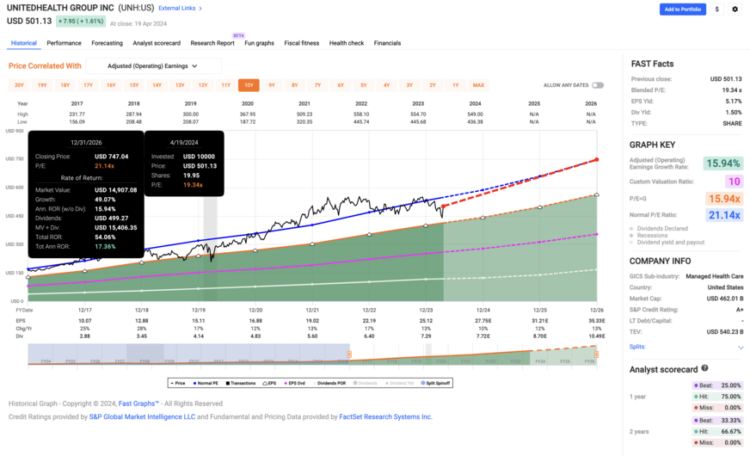

Suppose you are in pursuit of a distinguished dividend growth investment opportunity. In that case, our focus turns to an undervalued dividend stock of particular interest – United Health Group, identified by the UNH ticker. As of the time of writing, the stock is trading at ~$501 per share, prompting a closer examination of its valuation and suitability for investment. This analysis will assess whether United Health Group merits consideration as a sound destination for our hard-earned capital.Upon analysis using Fastgraph, the company’s financial outlook appears promising, with anticipated annual returns exceeding 17.4% for the next three years at the current share price.  Source: Fastgraphs

Source: Fastgraphs

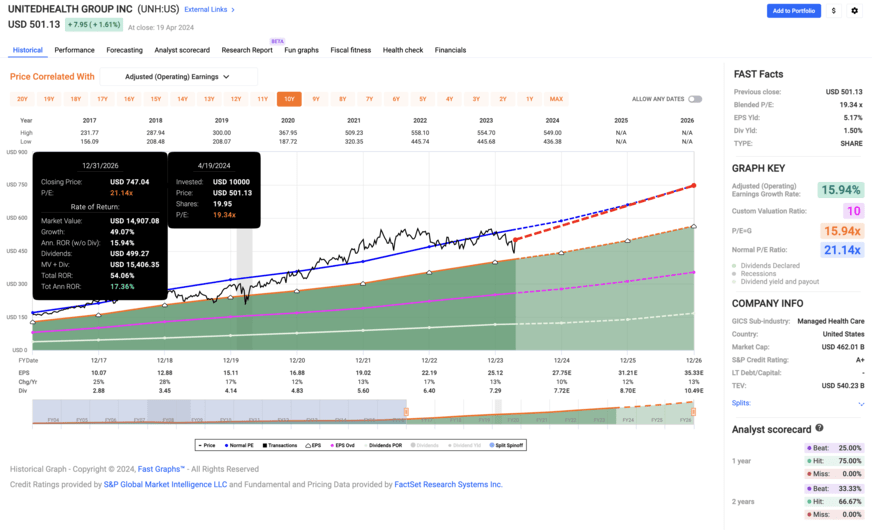

Here, we have a technical chart of UNH. We can see that it bounces along right at long-term support.  Source: TradingView

Source: TradingView

Overview of UNH

UnitedHealth Group Incorporated, a healthcare juggernaut founded in 1977 and headquartered in Minnetonka, Minnesota, operates through two main platforms: UnitedHealthcare and Optum. UnitedHealthcare, among the most prominent healthcare insurers in the U.S., offers a broad spectrum of health benefit plans catering to individuals, employers, and government programs. Optum, on the other hand, focuses on delivering innovative healthcare services through technology and data analytics, covering pharmacy care, healthcare delivery, population health management, and analytics. With its strategic integration of healthcare delivery, financing, and technology, UnitedHealth Group continues to lead the industry in driving efficiencies, improving patient outcomes, and advancing healthcare access and affordability globally.At present, the stock is trading at $501.13 per share, aligning closely with the mid-to-lower end of its 52-week price range, which spans from $436.38 to $554.70 per share. This positioning suggests that UNH may present an attractive opportunity for investors seeking to acquire shares at a favorable price point.

UNH Dividend History, Growth, and Yield

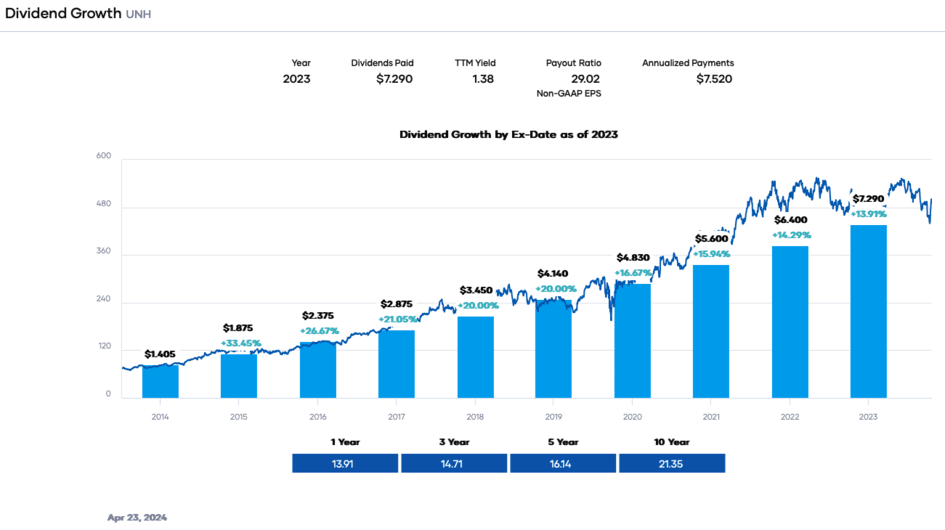

We will examine UNH’s dividend history, growth, and yield and determine whether it’s still a good buy at current prices.UNH is considered a Dividend Contender, a company that has increased its dividends for over ten years. In this case, UNH stock has increased its dividend for 14 consecutive years. UNH’s most recent dividend increase was 13.9%, announced in June 2023. People should expect another increase in June 2024.

Dividend Growth

Additionally, according to Portfolio Insight, UNH’s five-year dividend growth rate is about 16.1%, which is really good considering how fast inflation increased last year and this year. The 10-year dividend growth rate is a little lower at ~21.4%.  Source: Portfolio InsightIt is noteworthy that UNH stock continued to pay dividends during the most challenging period in the last 100 years. Many businesses and industries cut or suspended their dividend payments during the COVID-19 pandemic. However, unlike many other stocks, UNH continued to pay out its dividend and increased it. That is very noteworthy. This fact alone leads me to believe in the strength of the company and the fact that management is focused and committed to the dividend policy.

Source: Portfolio InsightIt is noteworthy that UNH stock continued to pay dividends during the most challenging period in the last 100 years. Many businesses and industries cut or suspended their dividend payments during the COVID-19 pandemic. However, unlike many other stocks, UNH continued to pay out its dividend and increased it. That is very noteworthy. This fact alone leads me to believe in the strength of the company and the fact that management is focused and committed to the dividend policy.

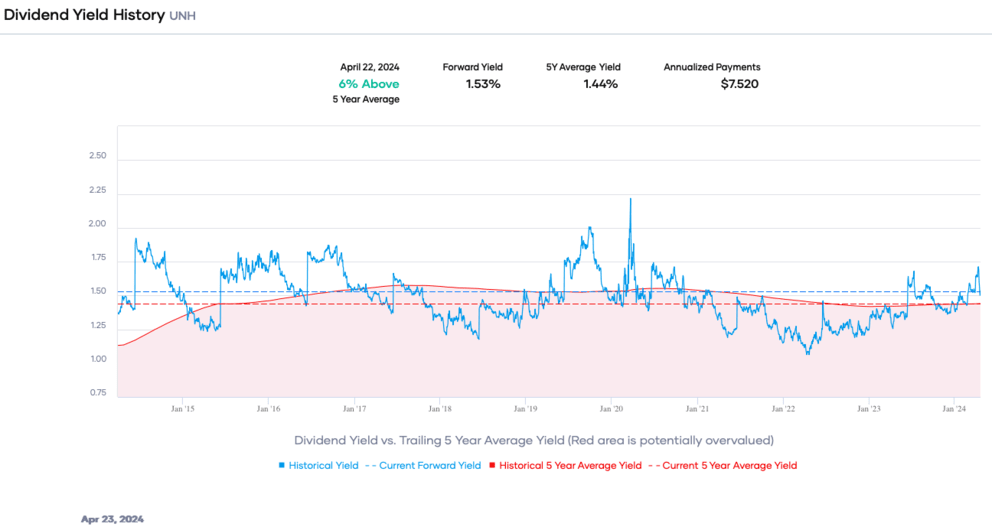

Dividend Yield

UNH offers an estimated dividend yield of approximately 1.5%, surpassing the dividend yield of the S&P 500 Index. This dividend yield serves as an attractive starting point for investors who prioritize dividend growth in their portfolios. However, there may be better choices for income-focused investors seeking a 4.5% or higher yield from their investments.  Source: Portfolio InsightThe current dividend yield for UNH surpasses its 5-year average dividend yield, which stands at approximately 1.3%. This metric provides valuable insight into the company’s valuation. The relationship between stock price and dividend yield is inherently inverse, meaning that when stock prices rise, dividend yields tend to decrease, and vice versa. Investors can gauge whether the stock is undervalued or overvalued by comparing the current dividend yield to the 5-year average. In this context, the higher current yield relative to the 5-year average suggests that UNH may be trading at a relatively attractive valuation.

Source: Portfolio InsightThe current dividend yield for UNH surpasses its 5-year average dividend yield, which stands at approximately 1.3%. This metric provides valuable insight into the company’s valuation. The relationship between stock price and dividend yield is inherently inverse, meaning that when stock prices rise, dividend yields tend to decrease, and vice versa. Investors can gauge whether the stock is undervalued or overvalued by comparing the current dividend yield to the 5-year average. In this context, the higher current yield relative to the 5-year average suggests that UNH may be trading at a relatively attractive valuation.

Dividend Safety

Ensuring the safety of the current dividend is of paramount importance for dividend growth investors, as undervalued dividend stocks can sometimes become “value traps,” with stock prices continuing to decline. Two crucial metrics must be examined to assess the sustainability of annual dividend payments: Adjusted operating earnings (EPS) and Free Cash Flow (FCF) or Operating Cash Flow (OCF) per share. Analysts’ projections indicate that UNH is expected to earn approximately $27.75 per share for fiscal year 2024, and historical accuracy in forecasting UNH’s future EPS is noted at 75%. Furthermore, the company is anticipated to distribute $7.72 per share in dividends over the entire year. This results in a computed payout ratio of roughly 27.8% based on EPS, which is a great payout for this company with an okay starting yield, and it does have room for continued dividend growth. UNH’s dividend yield of approximately 1.5%, combined with expectations for future growth, supports this goal and allows the company to sustain dividend growth at a double-digit rate without compromising dividend safety. Additionally, UNH maintains a dividend payout ratio of 26% based on Free Cash Flow (FCF), further affirming the dividend’s security in terms of EPS and FCF.

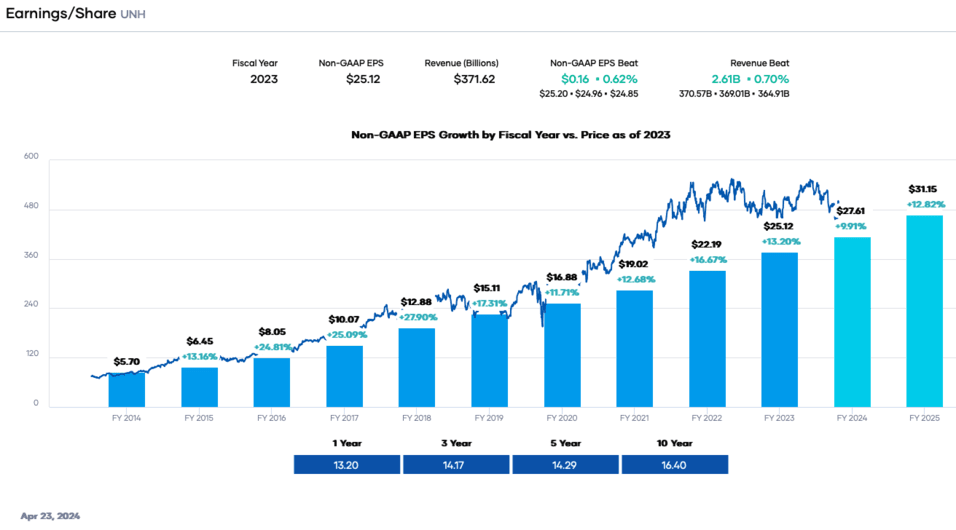

UNH Revenue and Earnings Growth / Balance Sheet Strength

We will now look at how well UNH performed and grew its EPS and revenue throughout the years. When valuing a company, these two metrics are at the top of my list to study. Without revenue growth, a company can’t have sustainable EPS growth and continue paying a growing dividend.According to Portfolio Insight, UNH’s revenue has grown at a compound annual growth rate (CAGR) of about 11.7% for the past ten years. Net income, however, had a CAGR of 16.6% over the same ten-year period. However, EPS has grown 16.4% annually for the past ten years and at a CAGR of 14.2% over the past five years.  Source: Portfolio InsightNotably, despite the challenges posed by the COVID-19 pandemic over the past three years, UNH achieved a 13% increase in EPS, rising from $16.88 per share in FY2020 to $19.02 per share for FY2021. Furthermore, analysts anticipate that UNH will attain an EPS of $27.75 per share for fiscal year 2024, reflecting approximately a 13% increase compared to FY2023. This consistent pattern of earnings growth is a positive indicator for investors, indicating the company’s resilience and ability to continue improving its financial performance. Also, the forecasted earnings for the subsequent years suggest a 12% increase in 2025 and 2026, further bolstering confidence in UNH’s future earnings potential.Furthermore, UNH maintains a robust balance sheet with a favorable debt-to-equity ratio of zero and an “A+” S&P Global credit rating. This strong financial position enhances the company’s capacity to navigate significant economic challenges, as evidenced by its stability during the two-year impact of the COVID-19 pandemic. This aspect also contributes to the security of the company’s dividend payments.

Source: Portfolio InsightNotably, despite the challenges posed by the COVID-19 pandemic over the past three years, UNH achieved a 13% increase in EPS, rising from $16.88 per share in FY2020 to $19.02 per share for FY2021. Furthermore, analysts anticipate that UNH will attain an EPS of $27.75 per share for fiscal year 2024, reflecting approximately a 13% increase compared to FY2023. This consistent pattern of earnings growth is a positive indicator for investors, indicating the company’s resilience and ability to continue improving its financial performance. Also, the forecasted earnings for the subsequent years suggest a 12% increase in 2025 and 2026, further bolstering confidence in UNH’s future earnings potential.Furthermore, UNH maintains a robust balance sheet with a favorable debt-to-equity ratio of zero and an “A+” S&P Global credit rating. This strong financial position enhances the company’s capacity to navigate significant economic challenges, as evidenced by its stability during the two-year impact of the COVID-19 pandemic. This aspect also contributes to the security of the company’s dividend payments.

UNH Stock’s Competitive Advantage

UnitedHealth Group maintains a formidable competitive edge in the healthcare industry through its broad scale and diversified offerings. With UnitedHealthcare providing a wide array of health benefit plans and Optum delivering innovative healthcare services and technology solutions, the company caters to diverse customer needs while capitalizing on cross-selling opportunities. Leveraging data analytics and technology, mainly through its Optum platform, UNH drives efficiency and enhances patient outcomes, staying at the forefront of the digital healthcare landscape.Yet, UNH faces several risks that could impact its operations and financial performance. Regulatory uncertainties, including potential changes in healthcare policies and reforms, pose significant challenges. Additionally, fierce competition within the industry, technological advancements, and macroeconomic factors such as economic downturns and demographic trends all require UNH to remain agile and proactive in addressing risks to sustain its leadership position and deliver shareholder value over the long term.

Valuation for UNH

One of the valuation metrics that I would like to look for is the dividend yield compared to the past few years’ history. I also want to look for a lower price-to-earnings (P/E) ratio based on the past 5-year or 10-year average. Lastly, I like to use the Dividend Discount Model (DDM). I use a DDM analysis because a business ultimately equals the sum of the future cash flow that the company can provide. Let’s first look at the P/E ratio. UNH has a P/E ratio of ~19.3X based on FY 2024 EPS of $27.75 per share. The P/E multiple is excellent compared to the past 5-year P/E average of 22.2X. If UNH were to revert back to a P/E of 22.2X, we would obtain a price of $616.05 per share.Now, let’s look at the dividend yield. As I mentioned, the dividend yield currently is 1.5%. There is good upside potential as UNH’s 5-year dividend yield average is ~1.3%. For example, if UNH were to return to its dividend yield 5-year average, the price target would be $560.The last item I would like to examine to determine a fair price is the DDM analysis. I factored in a 10% discount rate and a long-term dividend growth rate of 9%. I use a 10% discount rate because of the low current dividend yield. In addition, the projected dividend growth rate is conservative and lower than its past 5-year average. These assumptions give a fair price target of approximately $794.61 per share.If we average the three fair price targets of $616.05, $560, and $794.61, we obtain a reasonable, fair price of $656.88 per share, giving UNH a possible upside of 31.1% from the current price of $501.13.

Final Thoughts on UnitedHealth Group (UNH) Dividend Stock

UNH is a high-quality company that aligns well with the needs of most investors. The company offers a 1.5% yield, outperforming the broader market, and boasts a commendable track record of long-term dividend growth. Historical earnings growth has been impressive, although it’s important to note that past performance does not guarantee future results. Nevertheless, considering the current stock price, UNH is an appealing investment opportunity, presenting a potentially attractive proposition for investors seeking dividend income and growth in their portfolio.More By This Author:Dividends Vs. Stock Buybacks: How Can You Benefit From Both?

The Stock Market This Week – Saturday, April 20

Stock Market This Week – Saturday, April 6