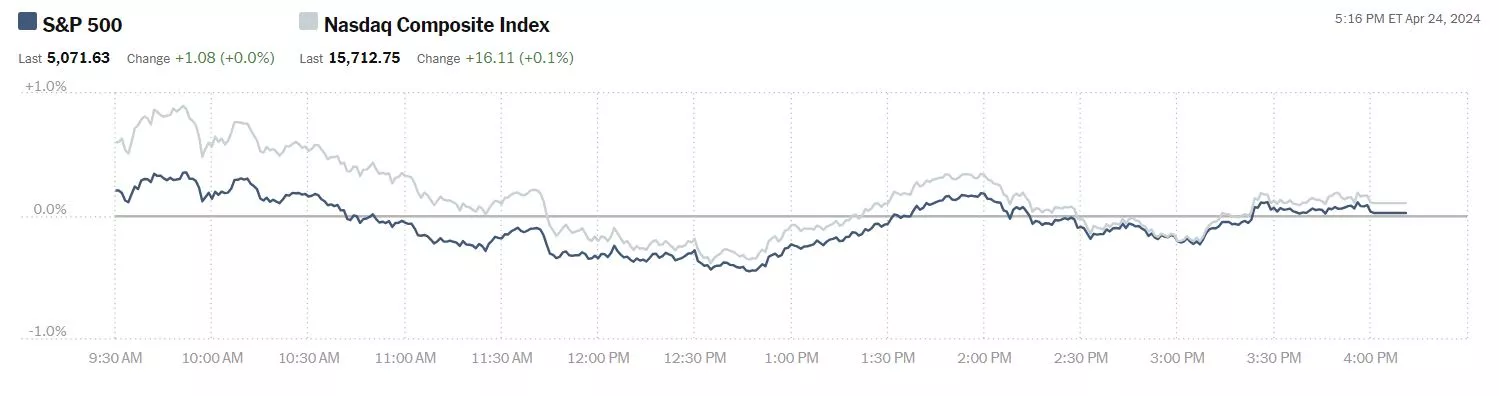

So far April has been a month for corrections but the major indices have kept a steady keel from Tuesday to Wednesday, this week. Middle East tensions are keeping oil prices high which is spilling over to hesitation in some stocks. Pixabay The S&P 500 closed at 5,072 on Wednesday, (5,071 on Tuesday), up 1 point, the Dow closed at 38, 461, (38,504 on Tuesday), down 43 points and the Nasdaq Composite closed at 15, 713, (15,696 on Tuesday), up 16 points.

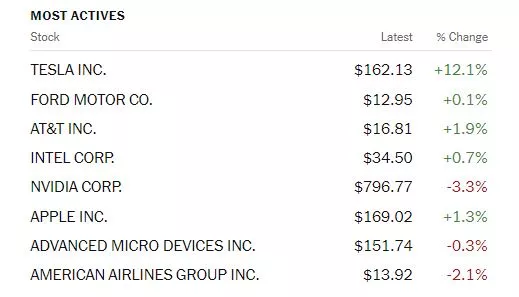

Pixabay The S&P 500 closed at 5,072 on Wednesday, (5,071 on Tuesday), up 1 point, the Dow closed at 38, 461, (38,504 on Tuesday), down 43 points and the Nasdaq Composite closed at 15, 713, (15,696 on Tuesday), up 16 points.  Chart: The New York TimesMost actives were led by Tesla (TSLA), up 12.1%, followed by Ford (F), up 0.1% and AT&T (T), up 1.9%.

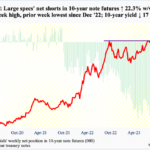

Chart: The New York TimesMost actives were led by Tesla (TSLA), up 12.1%, followed by Ford (F), up 0.1% and AT&T (T), up 1.9%.  In morning futures trading, S&P 500 market futures are down 27 points, Dow market futures are down 131 points and Nasdaq 100 market futures are down 144 points.In an Editor’s Choice column, TM contributor Lance Roberts asks Just A Correction, Or Is The Bull Market Over?“Is this just a correction after a strong bullish advance from November, or is the bull market ending? If you read some of the headlines, you would suspect the latter. As noted by MarketWatch last week:

In morning futures trading, S&P 500 market futures are down 27 points, Dow market futures are down 131 points and Nasdaq 100 market futures are down 144 points.In an Editor’s Choice column, TM contributor Lance Roberts asks Just A Correction, Or Is The Bull Market Over?“Is this just a correction after a strong bullish advance from November, or is the bull market ending? If you read some of the headlines, you would suspect the latter. As noted by MarketWatch last week:

“For the first time since early November 2023, less than 30% of S&P 500 stocks are trading above their 50-day moving average — a clear indicator of the current poor market’s breadth. This significant drop from the 85% observed in late March and 92% at the beginning of January highlights a dramatic reversal in market dynamics.

The 50-day moving average is often seen as a barometer for the short-term health of stocks. Falling below this level en masse suggests that a broad swath of the market is facing downward pressure. This shift comes amid escalating geopolitical tensions in the Middle East and renewed concerns over inflation, which have collectively nudged traders towards a more guarded stance in April.”

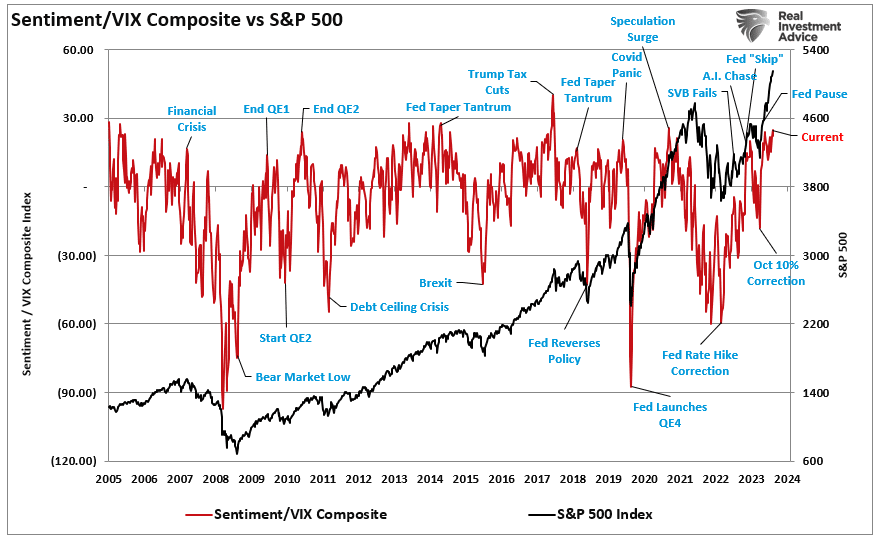

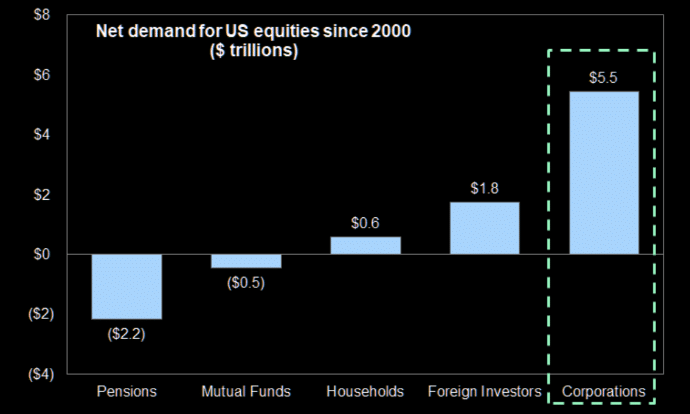

the “blackout” of corporate buybacks coincided with an aggressively bullish investor sentiment. As we noted in that same article:

“Investor sentiment is once again very bullish. Historically, when retail investor sentiment is exceedingly bullish combined with low volatility, such has generally corresponded to short-term market peaks.”

Given that corporate share buybacks have accounted for roughly 100% of net equity purchases over the last two decades, the blackout period combined with aggressive bullish sentiment was the recipe for a decline in asset prices.

Given that corporate share buybacks have accounted for roughly 100% of net equity purchases over the last two decades, the blackout period combined with aggressive bullish sentiment was the recipe for a decline in asset prices. Here is the math of net flows if you don’t believe the chart:

Here is the math of net flows if you don’t believe the chart:

- Sub Total = (-$0.3 T)

- Net Total = $5.2 Trillion = Or 100% of all equities purchased..

Despite the current “panic” in the media headlines, this is likely just a correction within an ongoing bullish market. Such is particularly the case given that corporate share buybacks will resume in May, providing critical support for the markets heading into summer…With that said, this correction, when complete, likely won’t be the last we see this year. Market history suggests we could see another “bumpy ride” heading into what many expect will be a somewhat contentious election.”See Roberts full column for more details and gory charts.Contributor Daniel Lacalle says Governments Could Stop Inflation If They Wanted But They Will Not. Pexels“Inflation is no coincidence. It is a policy. Governments, along with their so-called experts, attempt to persuade you that inflation stems from anything other than the consistent, albeit slower, rise in aggregate prices year after year. Issuing more currency than the private sector demands, thus eroding its purchasing power and creating a constant annual transfer of wealth from real wages and deposit savings to the government.Oil prices are not a cause of inflation but a consequence. Prices increase as more units of the currency used to denominate the commodity shift to relatively scarce assets. Therefore, oil prices do not cause inflation; they are one of the signals of currency debasement. Furthermore, if oil prices caused inflation, we would go from inflation to deflation quickly, not from elevated inflation to slower price increases.The same goes for all the causes that governments and their agents try to use as an excuse for inflation. Most are just manifestations, not causes of inflation…It is surprising to see how some so-called experts say that a few large corporations make all prices rise but deny that the state that monopolizes the creation of money is the cause of inflation.The only real cause of inflation is government spending. While banks can generate money -credit- through lending, they rely on projects and investments to support these loans. Banks cannot create money to bail themselves out. No financial entity would go bankrupt then. In fact, banks’ largest asset imbalance comes from lending at rates below the cost of risk and having government loans and bonds as “no-risk” investments, two things that are imposed by regulation, law, and central bank planning. Meanwhile, the state does issue more currency to disguise its fiscal imbalances and bail itself out, using regulation, legislation, and coercion to impose the use of its own form of money…Biden says the government has a plan to cut inflation, but all they have done is perpetuate it, making citizens poorer and the productive sector weaker.If Biden wants to cut inflation, all he must do is eliminate the deficit by cutting expenditures. The reason why governments should never oversee monetary policy and be allowed to monetize all deficits is that no administration will cut its size to defend citizens’ wages because nationalization by inflation and taxes is the goal of interventionism: to create a dependent and hostage economy.”Contributor Michael J. Kramer jumps in with some technical details on the market’s behavior this week in Stocks Stall Ahead Of Massive Data Dump And Earnings.”Stocks finished flattish on the day, but we are moving into the busiest part of the week. Now that Meta’s results are out of the way, we will have GDP and PCE to finish the week off, along with earnings from Microsoft and Alphabet. On top of that, next week will be even busier with an “alphabet soup” of economic data points and more big earnings reports.I have repeatedly cautioned the last two days not to get complacent. The equity market had all the signs of a negative gamma regime driving trade. That stalled out today because gamma levels in the S&P 500, while still negative, have risen a lot over the past few days, which has helped to stabilize markets… 10-YrBut again, it is not about the S&P 500 right, or the Nasdaq for that matter. It is about bond yields and the dollar, and the data over the next couple of days is going to have a lot of say as to where rates and the dollar go. The 10-year has been consolidating and patiently waiting at the 4.65% level for some time, and break out would get the 10-year moving to 5%. There is a bullish ascending triangle that is present in the 10-year Treasury, and the RSI shows that momentum is pointing higher.

Pexels“Inflation is no coincidence. It is a policy. Governments, along with their so-called experts, attempt to persuade you that inflation stems from anything other than the consistent, albeit slower, rise in aggregate prices year after year. Issuing more currency than the private sector demands, thus eroding its purchasing power and creating a constant annual transfer of wealth from real wages and deposit savings to the government.Oil prices are not a cause of inflation but a consequence. Prices increase as more units of the currency used to denominate the commodity shift to relatively scarce assets. Therefore, oil prices do not cause inflation; they are one of the signals of currency debasement. Furthermore, if oil prices caused inflation, we would go from inflation to deflation quickly, not from elevated inflation to slower price increases.The same goes for all the causes that governments and their agents try to use as an excuse for inflation. Most are just manifestations, not causes of inflation…It is surprising to see how some so-called experts say that a few large corporations make all prices rise but deny that the state that monopolizes the creation of money is the cause of inflation.The only real cause of inflation is government spending. While banks can generate money -credit- through lending, they rely on projects and investments to support these loans. Banks cannot create money to bail themselves out. No financial entity would go bankrupt then. In fact, banks’ largest asset imbalance comes from lending at rates below the cost of risk and having government loans and bonds as “no-risk” investments, two things that are imposed by regulation, law, and central bank planning. Meanwhile, the state does issue more currency to disguise its fiscal imbalances and bail itself out, using regulation, legislation, and coercion to impose the use of its own form of money…Biden says the government has a plan to cut inflation, but all they have done is perpetuate it, making citizens poorer and the productive sector weaker.If Biden wants to cut inflation, all he must do is eliminate the deficit by cutting expenditures. The reason why governments should never oversee monetary policy and be allowed to monetize all deficits is that no administration will cut its size to defend citizens’ wages because nationalization by inflation and taxes is the goal of interventionism: to create a dependent and hostage economy.”Contributor Michael J. Kramer jumps in with some technical details on the market’s behavior this week in Stocks Stall Ahead Of Massive Data Dump And Earnings.”Stocks finished flattish on the day, but we are moving into the busiest part of the week. Now that Meta’s results are out of the way, we will have GDP and PCE to finish the week off, along with earnings from Microsoft and Alphabet. On top of that, next week will be even busier with an “alphabet soup” of economic data points and more big earnings reports.I have repeatedly cautioned the last two days not to get complacent. The equity market had all the signs of a negative gamma regime driving trade. That stalled out today because gamma levels in the S&P 500, while still negative, have risen a lot over the past few days, which has helped to stabilize markets… 10-YrBut again, it is not about the S&P 500 right, or the Nasdaq for that matter. It is about bond yields and the dollar, and the data over the next couple of days is going to have a lot of say as to where rates and the dollar go. The 10-year has been consolidating and patiently waiting at the 4.65% level for some time, and break out would get the 10-year moving to 5%. There is a bullish ascending triangle that is present in the 10-year Treasury, and the RSI shows that momentum is pointing higher.  Anyway… Meta

Anyway… Meta

META reported better-than-expected earnings and just barely beat on ad revenue, which came in at $35.635 billion versus estimates of $35.573 billion. Total revenue was $36.5 billion, less than 1% better than estimates for $36.1. The company noted that second-quarter revenue would be $37.75 billion at the mid-point, a miss versus estimates for $38.2 billion. Meanwhile, the company said capex would rise to $37.50 billion versus estimates for $34.5 billion. They are making less than expected and spending more, which has the stock sinking 12.6%.The market was very nervous heading into the result. This was obvious from the elevated put skew and a large amount of put gamma down at the $470 level, which suggested hedging activity. It looks like, at this point, the stock will try to fill the gap from its earnings report in February at $394, which seems like the obvious place.  Contributor Phil Flynn is still concerned about the price of oil amidst Middle East tensions, as well as availability of oil in the long term. He racks it up in The Energy Report: Not Over.”Oil prices rebounded yesterday from signs that the geopolitical tension may not have eased as much as previously believed. After the close we saw the American Petroleum Institute (API) report that petroleum supplies came in tighter than the market was expecting. The API reported the crude oil inventories fell by 3.23 million barrels where the market expectation was that they were going to increase by 1.8 million barrels…The reduction of the war premium in oil came when it appeared that the global tensions between Israel and Iran had calmed down, yet that war premium is creeping back in on reports as Israel is warning civilians to get out of Rafah as they prepare an invasion. Reports say that Israel is getting ready to find tents for Palestinian civilians they intend to evacuate before the invasion. There’s also some speculation that Israel’s response Iran’s attack isn’t over yet and it’s just biding its time before it sends Iran a real message…The Biden administration is very anti fossil fuel production in the United States. While they are trying to take credit for record oil and gas production, it’s clear that most of the gains have been made by innovation by the oil and gas industry and most of it has been done on private lands. Private oil and gas companies have been flourishing despite the attempts by the Biden administration to accuse them of war profiteering and price gouging…What are we going to do with the electric car glut. The Biden administration says that we are in a race with China to control the EV market. The problem is that the Chinese consumers, like the American consumers, just don’t not want them. Oh sure, the International Energy Agency claims that, “over 20% of global car sales this year are projected to be electric, driving a transformative shift in the auto industry and cutting oil use for transport.” Yet these are the same folks that predicted that global oil demand would peak years ago.Reuters reported that, “By most measures, the last thing China needs is more electric cars crowding a market with more losers than winners, driving down prices at the expense of profit and taking the fight for market share beyond China. And that’s just what it is getting. Automakers are expected to launch 110 EVs and plug-in hybrids in 2024, many at the Beijing auto show that starts Thursday…By contrast, there were just over 50 EV models on sale in the United States last year. But while there is a peril in China’s overcapacity, there is also a power in the hyper-competition it has unleashed, analysts, suppliers and executives say. China’s leading EV makers have found ways to slash vehicle development time, combining speed to market with new features and a pricing advantage rivals outside cannot match. the almost 400 “new energy” models already in China’s showrooms, according to industry data.” But the main problem is still sales, which even though they are growing in China, are not growing at the pace to get rid of the oversupply. And there doesn’t appear to be any plan to deal with the batteries once they start to go bad in 10 years.Natural gas is still trying to put in a little bit of a bottom here. It has a tough road ahead. We are looking for an injection of 85 BCF this week.”Plenty of info in Flyn’s report to stay alarmed, but my advice is to take it at a slower pace.TalkMarkets contributor Sheraz Mian takes us out by asking What Can Investors Expect From Big Tech Earnings?

Contributor Phil Flynn is still concerned about the price of oil amidst Middle East tensions, as well as availability of oil in the long term. He racks it up in The Energy Report: Not Over.”Oil prices rebounded yesterday from signs that the geopolitical tension may not have eased as much as previously believed. After the close we saw the American Petroleum Institute (API) report that petroleum supplies came in tighter than the market was expecting. The API reported the crude oil inventories fell by 3.23 million barrels where the market expectation was that they were going to increase by 1.8 million barrels…The reduction of the war premium in oil came when it appeared that the global tensions between Israel and Iran had calmed down, yet that war premium is creeping back in on reports as Israel is warning civilians to get out of Rafah as they prepare an invasion. Reports say that Israel is getting ready to find tents for Palestinian civilians they intend to evacuate before the invasion. There’s also some speculation that Israel’s response Iran’s attack isn’t over yet and it’s just biding its time before it sends Iran a real message…The Biden administration is very anti fossil fuel production in the United States. While they are trying to take credit for record oil and gas production, it’s clear that most of the gains have been made by innovation by the oil and gas industry and most of it has been done on private lands. Private oil and gas companies have been flourishing despite the attempts by the Biden administration to accuse them of war profiteering and price gouging…What are we going to do with the electric car glut. The Biden administration says that we are in a race with China to control the EV market. The problem is that the Chinese consumers, like the American consumers, just don’t not want them. Oh sure, the International Energy Agency claims that, “over 20% of global car sales this year are projected to be electric, driving a transformative shift in the auto industry and cutting oil use for transport.” Yet these are the same folks that predicted that global oil demand would peak years ago.Reuters reported that, “By most measures, the last thing China needs is more electric cars crowding a market with more losers than winners, driving down prices at the expense of profit and taking the fight for market share beyond China. And that’s just what it is getting. Automakers are expected to launch 110 EVs and plug-in hybrids in 2024, many at the Beijing auto show that starts Thursday…By contrast, there were just over 50 EV models on sale in the United States last year. But while there is a peril in China’s overcapacity, there is also a power in the hyper-competition it has unleashed, analysts, suppliers and executives say. China’s leading EV makers have found ways to slash vehicle development time, combining speed to market with new features and a pricing advantage rivals outside cannot match. the almost 400 “new energy” models already in China’s showrooms, according to industry data.” But the main problem is still sales, which even though they are growing in China, are not growing at the pace to get rid of the oversupply. And there doesn’t appear to be any plan to deal with the batteries once they start to go bad in 10 years.Natural gas is still trying to put in a little bit of a bottom here. It has a tough road ahead. We are looking for an injection of 85 BCF this week.”Plenty of info in Flyn’s report to stay alarmed, but my advice is to take it at a slower pace.TalkMarkets contributor Sheraz Mian takes us out by asking What Can Investors Expect From Big Tech Earnings?  Unsplash“Many in the market are looking to this week’s quarterly results from the four members of ‘the Magnificent 7’ to help reverse the stock market’s ongoing weakness.The immediate catalyst for the stock market pullback appears to be tied to the timing of Fed easing as a result of the evolving inflation picture rather than any deterioration in the overall earnings picture. If anything, the overall earnings picture has actually been improving ever so slightly in recent weeks, as we have been noting in our earnings commentary.The hope appears to be that robust results from the Mag 7 companies reporting this week – Tesla (TSLA – Free Report) on Tuesday, April 23rd, Meta Platforms (META – Free Report) on Wednesday, April 24th, Microsoft (MSFT – Free Report) and Alphabet (GOOGL – Free Report) on Thursday, April 25th – will help restore confidence in the market’s fundamental underpinnings and offset some of the Fed-centric worries.The chart below shows the year-to-date performance of Meta, Alphabet, Microsoft, and Tesla relative to the S&P 500 index.

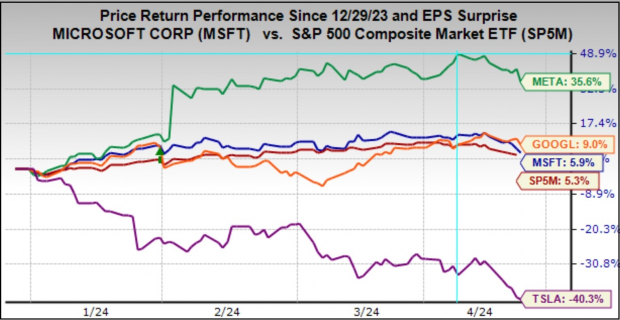

Unsplash“Many in the market are looking to this week’s quarterly results from the four members of ‘the Magnificent 7’ to help reverse the stock market’s ongoing weakness.The immediate catalyst for the stock market pullback appears to be tied to the timing of Fed easing as a result of the evolving inflation picture rather than any deterioration in the overall earnings picture. If anything, the overall earnings picture has actually been improving ever so slightly in recent weeks, as we have been noting in our earnings commentary.The hope appears to be that robust results from the Mag 7 companies reporting this week – Tesla (TSLA – Free Report) on Tuesday, April 23rd, Meta Platforms (META – Free Report) on Wednesday, April 24th, Microsoft (MSFT – Free Report) and Alphabet (GOOGL – Free Report) on Thursday, April 25th – will help restore confidence in the market’s fundamental underpinnings and offset some of the Fed-centric worries.The chart below shows the year-to-date performance of Meta, Alphabet, Microsoft, and Tesla relative to the S&P 500 index. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

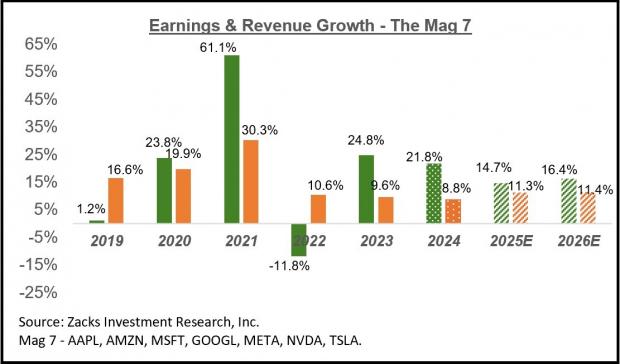

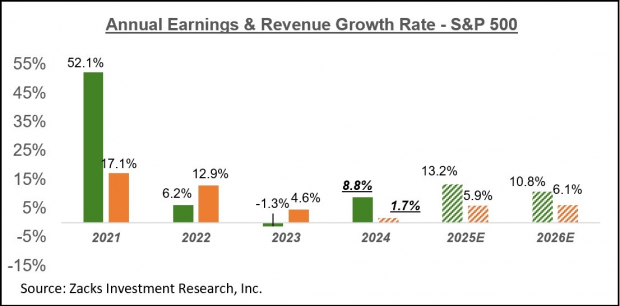

As the above chart shows, Meta is in a league of its own, while Microsoft and Alphabet are roughly tracking each other…The chart below shows the group’s earnings and revenue growth on an annual basis. Beyond these Mag 7 players, total Q1 earnings for the Technology sector as a whole are expected to be up +19.4% from the same period last year on +8.3% higher revenues…Looking at Q1 as a whole, total S&P 500 earnings are expected to be up +3.8% from the same period last year on +3.9% higher revenues, which would follow the +6.8% earnings growth on +3.9% revenue gains in the preceding period…Looking at the overall earnings picture on an annual basis, total 2024 S&P 500 earnings are expected to be up +8.8% on +1.7% revenue growth.”

Beyond these Mag 7 players, total Q1 earnings for the Technology sector as a whole are expected to be up +19.4% from the same period last year on +8.3% higher revenues…Looking at Q1 as a whole, total S&P 500 earnings are expected to be up +3.8% from the same period last year on +3.9% higher revenues, which would follow the +6.8% earnings growth on +3.9% revenue gains in the preceding period…Looking at the overall earnings picture on an annual basis, total 2024 S&P 500 earnings are expected to be up +8.8% on +1.7% revenue growth.” A rosy picture, indeed.Have a good one.

A rosy picture, indeed.Have a good one.  PexelsMore By This Author:Thoughts For Thursday: Earnings In Earnest

PexelsMore By This Author:Thoughts For Thursday: Earnings In Earnest

Tuesday Talk: Money And War Go Together Like…

Thoughts For Thursday: About Those Rate Cuts