Image Source: Pixabay

Image Source: Pixabay

Asian stock markets are trading with mixed results on Thursday, following the uncertain signals from Wall Street overnight as META earnings failed to impress afterhours causing a late selloff. Traders are exercising caution as they await the report on first quarter US GDP data, which could potentially influence the outlook for interest rates. While the Fed is anticipated to maintain interest rates at next week’s US Fed monetary policy meeting, traders are keen to gather hints about the likelihood of future rate cuts.In the UK, the morning’s CBI distributive trades survey offers early insights into consumer trends this month. March’s retail sales balance hit a 10-month peak, signaling a promising sectoral outlook, although this month’s balance might taper slightly, possibly due to Easter’s early timing this year. Attention will likely turn to the UK GfK consumer confidence survey set for early release on Friday. With a recent upward trend, indicative of modest enhancements in consumer fundamentals amid peaking interest rates and real wage increments, another minor uptick to -20 is expected this month. This rise is bolstered by recent Budget tax cuts and ongoing inflationary retreat.Across the pond, today’s focal point lies in the initial assessment of US Q1 GDP growth. Last week’s robust March retail sales data, coupled with upward revisions to prior months, suggests another substantial GDP uptick. Anticipating a 2.5% annualized increase, matching consensus estimates, the surge primarily stems from continued robust consumer spending. However, weaker contributions from sectors like business investment and slowed inventory accumulation may dampen growth. Despite potentially marking the slowest quarterly growth rate in three quarters, it still exceeds most trend growth estimates, prompting Federal Reserve policymakers to maintain cautious optimism regarding interest rate adjustments.On Friday, the Bank of Japan unveils its latest monetary policy update, expected to maintain short-term interest rates within a 0%-0.1% range after exiting negative territory last month. Market focus centers on Governor Ueda’s guidance, with expectations for further rate hikes later in the year.

Overnight Newswire Updates of Note

Japan Keeps Traders On Intervention Alert After Yen Pierces 155

Bank Of Japan Feels Inflation Heat From Fed’s ‘Higher For Longer’ Shift

China 2024 Growth Outlook Raised To 4.8%, Deflation Risk Lingers

Blinken Tells China To Manage Ties ‘Responsibly’ As Talks Begin

Yen Inches Closer To Intervention Point As BoJ Meeting Starts

Treasury Yields Rise As Traders Await Key US Economic Data

Oil Prices Creep Lower Amid Mixed US Inventories

Meta Projects Higher Spending, Weak Revenue In AI Push

Ford Beats Sales, Profit Estimates Amid EV Strategy Overhaul

IBM Reports Consulting Slump, Overshadowing HashiCorp Deal

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0640-50 (2.2BLN), 1.0700 (750M), 1.0710-15 (587M)

1.0750-60 (1.6BLN), 1.0800 (689M)

USD/CHF: 0.9175 (200M), 0.9200-05 (360M). EUR/CHF: 0.9720 (400M)

GBP/USD: 1.2475 (195M), 1.2495-1.2500 (656M)

AUD/USD: 0.6430 (559M), 0.6540-50 (500M)

USD/CAD: 1.3650 (379M), 1.3740-50 (1BLN), 1.3835 (333M)

AUD/NZD: 1.0850 (1.1BLN), 1.1000 (875M)

USD/JPY: 155.00-05 (2.4BLN) , 155.25 (517M), 155.85 (1.2BLN)

EUR/JPY: 165.55 (1.3BLN), 166.65 (1BLN)

AUD/JPY: 102.00 (1BLN). CHF/JPY: 169.70 (590M)

The overnight option expiry has been extended to 10 am New York time on Friday, April 26, and this includes the Bank of Japan (BoJ). There has been a significant increase in the implied volatility of JPY-related FX options. Implied volatility is used to assess the risk of FX realized volatility when determining the premium. The overnight USD/JPY implied volatility is currently at 10.0 to 25.0, the highest since the December BoJ meeting. The premium/break-even for a vanilla straddle is now at 162 compared to 65 JPY pips in either direction. The market is showing a high level of nervousness about potential intervention and the possibility of further weakening of the JPY. Additionally, the Tokyo CPI data is also a factor, along with the U.S. CPI data later on Friday.

CFTC Data As Of 19/04/24

Japanese yen net short position is -165,619 contracts

Swiss franc posts net short position of -36,212 contracts

British pound net long position is 8,619 contracts

Euro net long position is 12,224 contracts

Bitcoin net short position is -363 contracts

Equity fund managers cut S&P 500 CME net long position by 89,326 contracts to 850,042

Equity fund speculators trim S&P 500 CME net short position by 139,497 contracts to 193,791

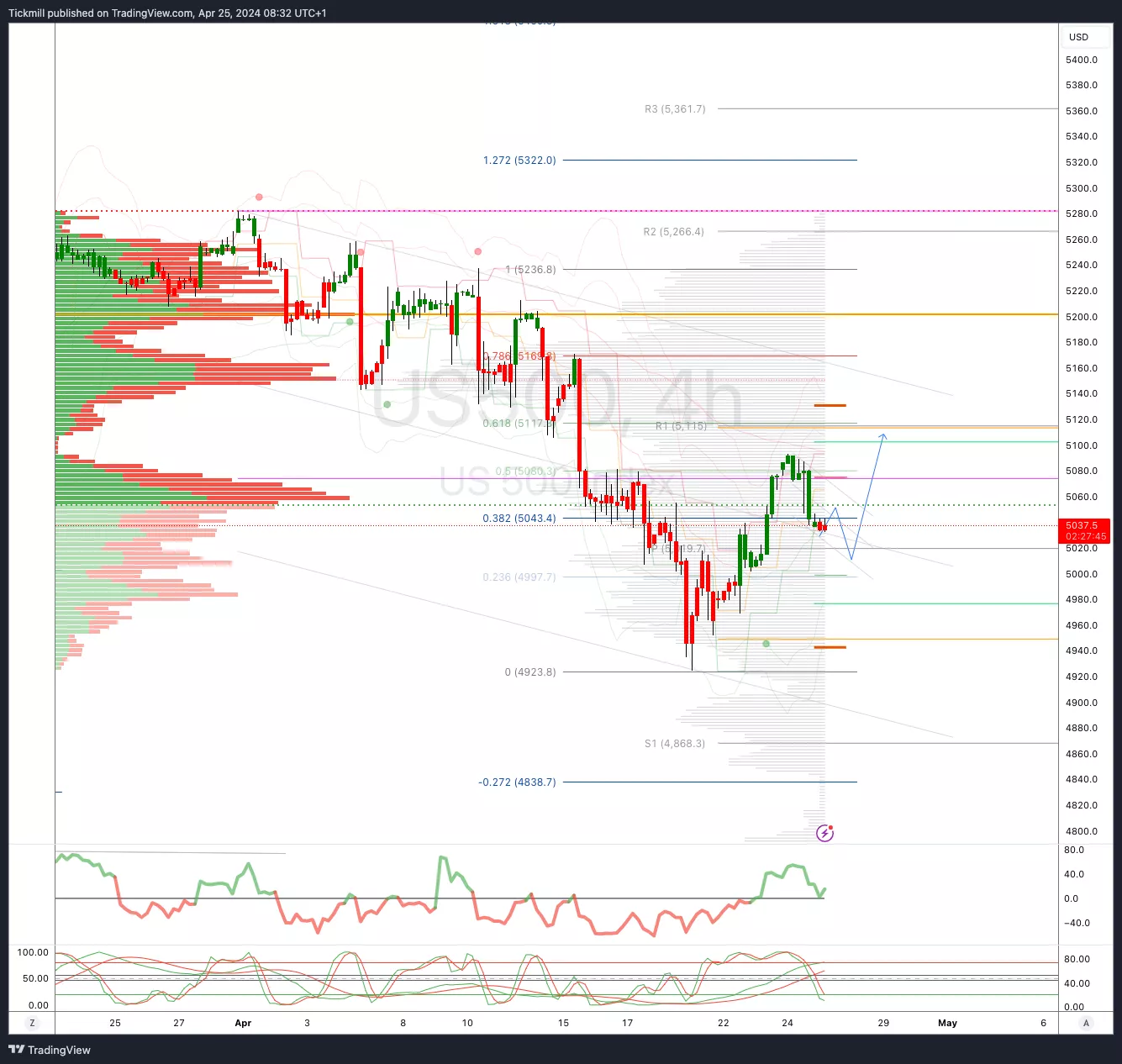

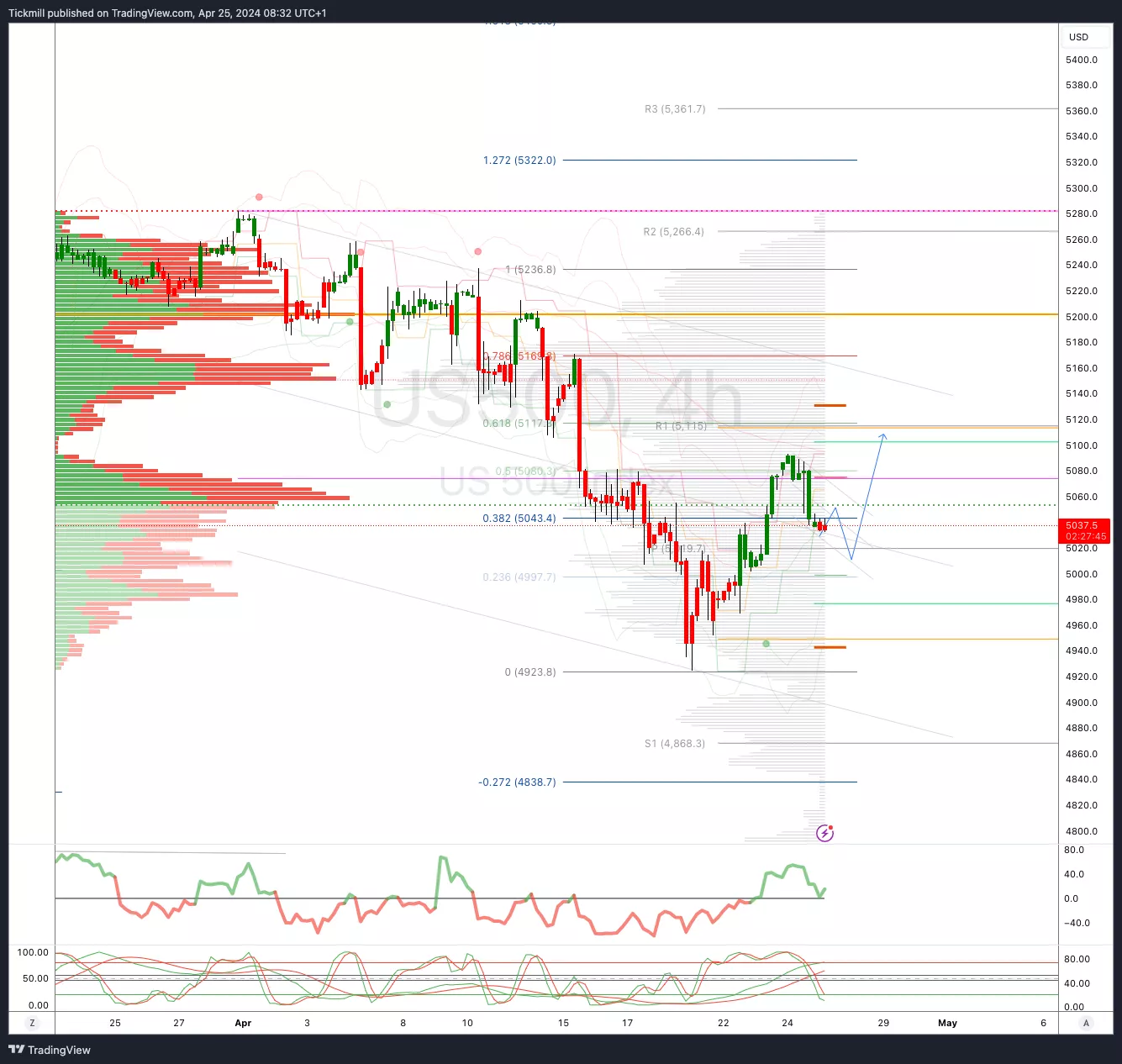

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5070

Daily VWAP bullish

Weekly VWAP bearish

Below 5020 opens 5000

Primary support 5007

Primary objective is 5150

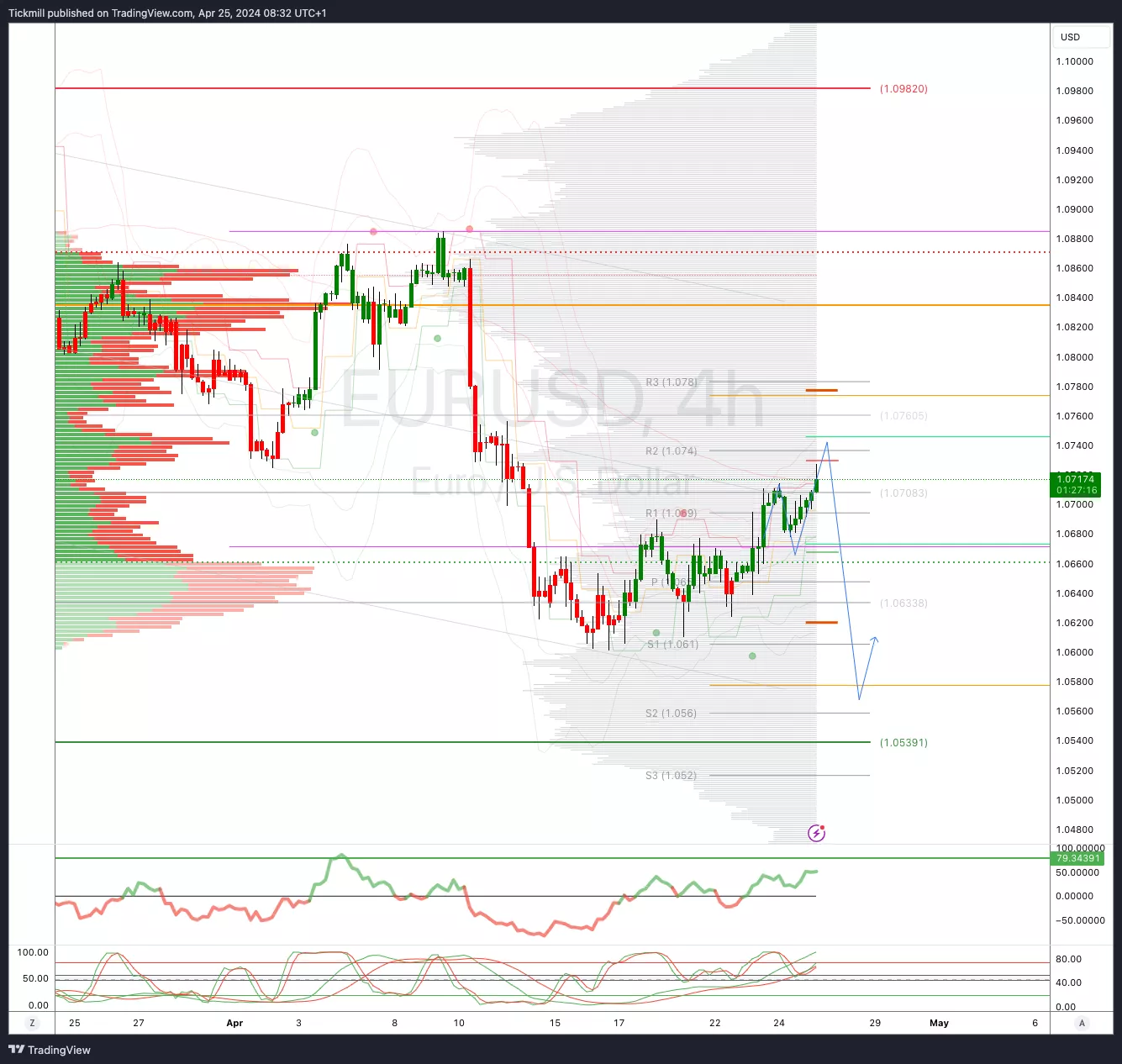

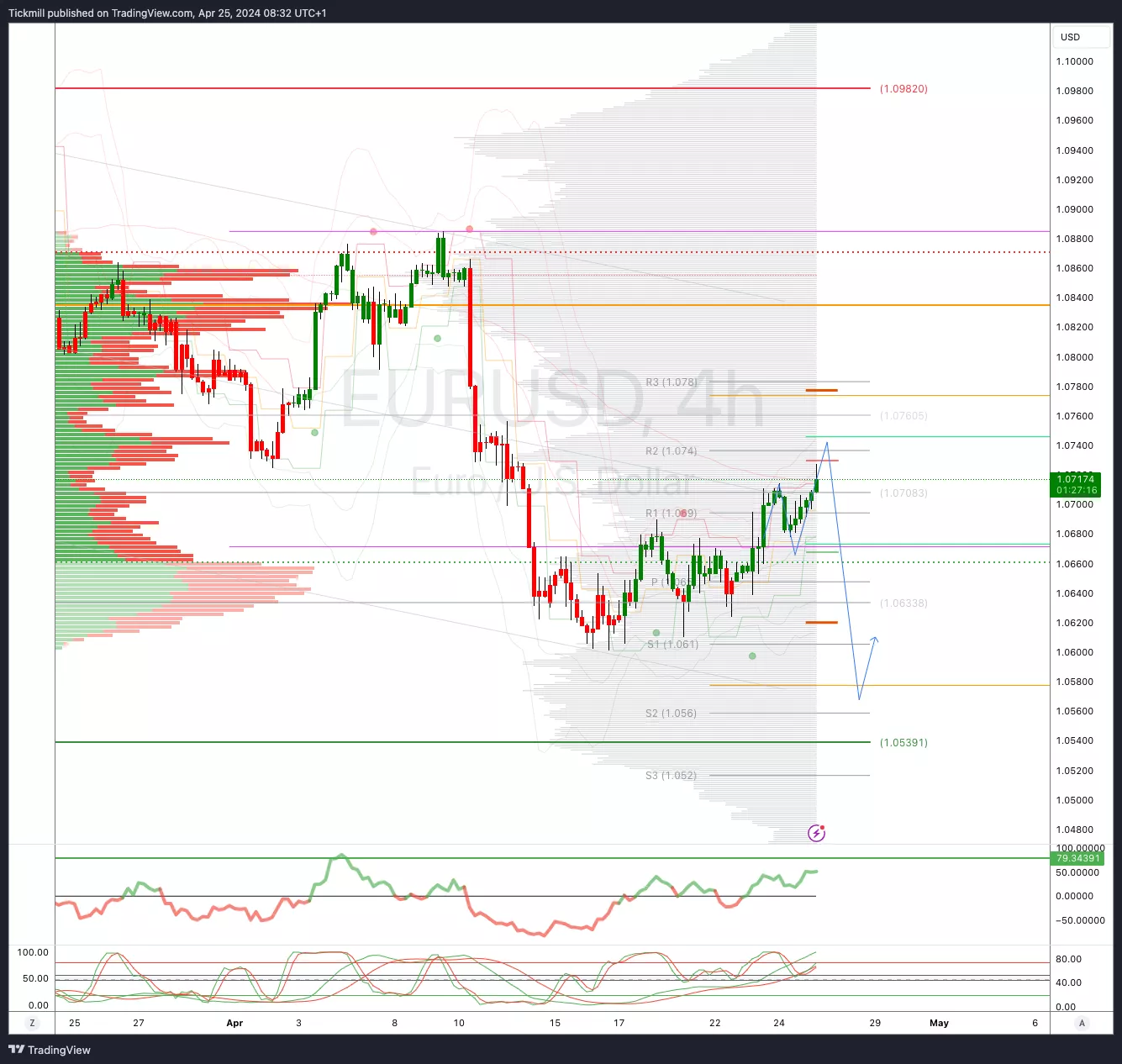

EURUSD Bullish Above Bearish Below 1.0720

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bullish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

GBPUSD Bullish Above Bearish Below 1.24

GBPUSD Bullish Above Bearish Below 1.24

Daily VWAP bullish

Weekly VWAP bearish

Above 1.25 opens 1.2570

Primary resistance is 1.2650

Primary objective 1.2350 TARGET HIT NEW PATTERN EMERGING

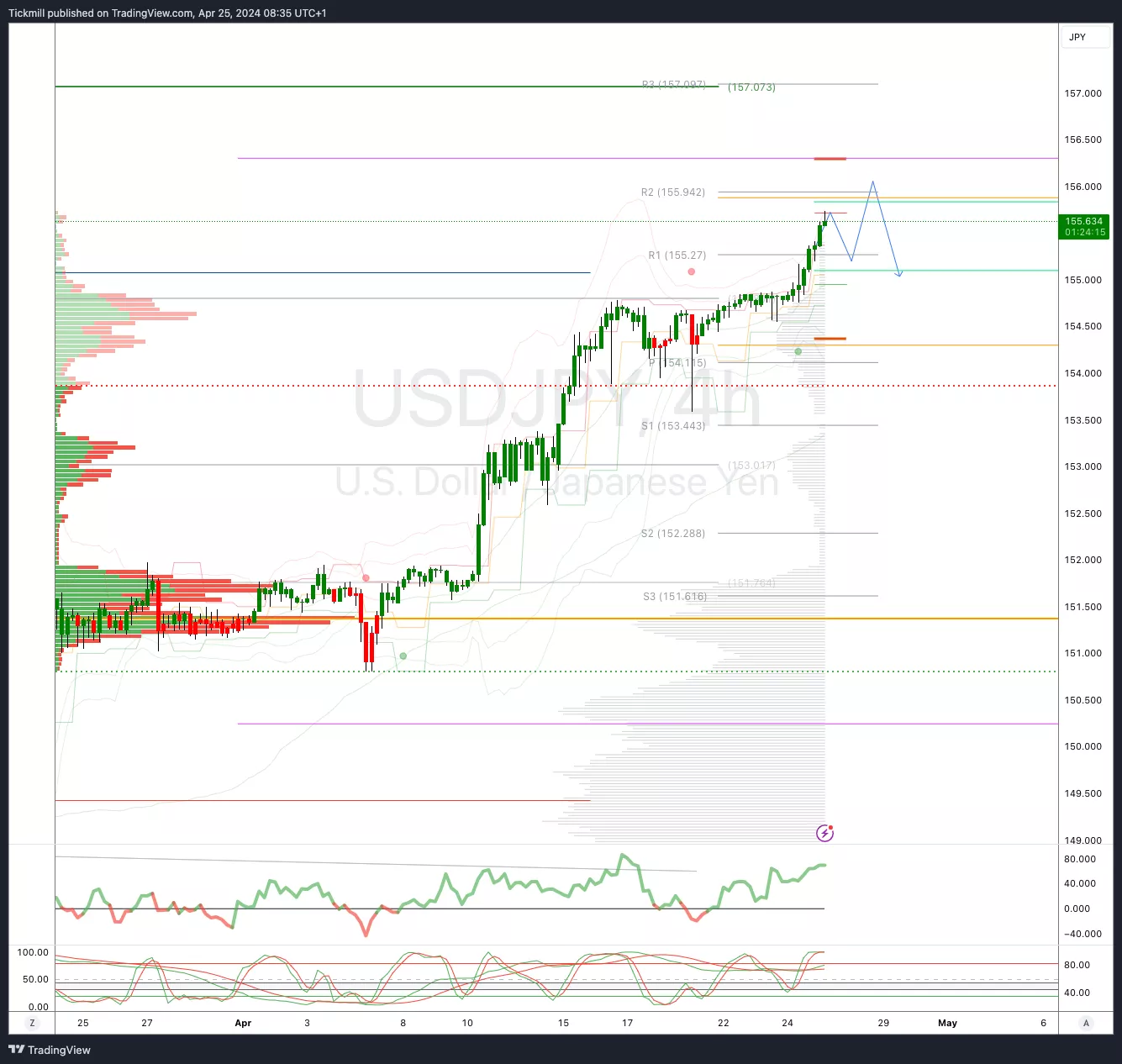

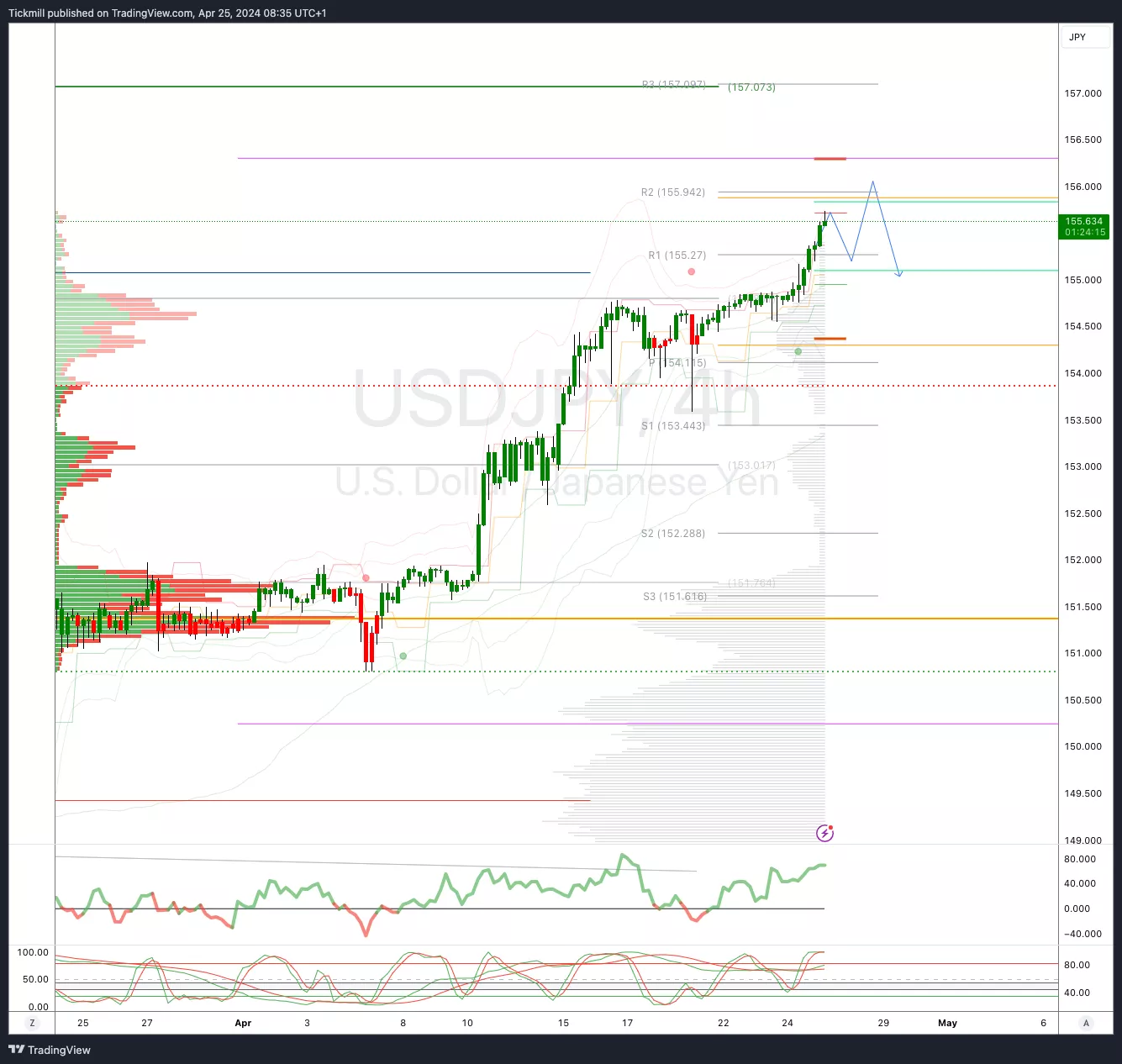

USDJPY Bullish Above Bearish Below 154.60

USDJPY Bullish Above Bearish Below 154.60

Daily VWAP bullish

Weekly VWAP bullish

Below 153.40 opens 152

Primary support 152

Primary objective is 155 TARGET HIT NEW PATTERN EMERGING

XAUUSD Bullish Above Bearish Below 2379

XAUUSD Bullish Above Bearish Below 2379

Daily VWAP bearish

Weekly VWAP bullish

Above 2420 opens 2460

Primary support 2300

Primary objective is 2310 TARGET HIT NEW PATTERN EMERGING

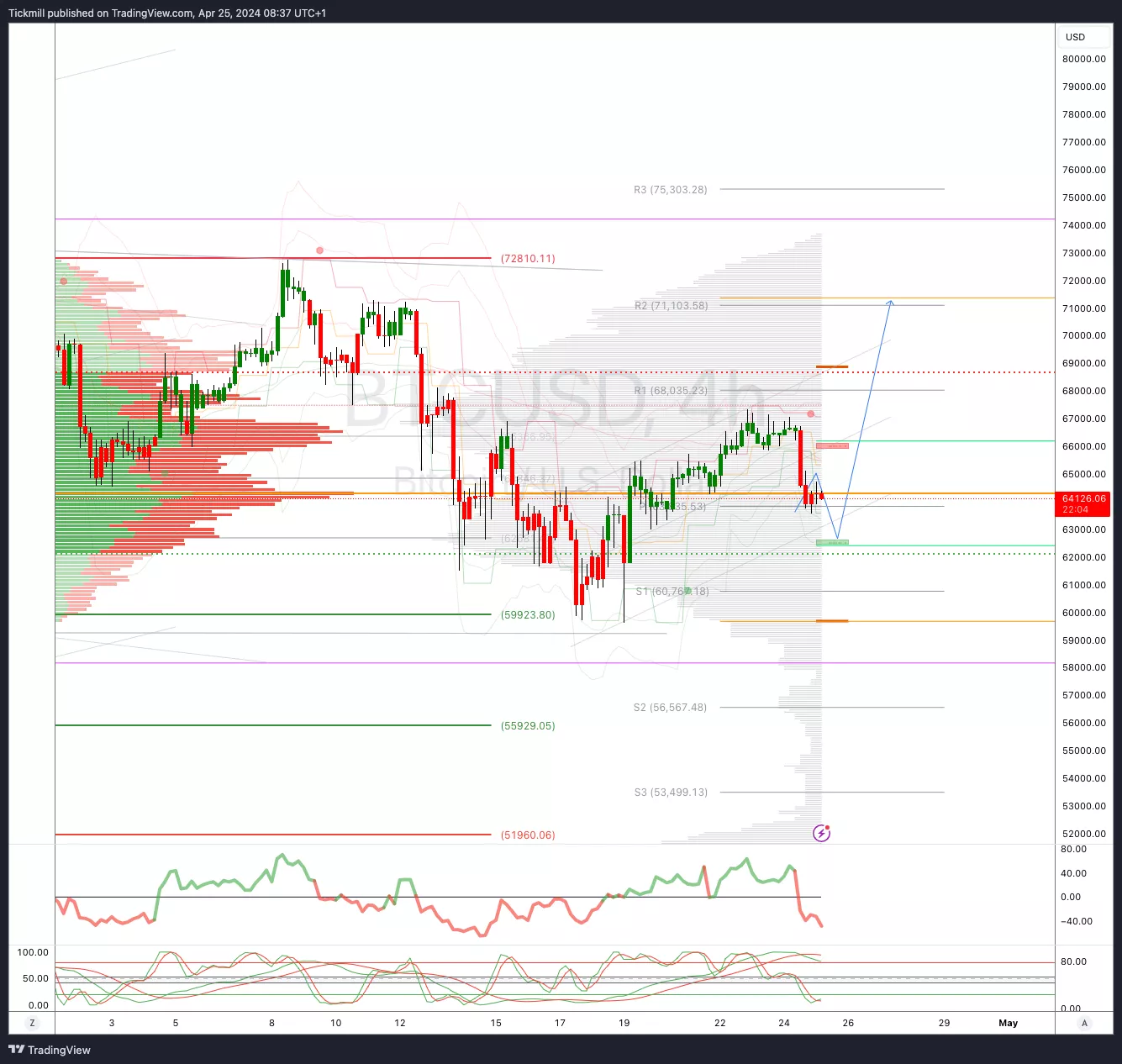

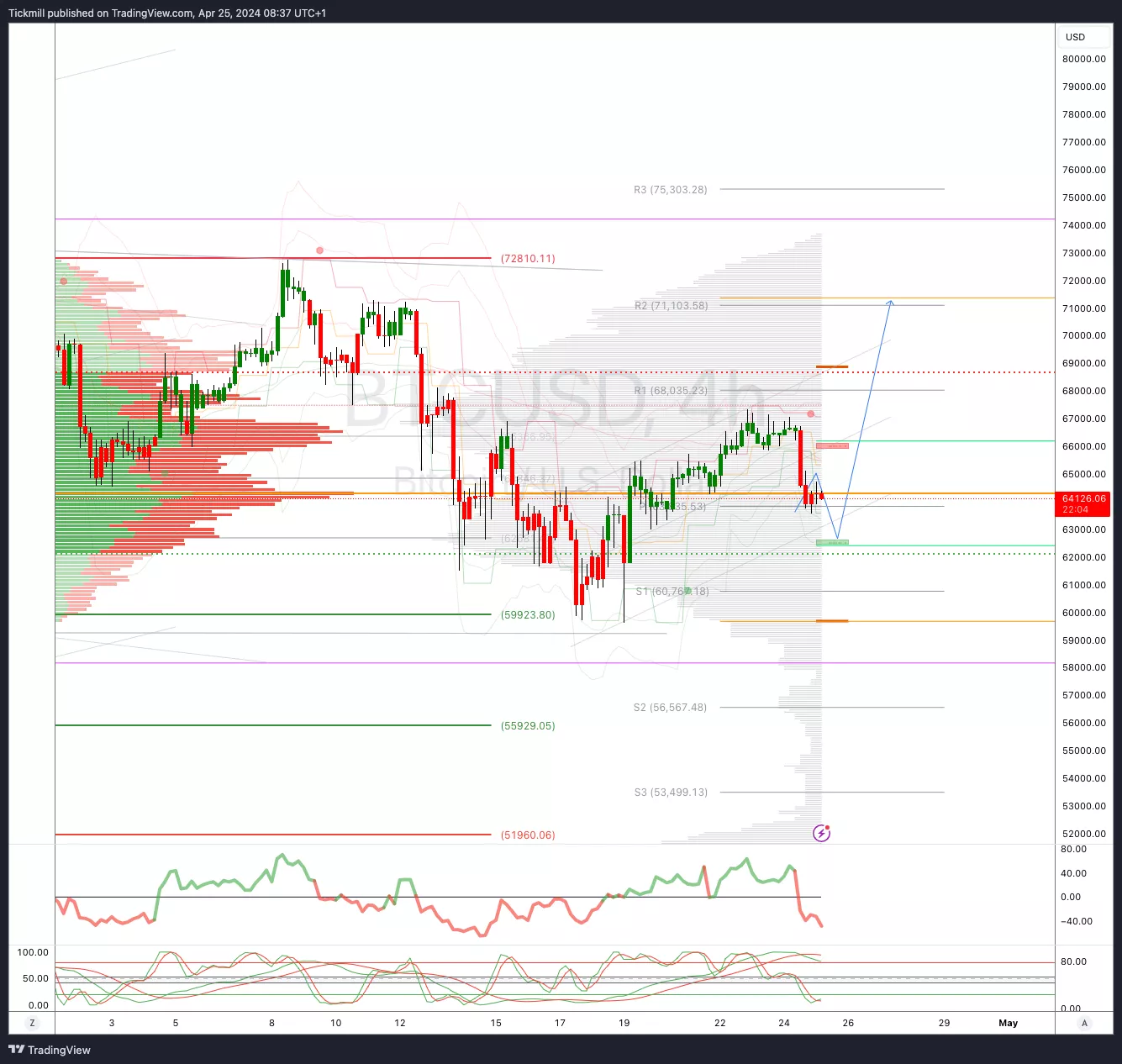

BTCUSD Bullish Above Bearish below 62000

BTCUSD Bullish Above Bearish below 62000

Daily VWAP bearish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 78000

More By This Author:FTSE Finally Breaks Record Highs Before PausingDaily Market Outlook – Tuesday, April 23FTSE On The Front Foot As MIddle East Tensions Recede

More By This Author:FTSE Finally Breaks Record Highs Before PausingDaily Market Outlook – Tuesday, April 23FTSE On The Front Foot As MIddle East Tensions Recede

Image Source: Pixabay

Image Source: Pixabay EURUSD Bullish Above Bearish Below 1.0720

EURUSD Bullish Above Bearish Below 1.0720 GBPUSD Bullish Above Bearish Below 1.24

GBPUSD Bullish Above Bearish Below 1.24 USDJPY Bullish Above Bearish Below 154.60

USDJPY Bullish Above Bearish Below 154.60 XAUUSD Bullish Above Bearish Below 2379

XAUUSD Bullish Above Bearish Below 2379 BTCUSD Bullish Above Bearish below 62000

BTCUSD Bullish Above Bearish below 62000 More By This Author:FTSE Finally Breaks Record Highs Before PausingDaily Market Outlook – Tuesday, April 23FTSE On The Front Foot As MIddle East Tensions Recede

More By This Author:FTSE Finally Breaks Record Highs Before PausingDaily Market Outlook – Tuesday, April 23FTSE On The Front Foot As MIddle East Tensions Recede