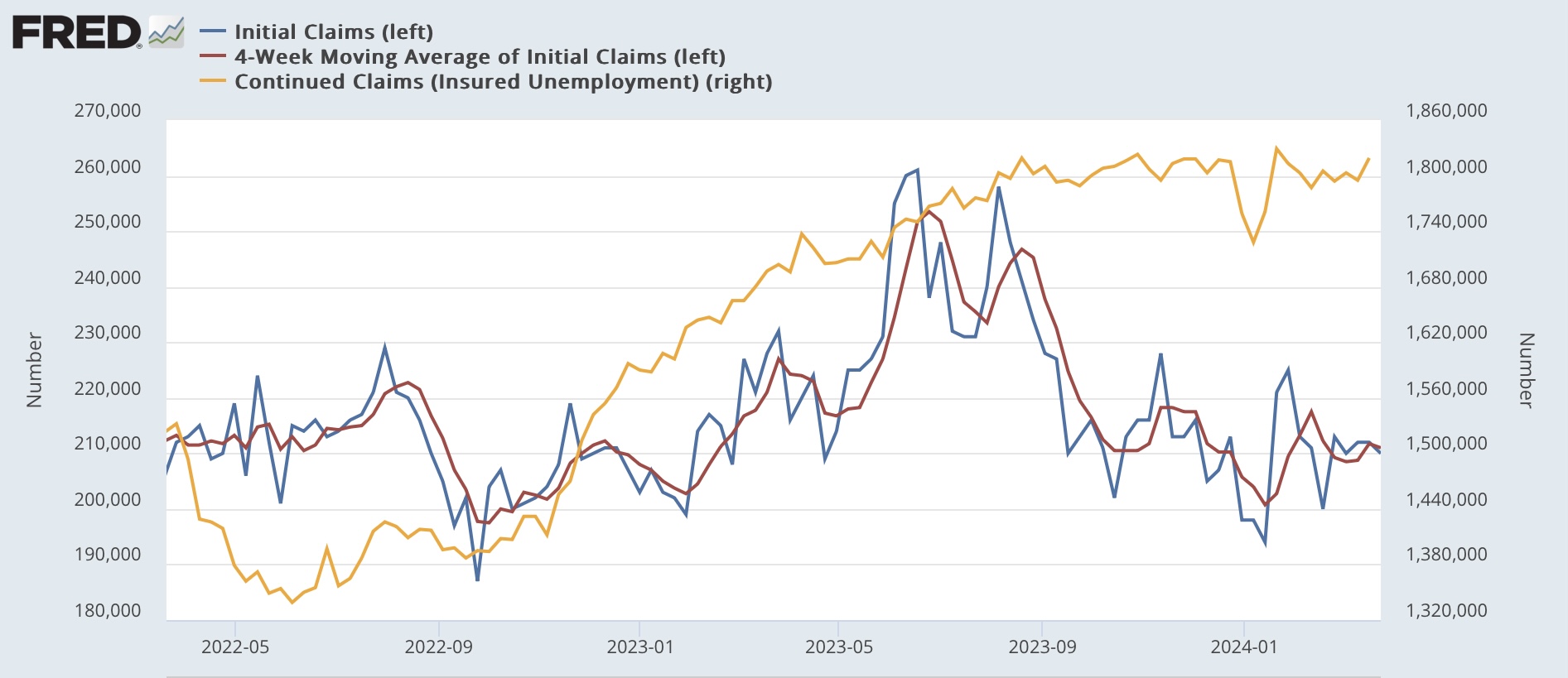

.Now let’s update the forecast of the Sahm rule. With last month’s 2 year high in the unemployment rate, I’ve been wondering whether, because unemployment includes both new and existing job losses, it followed continuing claims more than initial claims (although initial claims lead both). The historical graphs, which I posted two weeks ago so I won’t repeat now, indicated that continuing claims also lead to the unemployment rate, although with much less of a lead time.With that in mind, here is this week’s update of the post-pandemic record for the past two years on a monthly YoY% basis (unemployment rate YoY shown in red): Since on a monthly basis so far initial claims are significantly lower YoY, and continuing claims a little over 7% higher, I expect the unemployment rate to be either unchanged or slightly higher YoY in the next several months. This would take it back down to the 3.7% area.Here’s the same comparison on an absolute rather than YoY basis:

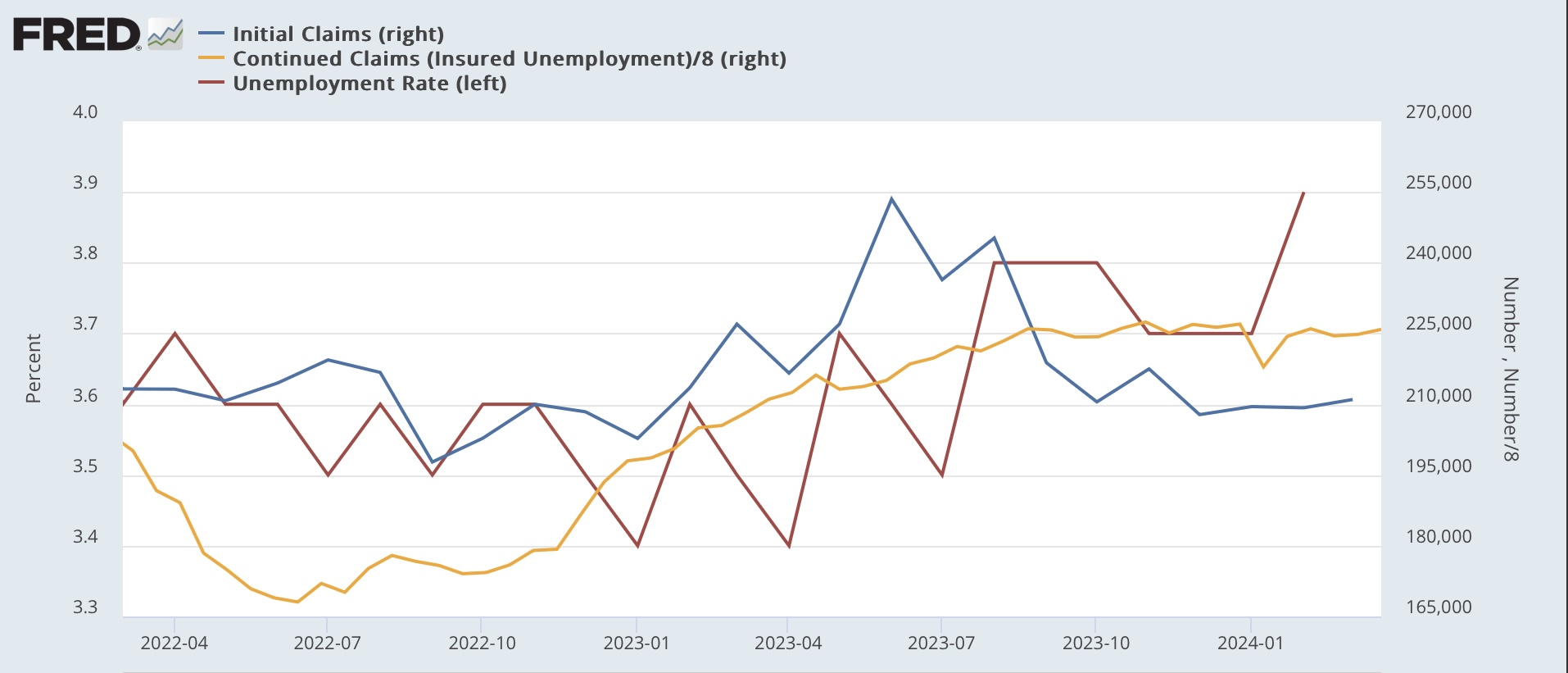

Since on a monthly basis so far initial claims are significantly lower YoY, and continuing claims a little over 7% higher, I expect the unemployment rate to be either unchanged or slightly higher YoY in the next several months. This would take it back down to the 3.7% area.Here’s the same comparison on an absolute rather than YoY basis: This similarly suggests a slight decline in the unemployment rate to 3.7% or 3.8%. Since the lowest three-month average of the unemployment rate in the past 12 months was 3.5%, it would take an increase to 4.0% averaged over three months to trigger the Sahm rule. Both initial and continuing claims indicate that is not going to happen in the immediate future.More By This Author:A Detailed Look At Manufacturing Repeat Home Sales Price Declined Slightly In January As Mortgage Rates Remain Rangebound, So Do New Home Sales

This similarly suggests a slight decline in the unemployment rate to 3.7% or 3.8%. Since the lowest three-month average of the unemployment rate in the past 12 months was 3.5%, it would take an increase to 4.0% averaged over three months to trigger the Sahm rule. Both initial and continuing claims indicate that is not going to happen in the immediate future.More By This Author:A Detailed Look At Manufacturing Repeat Home Sales Price Declined Slightly In January As Mortgage Rates Remain Rangebound, So Do New Home Sales