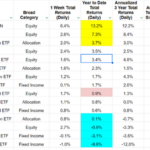

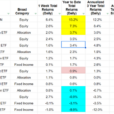

Markets in Asia apart from Shanghai’s were broadly higher on Monday, shrugging off the blues on Wall Street after big technology stocks logged their worst week since the COVID crash in 2020.Hong Kong’s Hang Seng led the region, gaining 1.6% while Tokyo’s Nikkei 225 added 0.4%.The US stock market ended lower on Friday to close out its third straight losing week.Here’s a table showing how US stocks performed on Friday:

Source: EquitymasterAt present, the BSE Sensex is trading 210 points higher and NSE Nifty is trading 77 points higher.BPCL, Wipro, and Coal India are among the top gainers today.NTPC, ONGC, and M&M the other hand are among the top losers today.Broader markets are trading on a positive note. The BSE Midcap index is trading 0.7% higher and the BSE Small Cap index is trading 1.1% higher.Barring telecom stocks all other sectoral indices are trading positive, with stocks in the realty sector, metal sector, and capital goods sector witnessing selling pressure.The rupee is trading at Rs 83.4 against the US dollar.In commodity markets, gold prices are trading 0.8% lower at Rs 72,240 per 10 grams today.Meanwhile, silver prices are trading 1.3% higher at Rs 82,402 per 1 kg.

Vodafone Idea FPO Ends TodayVodhares of beleaguered telecom service provider Vodafone Idea will be in focus on 22 April as its follow-on offer (FPO) will close later in the day. After two days of bidding for the Rs 180 bn issue, the subscription status shows that the FPO has garnered a decent response from investors 49 times booking.The retail portion of the FPO saw 13% buying, the NII portion subscribed 75%, while the QIB segment of the FPO was booked 0.93 times.The Vodafone Idea FPO price band was fixed at Rs 10-11 per equity share. In the grey market, the issue is available at a premium of Rs 1.4 per share. In the last session on 19 April, the telco’s shares closed at Rs 12.9 apiece, up Rs 1.9 from the upper price band. According to market observers, the GMP remained positive despite weakness in the secondary market.The conversion of government dues into equity will ease the financial burden but may not work well for investors anyway.

HDFC Bank Q4 ResultsPrivate sector lender HDFC Bank reported 37.1% growth in net profit for the quarter ended 31 March 2024 to Rs 165.1 bn, as compared to Rs 120.5 bn during the same quarter of the previous year.Net interest income (interest earned less interest expended) for the quarter grew by 24.5% to Rs 290.8 bn, while the core net interest margin was at 3.4% on total assets and 3.6% based on interest-earning assets.Operating expenses for the quarter ended 31 March 2024 included staff ex-gratia provision of Rs 15 bn.Other income or non-interest income for the quarter more than doubled to Rs 18,166 crore as against Rs 87.3 bn in the corresponding quarter ended 31 March 2023. Growth in other income is mainly due to trading and mark-to-market gain of Rs 79.5 bn, as compared to a loss of Rs 40 crore during the same period last year. In Q4, HDFC Bank completed selling a majority of its stake in HDFC Credila, an education finance subsidiary, for Rs 95.5 bn.HDFC Bank’s GNPA at 1.2%, as compared to 1.3% in the previous quarter and 1.1% in the fourth quarter of the previous financial year. The bank has made floating provisions of Rs 10.9 bn during the quarter.Provisions and contingencies, excluding the floating provisions, for the quarter ended 31 March 2024 were Rs 26.1 bn as against Rs 26.9 bn for the quarter ended 31 March 2023.

Zomato Hikes Platform Fees

Weeks before Zomato is expected to announce its March quarter financial results, the company increased its platform fee by 25% to Rs 5 per order as well as suspended its inter-city food delivery service called Intercity Legends.In August 2023, Zomato introduced a Rs 2 platform fee back when it looked to boost its margins and become profitable. The company subsequently increased the fee to Rs 3 before raising it again on 1 January to Rs 4. It had temporarily hiked the platform fee to Rs 9 on 31 December.As the company’s share price reacted positively to the development in January, analysts said that the platform fee hike would partially offset the impact of GST on delivery charges.Zomato caters to about 850-900 m orders annually. An increase in each Re 1 convenience fee across all geographies could lead to a positive impact of Rs 850-900 m on EBITDA, which is around a 5% positive impact on EBITDA. However, this hike is effective only in some cities as of now.The food delivery company’s stock price has been surging on the back of rising profitability in its core business and the fast growth of its quick commerce arm, Blinkit.More By This Author:Sensex Today Rallies 599 Points; Private Banks RallySensex Today Tanks 500 Points Amid Iran-Israel TensionsSensex Today Falls 1,000 Points From Day’s High, Slides For 4th Day