EC

Is Cash No Longer Trash?

Mar 11, 2018

Jeremy Parkinson

Finance

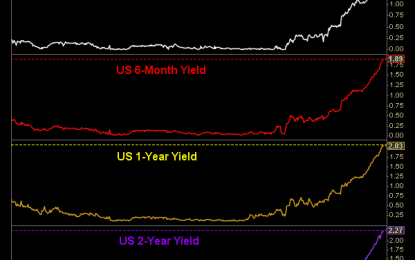

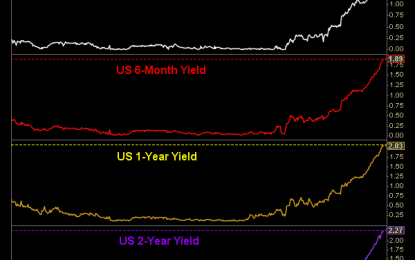

Short-term bond yields (1-month through 3-years) are hitting their highest levels in over 9 years. Why? The market (Fed Funds Futures) is expecting the Federal Reserve to hike rates 3 more times in 2018: a 25 basis point move in March, a 25 basis point move in June, and a 25 basis point move in […]

The New Fama Puzzle, Post-ZLB

Mar 11, 2018

Jeremy Parkinson

Finance

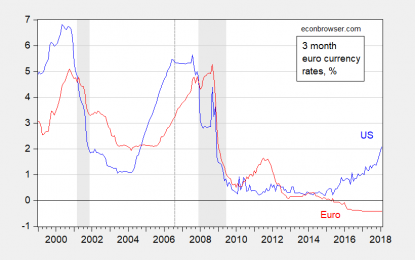

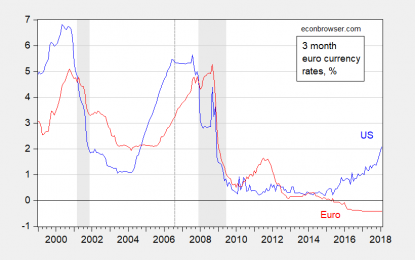

In a previous post, I documented the fact that the Fama puzzle had transformed post-global financial crisis, so that for most currency pairs, interest rate differentials pointed in the right direction for subsequent exchange rate depreciation, from 2006 through end-2015 (Bussiere, Chinn, Ferrara, Heipertz (2018)). Here I show that the new puzzle persists through the […]

Will Participation Be Enough?

Mar 10, 2018

Jeremy Parkinson

Finance

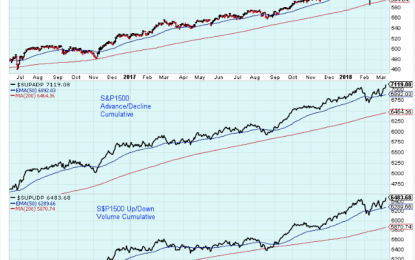

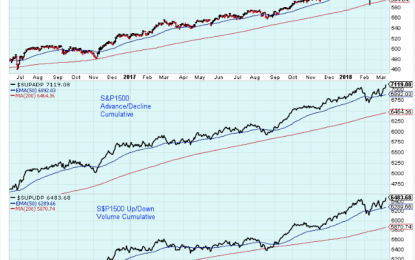

All I have energy for today is to post one of my favorite charts, and to make just a few comments. The NASDAQ is hitting new highs. Technology stocks are looking very strong, and they are helping to pull the market higher. New 52-week lows have pulled way back, and new 52-week highs are starting […]

10 High Probability Swing Trades

Mar 10, 2018

Jeremy Parkinson

Finance

Running length 00:15:37

Japanse Yen Vulnerable As Anxious Markets Find Relief

Mar 10, 2018

Jeremy Parkinson

Finance

Fundamental Forecast for the Japanese Yen: Neutral Japanese Yen suffers first drop in a month as sentiment risks recede BOJ forcefully pushing back against stimulus unwinding speculation On-trend US data unlikely to sour risk appetite, leaving Yen at risk After a month of steady gains, the Yen began last week perched at the highest level since mid-2017. Investors […]

Here’s Why Short-Term Muni Bond ETFs Might Seem Appealing

Mar 10, 2018

Jeremy Parkinson

Finance

The United States municipal bond market has grown in assets in the final quarter of 2017. It inched up to $3.851 trillion in the fourth quarter from $3.809 trillion in the previous quarter, per a quarterly report from the Federal Reserve. Although municipal bonds are not considered by investors when looking for market-beating returns, the current […]

Jim Grant On The Bond Bear Market, Jerome Powell And Much More

Mar 10, 2018

Jeremy Parkinson

Finance

Everyone wants to talk about rates these days and it’s no mystery why. The Fed is under new leadership at a pivotal juncture. Balance sheet rundown has commenced and the Trump administration has embarked on what multiple sellside desks (see here, here, and here for a few takes) have described as an ill-advised quest to try and supercharge an already […]

Tesla: Profit Taking Time?

Mar 10, 2018

Jeremy Parkinson

Finance

Tesla (Nasdaq:TSLA) could be on the brink of getting Model 3 production on track, but that provides investors with a great selling opportunity. This comes from Morgan Stanley’s Adam Jonas, who cites longer-term concerns about increasing competition. He reiterates his Equal Weight rating and $379 price target on the stock. “We have substantially higher conviction… that the company […]

Stocks Rally Despite Tariff Announcement

Mar 10, 2018

Jeremy Parkinson

Finance

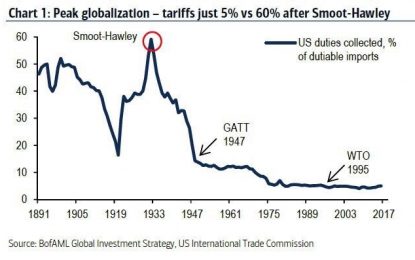

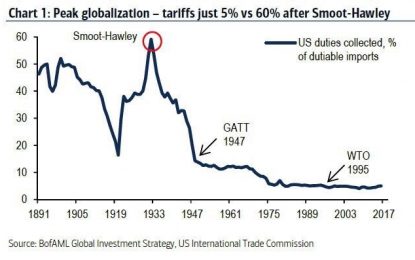

Last week some feared a trade war, a recession, and a bear market. This week all of that has been forgotten as the S&P 500 was up 0.45% on Thursday which was the day of the tariff announcement. President Trump announced that a 25% tariff on steel and a 10% tariff on aluminum would be […]

Citi Asks A Striking Question: We All Know How This Ends, So Why Are We So Slow To Price It In?

Mar 10, 2018

Jeremy Parkinson

Finance

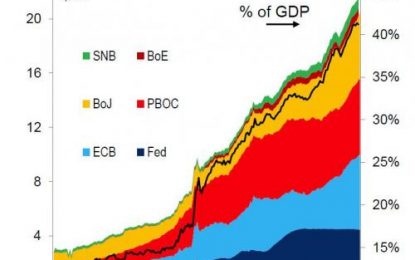

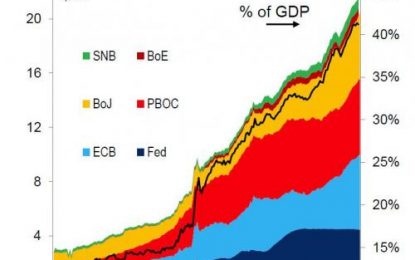

Earlier today, we showed that on the 9th anniversary of the so-called “bull market”, central bank balance sheet accounted for over 40% of global GDP, amounting to no less than $21 trillion. That in itself, should explain why the “most hated bull market” of all time is not a bull market at all, but the world’s biggest […]