Bitcoin BTC/USD Elliott Wave View Calling For Rally Toward $15.000

Mar 12, 2018

Jeremy Parkinson

Finance

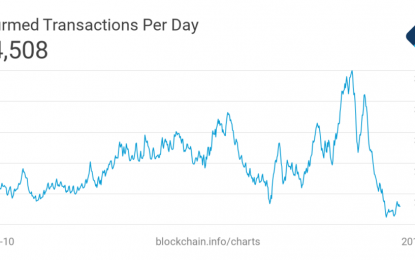

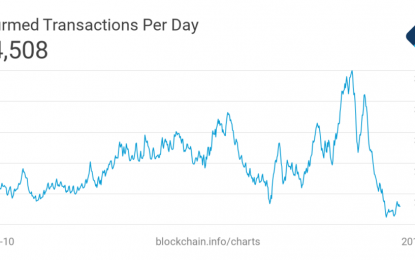

Since all-time high in December 2017, Bitcoin BTC/USD ( Value in US Dollar ) dropped 70% before finally bottoming around $6590 on the 6th of February 2018. The big decline drove fear into the digital market as many new investors/traders lost their money during that period so they decided to stay away and avoid further […]

Trends For New Home Sale Prices At The Beginning Of 2018

Mar 12, 2018

Jeremy Parkinson

Finance

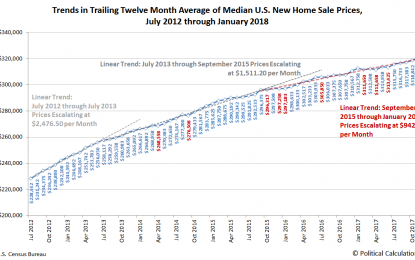

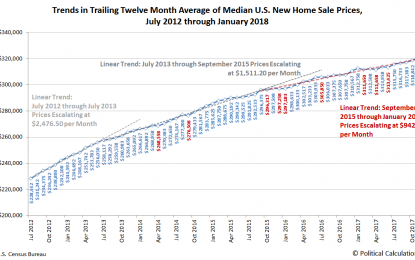

At the beginning of 2018, we find that median new home sale prices are continuing to follow the upward trajectory that they have since September 2015, where they are escalating at an average rate of $942 each month. That steady pace of growth is the slowest rate of change for median new home sale […]

Asian Markets Head Higher On U.S. Jobs Data

Mar 12, 2018

Jeremy Parkinson

Finance

Asian stock markets started the week higher on Monday morning after Friday’s strong U.S. jobs eased inflation fears and increased risk appetites. Nonfarm payroll data out Friday showed that 313,000 jobs were created in February, the highest increase in over 18 months, and a number well above Reuters’ prediction of 200,000 jobs. Hourly earnings were […]

E

Market Direction Is No Longer Important

Mar 12, 2018

Jeremy Parkinson

Finance

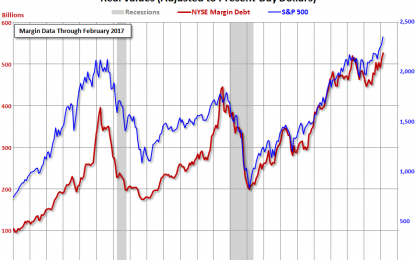

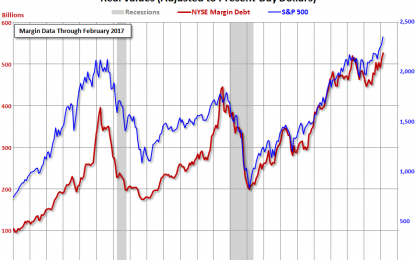

In February of 2018 the financial dam welling up all asset prices sprang a leak, demonstrating to newer investors that markets can actually go down – a lot, and fast. However, the Fed’s derivative finger was quickly applied to plug up the hole, and financial waters again started to rise toward their previous level. With […]

Stocks To Trade: GNTX, EWBC, NAV

Mar 12, 2018

Jeremy Parkinson

Finance

Monday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Long Gentex (GNTX) Long East West Bancorp (EWBC) Short Navistar (NAV)

Best And Worst S&P 500 Stocks Of The Bull Market

Mar 12, 2018

Jeremy Parkinson

Finance

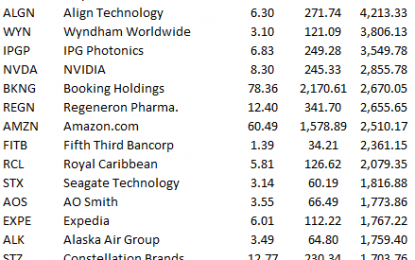

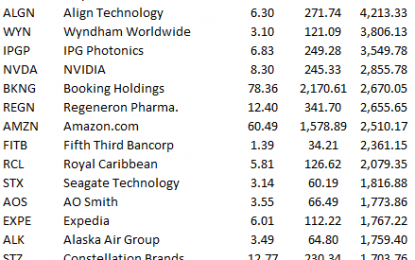

To commemorate the nine-year anniversary of the bull market, in an earlier post, we highlighted the best and worst performing stocks of the bull market that began on 3/9/09. The first list below highlights the 25 top performing current members of the S&P 500 since the bear market low in March 2009. The best performer of […]

Sentiment Snapshot: Fundamentally Sound

Mar 12, 2018

Jeremy Parkinson

Finance

Price by itself can very quickly change the tone in markets, and we saw a very clear example of that in the latest weekly sentiment survey on Twitter. With the S&P 500 closing above its 50-day moving average on Friday and apparently completing a so-called “W-shaped recovery”, technicals-sentiment rebounded sharply on the week. Fundamentals sentiment also rebounded […]

Crude Oil Price Rise May Stall On EIA Drilling Data

Mar 12, 2018

Jeremy Parkinson

Finance

Crude oil prices shot higher as February’s US labor-market statistics showed wage inflation dropped back to 2.6 percent, hinting January’s spike may have been a one-off and easing worries about a steep Fed rate hike cycle. That bolstered risk appetite, sending the WTI benchmark higher alongside the bellwether S&P 500 stock index. Gold prices also gained as the outcome weighed on […]

There Is No “Free Trade”–There Is Only The Darwinian Game Of Trade

Mar 12, 2018

Jeremy Parkinson

Finance

Rising income and wealth inequality is causally linked to globalization and the expansion of Darwinian trade and capital flows. Stripped of lofty-sounding abstractions such as comparative advantage, trade boils down to four Darwinian goals: 1. Find foreign markets to absorb excess production, i.e. where excess production can be dumped. 2. Extract foreign resources at low prices. […]

AUD/USD Daily Analysis – Monday, March 12

Mar 12, 2018

Jeremy Parkinson

Finance

AUD/USD broke above 0.7842 resistance, suggesting that the uptrend from 0.7712 has resumed. Further rally could be expected in a couple of days and next target would be at 0.7930 area. Support level is now at 0.7772, only a breakdown below this level could trigger another fall towards 0.7600.