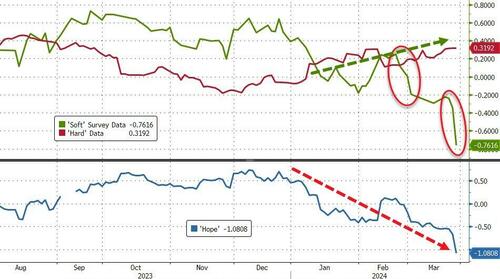

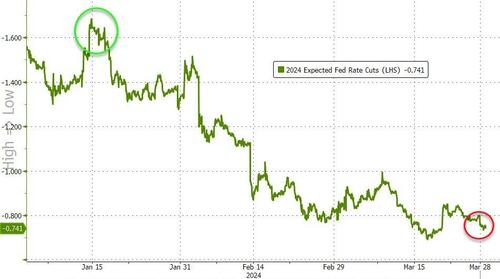

Source: BloombergThe strong ‘hard’ data – and sticky inflation – along with endless jawboning, drove rate-hike expectations drastically lower in Q1. 2024 expectations for The Fed crashed from almost seven cuts to less than three…

Source: BloombergThe strong ‘hard’ data – and sticky inflation – along with endless jawboning, drove rate-hike expectations drastically lower in Q1. 2024 expectations for The Fed crashed from almost seven cuts to less than three… Source: Bloomberg…and stocks did not even blink!

Source: Bloomberg…and stocks did not even blink! Source: BloombergWith the S&P 500 surging to its best start to a year since 2019 (outperforming Nasdaq)…

Source: BloombergWith the S&P 500 surging to its best start to a year since 2019 (outperforming Nasdaq)… Source: BloombergThat’s the 5th green month in a row…

Source: BloombergThat’s the 5th green month in a row… Source: BloombergAnd stocks are up for 18 of the last 22 weeks (it hasn’t done more than that since 1989)…

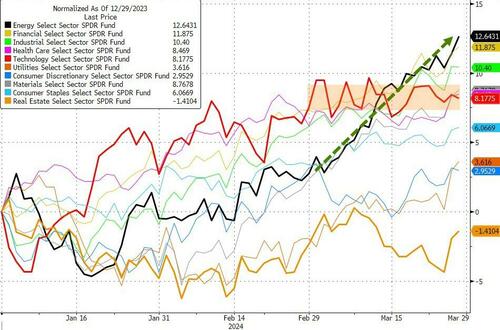

Source: BloombergAnd stocks are up for 18 of the last 22 weeks (it hasn’t done more than that since 1989)… Source: BloombergNotably, and perhaps surprisingly, Q1’s best performing sector was not tech… it was Energy (with Real Estate the only sector red in Q1). In fact in March, Energy stocks are up 10% while Tech is unchanged…

Source: BloombergNotably, and perhaps surprisingly, Q1’s best performing sector was not tech… it was Energy (with Real Estate the only sector red in Q1). In fact in March, Energy stocks are up 10% while Tech is unchanged… Source: BloombergSome have argued that Q1’s market strength reflects a growing belief that Republicans will win in November…

Source: BloombergSome have argued that Q1’s market strength reflects a growing belief that Republicans will win in November… Source: BloombergAnd don’t let anyone tell you this has not been a multiple expansion – tech is now back at over 28x – its post-dot-com bust highs…

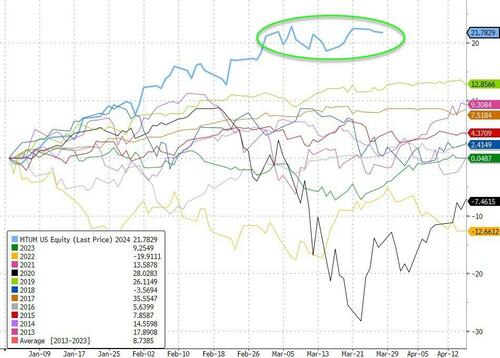

Source: BloombergAnd don’t let anyone tell you this has not been a multiple expansion – tech is now back at over 28x – its post-dot-com bust highs… Source: BloombergMTUM (momentum) saw its best start to a year… ever….

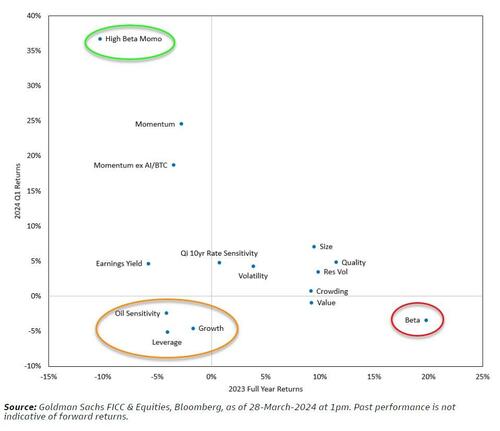

Source: BloombergMTUM (momentum) saw its best start to a year… ever…. Source: BloombergIn fact, as Goldman shows in the chart below, High Beta Momo – the big Q1 outperformer – reversed its laggard performance in 2023…

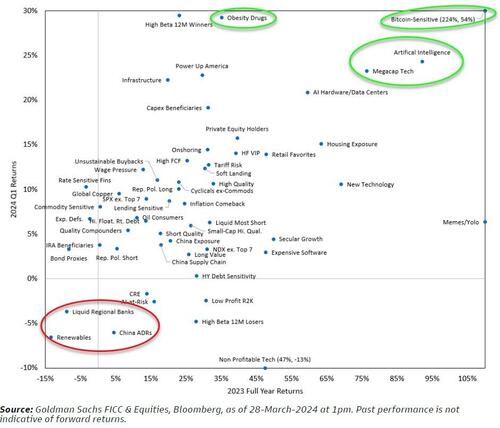

Source: BloombergIn fact, as Goldman shows in the chart below, High Beta Momo – the big Q1 outperformer – reversed its laggard performance in 2023… Thematically, Bitcoin-Sensitive stocks, AI stocks, and anti-obesity drug stocks all outperformed in Q1, continuing the trend of 2023 gains…

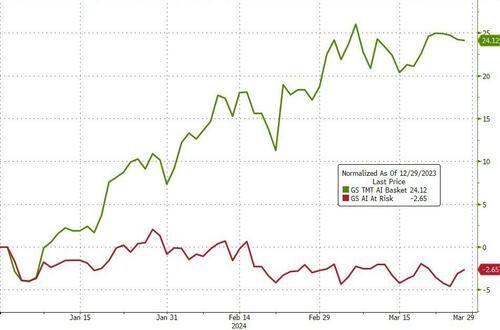

Thematically, Bitcoin-Sensitive stocks, AI stocks, and anti-obesity drug stocks all outperformed in Q1, continuing the trend of 2023 gains… AI-related stocks soared 24% in Q1 while stocks at risk from AI fell around 3% in Q1…

AI-related stocks soared 24% in Q1 while stocks at risk from AI fell around 3% in Q1… Source: BloombergAnti-Obesity stocks soared in Q1, actually outperforming AI stocks and even GLP-1-at-risk stocks (e.g. WW) managed gains in Q1…

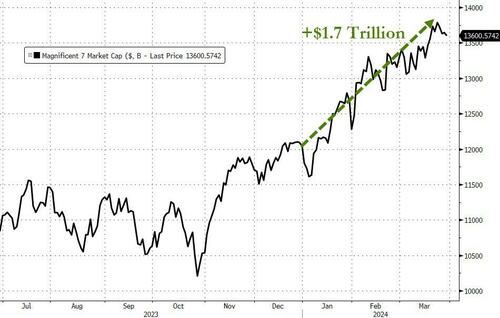

Source: BloombergAnti-Obesity stocks soared in Q1, actually outperforming AI stocks and even GLP-1-at-risk stocks (e.g. WW) managed gains in Q1… Source: Bloomberg‘Magnificent 7’ stocks added a stunning $1.7 trillion in market cap in Q1…

Source: Bloomberg‘Magnificent 7’ stocks added a stunning $1.7 trillion in market cap in Q1… Source: BloombergNotably, the implied vol of the Mag7 is once again very elevated relative to the implied vol of the S&P 500. In July of last year, this signaled a big reversal (demand for hedges). In Jan of this year, it was a signal of chasers buying levered bets on the upside. What does it mean this time?

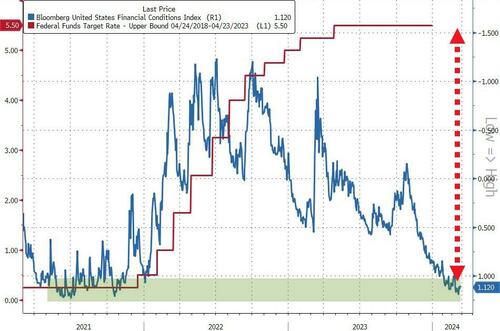

Source: BloombergNotably, the implied vol of the Mag7 is once again very elevated relative to the implied vol of the S&P 500. In July of last year, this signaled a big reversal (demand for hedges). In Jan of this year, it was a signal of chasers buying levered bets on the upside. What does it mean this time? Source: BloombergThe strength in stocks and credit has dominated any rise in yields and crushed financial conditions to their loosest since before The Fed started their rate-hiking cycle…

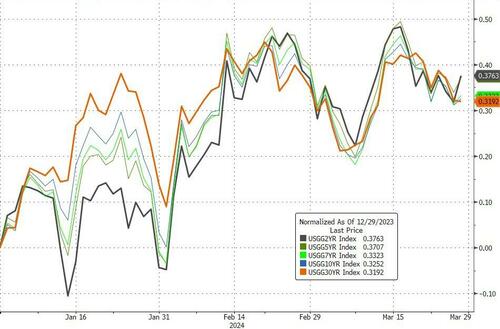

Source: BloombergThe strength in stocks and credit has dominated any rise in yields and crushed financial conditions to their loosest since before The Fed started their rate-hiking cycle… Source: BloombergUS Treasuries were dumped in Q1 as rate-cut expectations plunged with the short-end modestly underperforming…

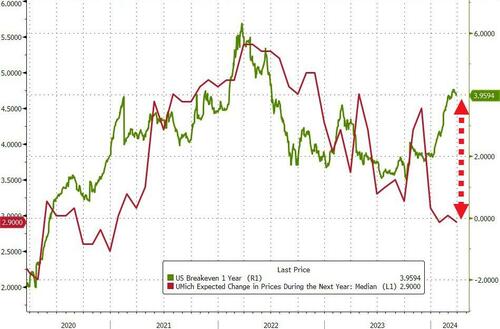

Source: BloombergUS Treasuries were dumped in Q1 as rate-cut expectations plunged with the short-end modestly underperforming… Source: BloombergAnd while survey-based inflation expectations (UMich) are sliding, the market’s expectation for inflation is anything but…

Source: BloombergAnd while survey-based inflation expectations (UMich) are sliding, the market’s expectation for inflation is anything but… Source: BloombergThe dollar rallied in Q1, erasing around half of the Q4 losses…

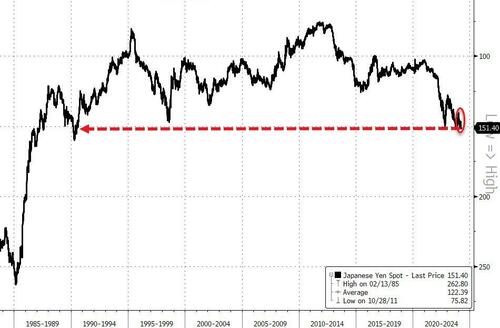

Source: BloombergThe dollar rallied in Q1, erasing around half of the Q4 losses… Source: BloombergThe dollar’s strength was supported by yen weakness as the Japanese currency plunged to its weakest since 1990…

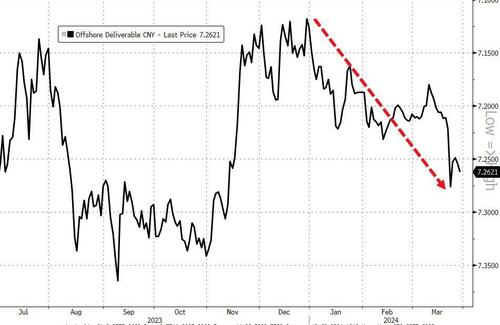

Source: BloombergThe dollar’s strength was supported by yen weakness as the Japanese currency plunged to its weakest since 1990… Source: BloombergNot to be outdone, the yuan also tumbled in Q1…

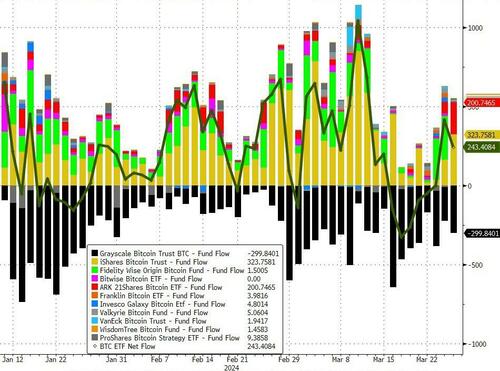

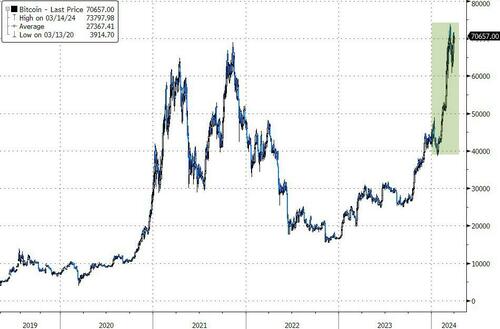

Source: BloombergNot to be outdone, the yuan also tumbled in Q1… Source: BloombergQ1 was dominated by bitcoin headlines – as the newly minted ETFs saw unprecedented inflows…

Source: BloombergQ1 was dominated by bitcoin headlines – as the newly minted ETFs saw unprecedented inflows… Source: BloombergWhich helped push Bitcoin to a new record high (in USD)…

Source: BloombergWhich helped push Bitcoin to a new record high (in USD)… Source: BloombergEthereum also soared in Q1 (up 55%) but Solana outperformed…

Source: BloombergEthereum also soared in Q1 (up 55%) but Solana outperformed… Source: BloombergAnother alternate currency – gold – also soared to a new record high in Q1…

Source: BloombergAnother alternate currency – gold – also soared to a new record high in Q1… Source: BloombergAnd just when you thought NVDA was the big winner, Cocoa hyperinflates in Q1, up 135% YTD!

Source: BloombergAnd just when you thought NVDA was the big winner, Cocoa hyperinflates in Q1, up 135% YTD! Source: BloombergOil, wholesale gasoline, and pump-prices all ripped higher in Q1 (especially March)…

Source: BloombergOil, wholesale gasoline, and pump-prices all ripped higher in Q1 (especially March)… Source: BloombergFinally, as Goldman’s Chris Hussey notes, it’s times like these – when ‘everything is awesome’ – when it is best to assess the risks that swirl around the investment landscape. Here are a few to consider:

Source: BloombergFinally, as Goldman’s Chris Hussey notes, it’s times like these – when ‘everything is awesome’ – when it is best to assess the risks that swirl around the investment landscape. Here are a few to consider:

A strong economic landing becomes a hard landing;

Inflation is sticky, not transitory, and the Fed pushes back;

The pandemic stimulus surge turns out not to be ‘cost-less’;

Concentration raises ‘key company’ risk;

Elections and geo-political risks.

And as a reminder, we’ve seen these ‘everything is awesome’ moments before… Source: BloombergAnd they never end well.More By This Author:Philadelphia Fed Admits US Payrolls Overstated By At Least 800,000Pending Home Sales Hover Near Record Lows In FebruaryStocks Set To Close Blowout Week, Month And Quarter At All-Time High; Gold Soars To Record

Source: BloombergAnd they never end well.More By This Author:Philadelphia Fed Admits US Payrolls Overstated By At Least 800,000Pending Home Sales Hover Near Record Lows In FebruaryStocks Set To Close Blowout Week, Month And Quarter At All-Time High; Gold Soars To Record