FOMC Statement March 21, 2018

Mar 21, 2018

Jeremy Parkinson

Finance

Information received since the Federal Open Market Committee met in January indicates that the labor market has continued to strengthen and that economic activity has been rising at a moderate rate. Job gains have been strong in recent months, and the unemployment rate has stayed low. Recent data suggest that growth rates of household spending […]

The Media Strikes Back Against Facebook

Mar 21, 2018

Jeremy Parkinson

Finance

Facebook Continues Its Decline Facebook stock was down 2.6% on Tuesday as the headlines about the Cambridge Analytica story swirled. I have a new perspective on the story which I don’t think others have covered. This situation is all about stakeholders in the company. Facebook will have an extremely tough time satisfying stakeholders because almost […]

EC

The S&P 500 And Stephen Hawking: A Theory On “Peak Everything”

Mar 21, 2018

Jeremy Parkinson

Finance

The NASDAQ served up an annualized return of 66% in its final two years of dot-com mania. Only after the balloon had burst did people begin to question the lunacy of paying 10x revenue for the privilege of being a shareholder. Ironically enough, since early 2016, the top 10 growth names in tech collectively produced […]

Fed Signals 2 More Hikes In 2018: Dot Plot, Projections, Statement, Analysis

Mar 21, 2018

Jeremy Parkinson

Finance

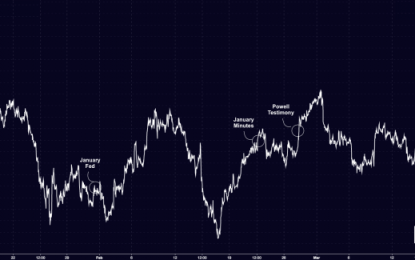

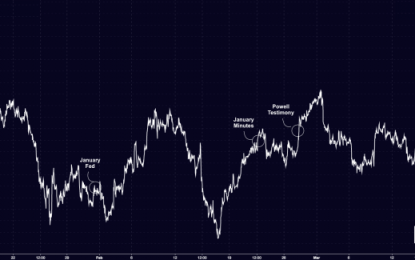

Ok, here comes the main event. There’s been so much written about this over the past two weeks that it would be impossible to try and summarize it (some recent posts here and here and here), but the bottom line is that all eyes are first and foremost on the median 2018 dot (four or three?). Then there’s the growth […]

Banks, Brokers Spike Higher After Fed Hikes Rates

Mar 21, 2018

Jeremy Parkinson

Finance

Shares of U.S. banks and brokerage firms are rallying after The Federal Reserve hiked its benchmark interest rate by a quarter-point to a range of 1.5%-1.75%. The financial sector’s profitability increases with higher interest rates. Retail banks, commercial banks, investment banks, insurance companies, and brokerages have large cash holdings due to customer balances. Interest rate […]

Can Energy ETFs Rebound On Middle East Tension?

Mar 21, 2018

Jeremy Parkinson

Finance

Oil price is recoiling this month after ending a five-month streak of gains in February. This is especially true, as some positive sentiments have again started to build up in the oil market, which were under pressure from growing U.S. crude production. In fact, oil price climbed more than 2% in the last trading session […]

Fed Hikes Quarter Point, Raises Economic Forecast

Mar 21, 2018

Jeremy Parkinson

Finance

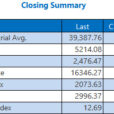

As expected, the Fed hiked a quarter of a point. Growth projections are up from December. The Fed anticipates three rate hikes this year. Here is a summary of Economic Projections. The FOMC Statement was pure boilerplate. Nonetheless, mainstream media pored over every word as if it matters. Here is some nonsense courtesy of Bloomberg. In another change to […]

E

Solar Energy Stock Rally Following CSIQ Results

Mar 21, 2018

Jeremy Parkinson

Finance

The shares of solar stocks have been on fire this week after Canadian Solar (CSIQ) reported higher than expected profits and provided guidance that beat expectations on Monday. Despite its name, Canadian Solar owns and operates multiple factories in China. The solar panel maker’s earnings per share came in at $1.01, versus the consensus outlook […]

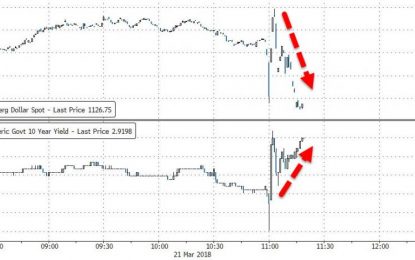

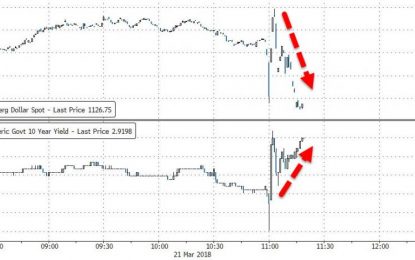

Banks, Bullion, & Bond Yields Jump As Hawkish Fed Sends Dollar Lower

Mar 21, 2018

Jeremy Parkinson

Finance

Baffle ’em with bullshit is working… The Fed hawkishly raised its rate-hike trajectory, raised GDP growth expectations, left the inflation outlook alone, but talked down the economic outlook in its statement – Powell has some ‘splaining to do. The Dollar index is lower (hawkish Fed statement) and bond yields only marginally higher… Banks are surging along with […]

E

FANGs’ Role In The Bull Run Is Overstated

Mar 21, 2018

Jeremy Parkinson

Finance

It is no secret that the strength of the hottest tech stocks really carried the market’s water over the last year or so. The so-called FANG stocks, in any of a number of iterations, outpaced the major indices and by some measures now account for a whopping 46% of the market value of the Nasdaq-100 […]