GDP Forecasts Sink After Outstanding Jobs Report: GDPNow Vs Nowcast

Mar 11, 2018

Jeremy Parkinson

Finance

The latest GDP forecasts put in a big question of the strength of the economy. Friday’s jobs report looked pretty good, didn’t it? Interestingly, the GDP forecasts did not think much of it, and neither did I. The chart is amusing. Nowcast seems impervious to darn near anything while GDPNow likes to swing wildly while steadily trending […]

Bitcoin, Ethereum, Litecoin: Concerning Or Exciting?

Mar 11, 2018

Jeremy Parkinson

Finance

Cryptocurrencies recovered somehow early March but they are now falling again. It’s getting frustrated for crypto investors. They are asking us how concerning this is. In other words, time to sell cryptocurrencies or is this a buy opportunity which should make crypto investors excited? We will address this question in this article. After dropping below […]

Weekly Trading Forecast: Key US Data Brings Fed Outlook In Focus

Mar 11, 2018

Jeremy Parkinson

Finance

Financial markets may turn their attention back to the Federal Reserve as critical economic data crosses the wires in the week ahead. US Dollar Forecast: Burning Coals and US Treasuries: USD Remains in the Fiscal Cross-Fire The US Dollar continues to struggle with strength; and next week brings inflation figures ahead of a widely-expected rate hike in […]

How Trump’s Tariffs Are ‘Perversely’ Consistent With China’s Medium-Term Goals

Mar 11, 2018

Jeremy Parkinson

Finance

On Saturday, we asked if Trump’s trade wars are “fake news“. That was just a kind of off-the-cuff post aimed at highlighting the following commentary from Goldman which suggests that while the market is pricing in the impact from the narrow steel and aluminum tariffs, no one seems particularly concerned about an imminent escalation: Beyond […]

Tom Cloud Precious Metals Market Update: March 2018

Mar 11, 2018

Jeremy Parkinson

Finance

In the newest update, Tom Cloud discusses what is going on in the precious metals market in March. He explains that while the small retail investor has pulled back on gold and silver buying, his company has seen the biggest purchases by larger investors.This makes perfect sense because the smaller retail investor tends to purchase […]

Weighing The Week Ahead: How Stocks Can Ignore Political Turmoil

Mar 11, 2018

Jeremy Parkinson

Finance

The economic calendar is normal with emphasis on inflation data and housing news. These routine reports continue in the background as the Washington headlines continue. We would all like to focus on markets, but the daily news flow emphasizes the turmoil. Many people are asking: How can markets ignore the political turmoil? Last Week Recap […]

Energy Infrastructure Needs A Catalyst

Mar 11, 2018

Jeremy Parkinson

Finance

Last week we spent a couple of days with Catalyst Funds at their annual sales conference. Catalyst CEO Jerry Szilagyi has been a great partner for our MLP mutual fund, and we were asked to host eight roundtable discussions with the wholesalers who market it. We have developed many great relationships with them over the […]

3 ‘Strong Buy’ Biotechs That Can Double In 2018

Mar 11, 2018

Jeremy Parkinson

Finance

Here are three stocks that analysts say are primed for huge out-sized growth in the next 12 months. Biotech stocks often present intriguing investment opportunities- although the rewards can be quickly eradicated if key regulatory approvals are delayed or refused. To minimize the risk, we specifically searched for stocks with a high degree of confidence from […]

Warnings Of A New Credit Crisis And The Potential For System Wide Bail-In Push

Mar 11, 2018

Jeremy Parkinson

Finance

Alternative analysts are often shunned in their views that the ‘world is ending’ when it comes to the financial system, and this despite the fact that those who correctly forecast the bursting of the housing bubble and subsequent credit crisis were dead on in their assertions. But while many of these same prognosticators have so […]

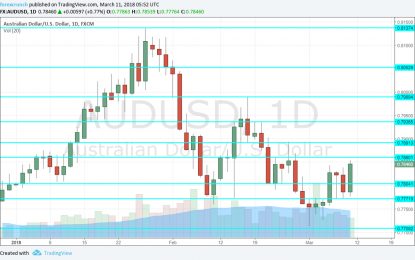

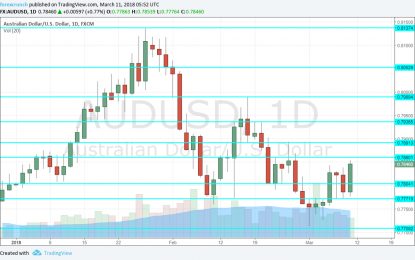

AUD/USD Forecast Mar. 12-16

Mar 11, 2018

Jeremy Parkinson

Finance

The Australian dollar managed to recover mostly thanks to hopes that the Trump tariffs are not so bad and despite not-so-great Australian data. Can it continue higher? Speeches by RBA members and an important Chinese figure stand out. Here are the highlights of the week and an updated technical analysis for AUD/USD. The Australian economy grew by […]