Markets React To U.S. Interest Rate Hike

Mar 22, 2018

Jeremy Parkinson

Finance

In its first policy meeting since the induction of new chief Jerome Powell, the U.S. Federal Reserve met analysts’ expectations on Wednesday by raising interest rates and predicting at least two more interest rate hikes before the end of the year. The central bank also hinted that inflation should finally head higher after hovering for years below […]

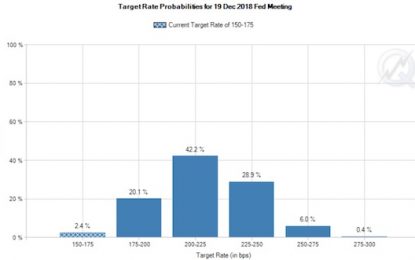

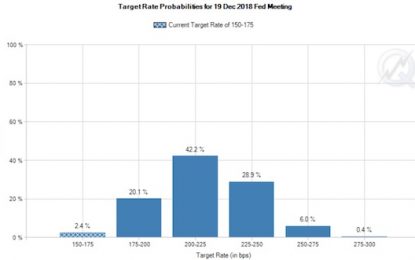

Four Fed Rate Hikes This Year? Still Not Likely

Mar 22, 2018

Jeremy Parkinson

Finance

I heard commentary after the Fed’s proclamation on monetary policy on March 21st that the Fed is “one vote away” from 4 rate hikes this year. Yet, something strange happened along the way to over-speculation on the number of rate hikes in 2018: the traders putting their money on the line on the 30-Day Fed Funds […]

EU Unveils New Digital-Tax Proposal That Could Cost US Tech Firms Hundreds Of Millions

Mar 22, 2018

Jeremy Parkinson

Finance

US tech firms will no longer be able to choose the destination with the lowest tax rate for their European headquarters, if a widely expected European Commission proposal is approved. Beginning Wednesday, the European Commission has proposed new tax rules that would require US tech firms to pay taxes in the countries or regions where they […]

Crude Oil Prices May Retreat As Trump China Tariffs Sour Sentiment

Mar 22, 2018

Jeremy Parkinson

Finance

The US Dollar’s retreat in the wake of the FOMC policy announcement buoyed raw materials prices, which are typically denominated in terms of the benchmark currency on global markets. Officials delivered a widely expected interest rate hike but offered guidance that was a bit more cautious than markets anticipated. Most notably, the projected number of interest rate hikes this year remained […]

Cardano Bottoms Out At Key Support – Faster Recovery On The Way?

Mar 22, 2018

Jeremy Parkinson

Finance

We’ve been keeping an eye on Cardano Foundation and its token, ADA, for quite a while now, anticipating its market cap growth and potentially becoming the third largest cryptocurrency by the end of the year. However, ADA/USD had its fair share of losses as the cryptocurrency market as a whole continued its bearish movement in […]

Dollar Trades Off

Mar 22, 2018

Jeremy Parkinson

Finance

The US dollar has not recovered from the judgment that yesterday’s that Fed was not as hawkish as many had anticipated. There was no indication that officials thought they were behind the curve or prepared to accelerate the pace of hikes. Powell is comfortable with the broad policy framework that has been established but seemed to have […]

Sensex Opens Higher; ONGC & Sun Pharma Top Gainers

Mar 22, 2018

Jeremy Parkinson

Finance

Asian stocks are lower today as Japanese and Hong Kong shares fall. The Nikkei 225 is off 0.38% while the Hang Seng is down 0.77%. The Shanghai Composite is trading down by 0.81%. US stocks ended slightly lower on Wednesday, with major indices giving up gains in choppy trade after the Federal Reserve raised US interest rates, while a strong […]

S&P 500 And Nasdaq 100 Forecast – Thursday, March 22

Mar 22, 2018

Jeremy Parkinson

Finance

S&P 500 The S&P 500 was a bit choppy over the last several sessions, and of course, Wednesday was the same as we have seen a lot of volatility after the Federal Reserve announcement. The fact that the market started to rally into the announcement was followed by a quick pull back, and then to […]

E

Market Briefing For Thursday, March 22

Mar 22, 2018

Jeremy Parkinson

Finance

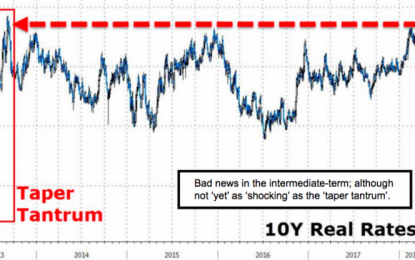

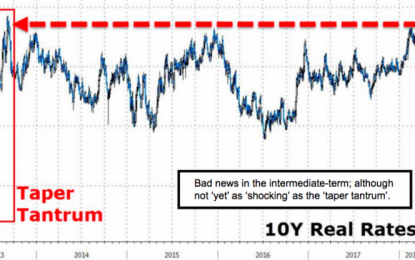

Values remain extended; and the market dances around shy of the S&P inflection zone, identified around the June S&P 2750 area. Today’s reaction to the Fed’s nominal rate hike, and straight-forward ‘news conference’ (see video 2), also conformed to the pattern outlined last night (up if they moved a little, then selling, then a bounce […]

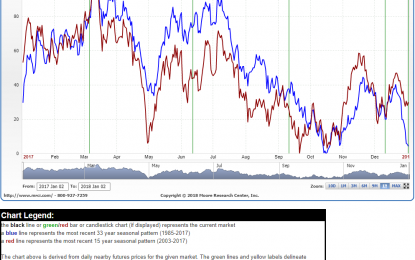

US Dollar Index Seasonality – Best Times To Buy And Sell

Mar 22, 2018

Jeremy Parkinson

Finance

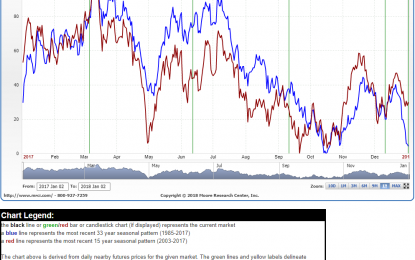

Normally we look at charts in chronological order, day after day and year after year. These typical chart types show the price path of an asset or index over days, weeks, months, or years and provide a lot of information for technicians to use. Yet there is another way to view charts, and that is to […]