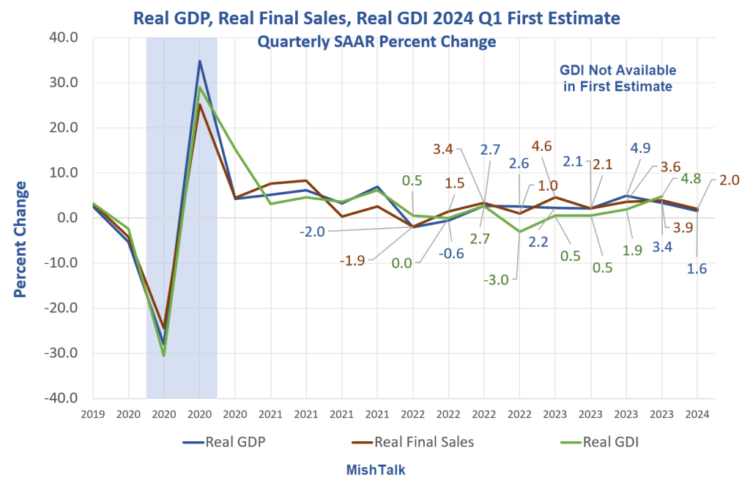

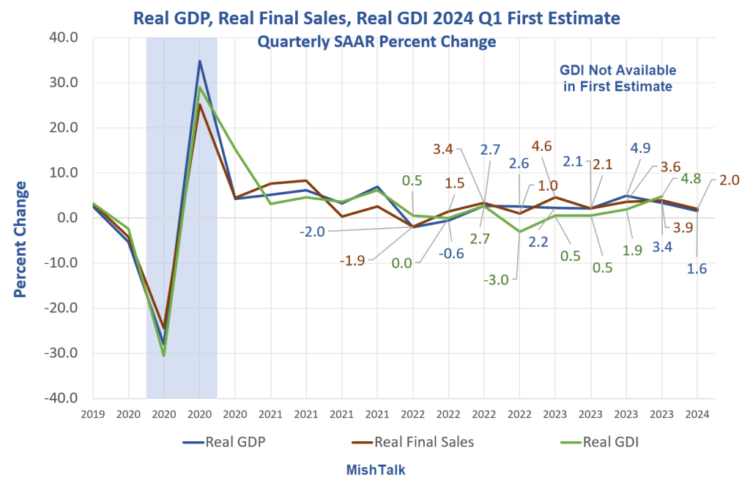

First-quarter GDP was lower than any estimate in the Bloomberg Econoday consensus range of 1.7 percent to 2.8 percent. Inflation was higher than expected. GDP and GDI from the BEA, chart by Mish Chart Notes

GDP and GDI from the BEA, chart by Mish Chart Notes

Gross Domestic Product (GDP) and Gross Domestic Income (GDI) are two measures of the same thing. Product produced should match sales and income. They do over time, but this is a large ongoing discrepancy.

Real Final Sales is the bottom line estimate of GDP. The difference between GDP and Real Final Sales is inventory adjustment which nets to zero over time.

Real means Inflation adjusted using the GDP deflator as calculated by the BEA as the adjustment.

Advance GDP 2024 Q1Real gross domestic product (GDP) increased at an annual rate of 1.6 percent in the first quarter of 2024, according to the “advance” estimate released by the Bureau of Economic Analysis.

The increase in real GDP primarily reflected increases in consumer spending, residential fixed investment, nonresidential fixed investment, and state and local government spending that were partly offset by a decrease in private inventory investment.

The increase in consumer spending reflected an increase in services that was partly offset by a decrease in goods. Within services, the increase primarily reflected increases in health care as well as financial services and insurance. Within goods, the decrease primarily reflected decreases in motor vehicles and parts as well as gasoline and other energy goods.

Within residential fixed investment, the increase was led by brokers’ commissions and other ownership transfer costs as well as new single-family housing construction. The increase in nonresidential fixed investment mainly reflected an increase in intellectual property products.

The increase in state and local government spending reflected an increase in compensation of state and local government employees.

The decrease in inventory investment primarily reflected decreases in wholesale trade and manufacturing. Within imports, the increase reflected increases in both goods and services.

Understanding ImportsThe BEA says “Imports, which are a subtraction in the calculation of GDP, increased.”That statement is inaccurate. Imports do not change GDP given the “D” stands for “Domestic” and imports are not domestic.However, the BEA needs to subtract exports because procedures are such that imports are included in sales when they they shouldn’t be,Price Indexes

The price index for gross domestic purchases increased 3.1 percent in the first quarter, compared with an increase of 1.9 percent in the fourth quarter.

The personal consumption expenditures (PCE) price index increased 3.4 percent, compared with an increase of 1.8 percent.

Excluding food and energy prices, the PCE price index increased 3.7 percent, compared with an increase of 2.0 percent.

If the measures of inflation are understated, then Real GDP and GDI are overstated.Compared to expectations, this was a miserable report. One can see it in bond yields (up) and the stock market (down).Bond Yields

10-year: 4.73%, up 8 basis points (.08 percentage points)

30-year: 4.84%, up 6 basis points

2-year: 5.02% up 8 basis points

Growth underperformed while inflation was higher than expected.More By This Author:Tesla Rebounds On Musk Promises With No Details, It Won’t StickARK Destroyed More Wealth Than Any Asset Manager Over The Previous Decade New Home Sales Rise 8.8 Percent After 3.8 Percent Negative Revision

GDP and GDI from the BEA, chart by Mish Chart Notes

GDP and GDI from the BEA, chart by Mish Chart Notes