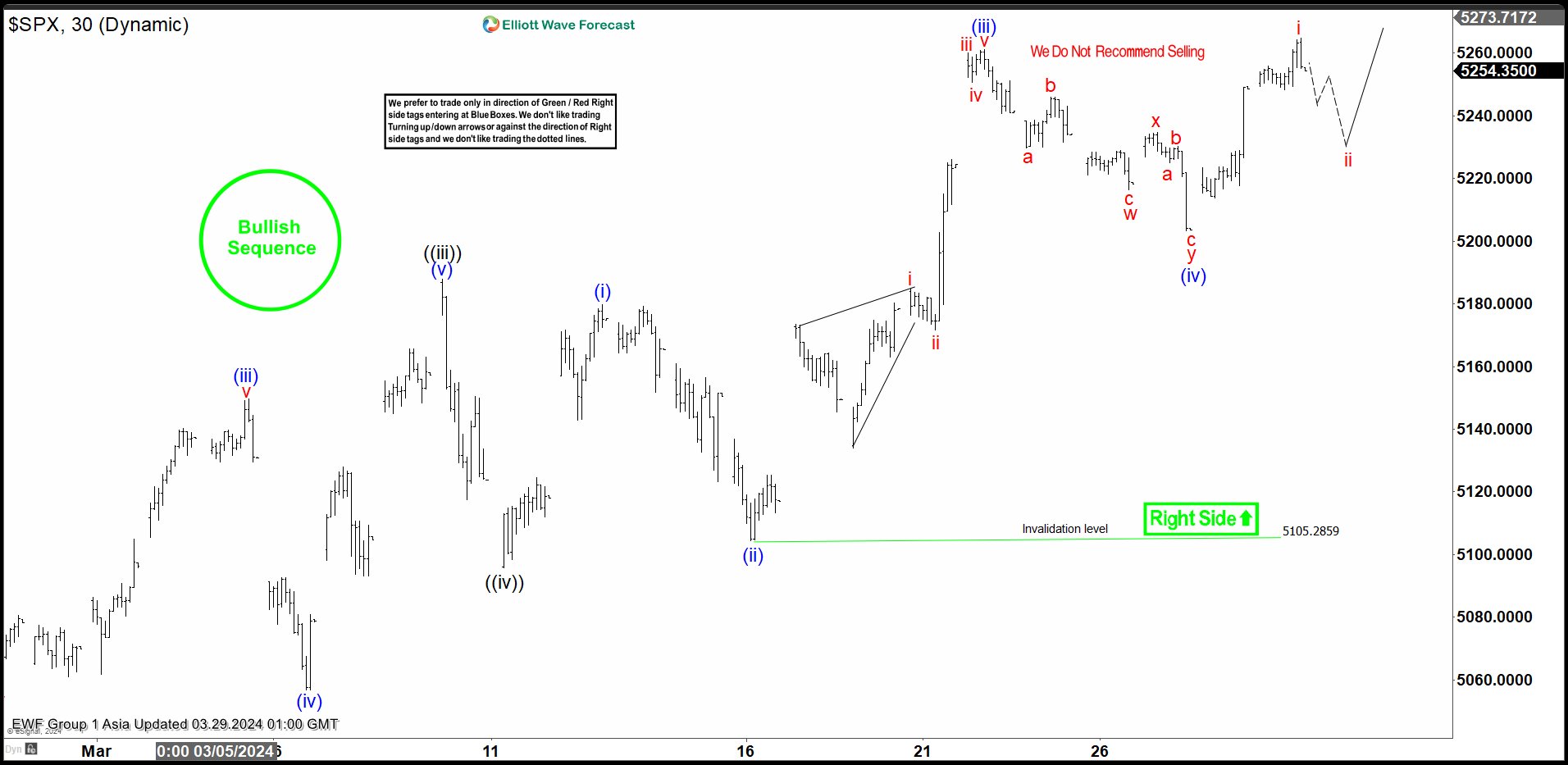

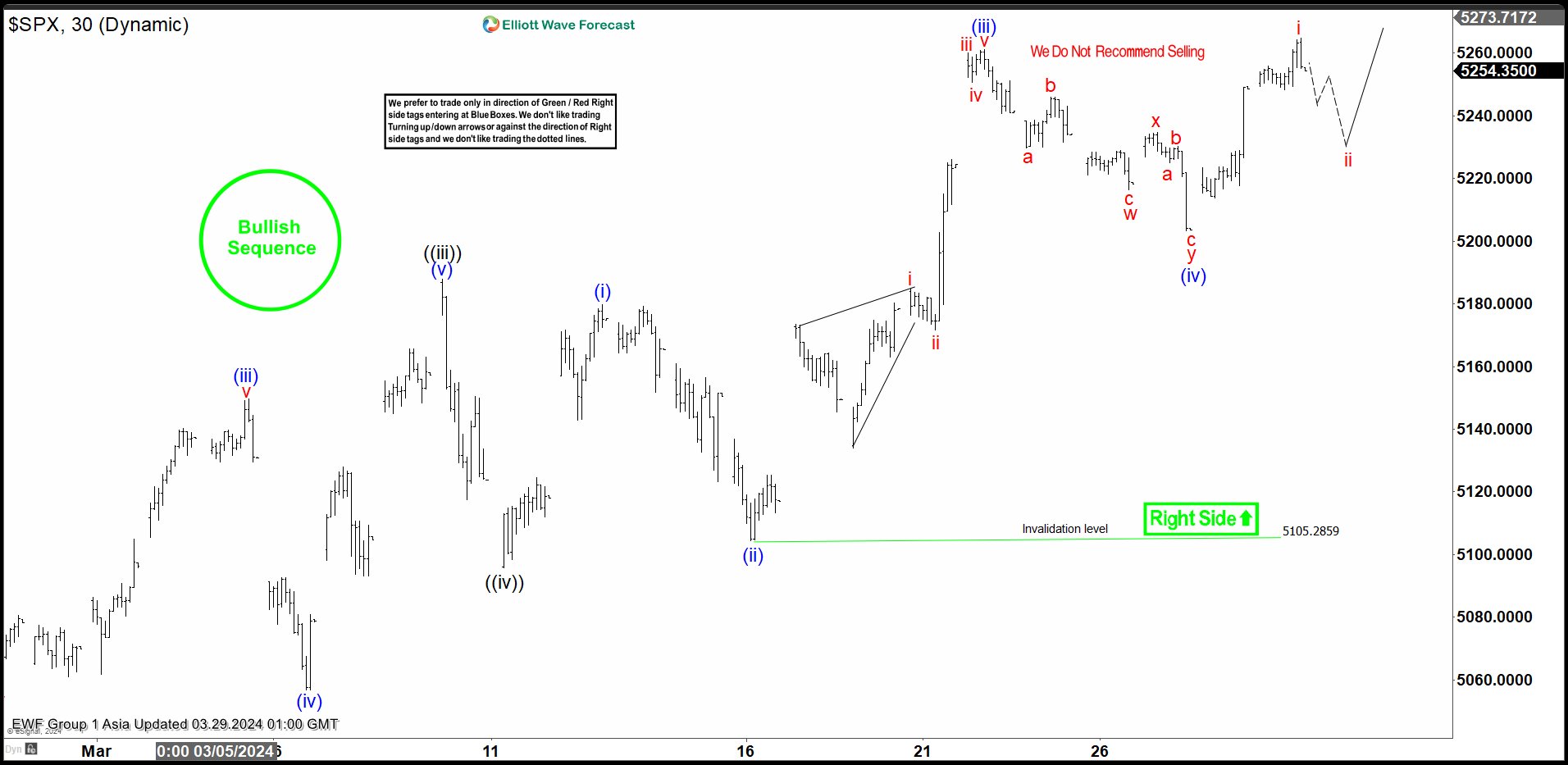

S&P 500 (SPX) Elliott Wave VideoVideo Length: 00:05:11More By This Author:Nasdaq 100 Potential Support AreaNikkei Looking To End Impulsive Rally Block, Inc. 50% Move On The Horizon

S&P 500 (SPX) Elliott Wave VideoVideo Length: 00:05:11More By This Author:Nasdaq 100 Potential Support AreaNikkei Looking To End Impulsive Rally Block, Inc. 50% Move On The Horizon

Mar 28, 2024Jeremy ParkinsonFinance, No picture0

S&P 500 (SPX) Elliott Wave VideoVideo Length: 00:05:11More By This Author:Nasdaq 100 Potential Support AreaNikkei Looking To End Impulsive Rally Block, Inc. 50% Move On The Horizon

S&P 500 (SPX) Elliott Wave VideoVideo Length: 00:05:11More By This Author:Nasdaq 100 Potential Support AreaNikkei Looking To End Impulsive Rally Block, Inc. 50% Move On The Horizon

User rating: 0.00% ( 0

User rating: 0.00% ( 0

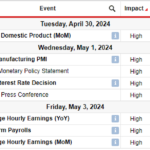

Apr 27, 2024 0

Apr 27, 2024 0

Apr 27, 2024 0

Apr 27, 2024 0