The AUD/USD At 0.78? Well That Escalated Quickly

Jul 17, 2017

Jeremy Parkinson

Finance

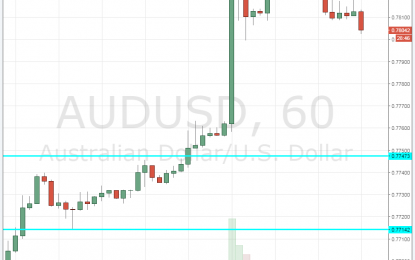

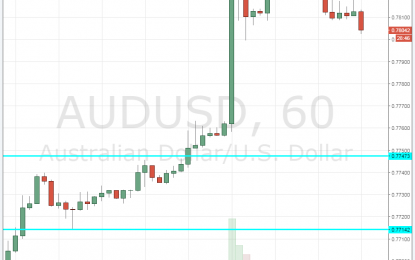

The Australian dollar shot up to 0.7834 AUD/USD following poor and disappointing US economic and inflation data released on Friday. This inflation data is likely to complicate the Fed’s path of monetary tightening and retail data suggests that Americans are pulling back their spending. The discouraging data indicated that last month was only the fifth […]

GBP/USD Breaks Above Key 1.30 Resistance With Sturdy Impulse

Jul 17, 2017

Jeremy Parkinson

Finance

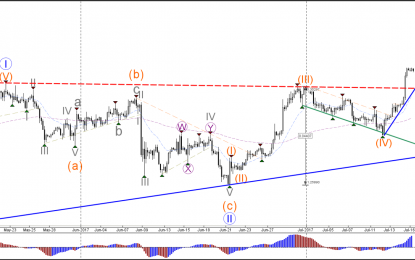

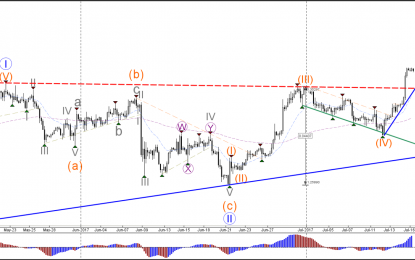

GBP/USD 4 hour The GBP/USD broke sturdily above the previous top which is indicated by the dotted red trend line. The breakout candle is showing strong momentum, which could indicate that the Cable could continue towards the Fibonacci targets of wave 5 vs 1+3. 1 hour The GBP/USD is in a wave 3 (purple) momentum […]

Why Jobs Growth No Longer Induces Wage Growth In America

Jul 17, 2017

Jeremy Parkinson

Finance

Or The Eclipse of the Phillips Curve in America While the Fed’s continued tightening may suppress growth in emerging economies, US labor market may not be as strong as recent reports suggest. US experienced strong job growth in June, when the economy created 222,000 net new jobs, which exceeded analyst expectations. At the Federal Reserve, […]

Macro Mondays: Jensen’s ‘Alpha’

Jul 17, 2017

Jeremy Parkinson

Finance

It’s no coincidence that many investment publications refer to alpha as the end all be all for investors. The reason? It’s an easy way to determine if the investment (namely a mutual fund) is earning the kinds of returns you would expect given a certain level of risk. Risk-adjusted returns are very important to consider […]

Growing Number Of Companies Complain About Inability To Find Workers: So Why Is Wage Growth So Low?

Jul 17, 2017

Jeremy Parkinson

Finance

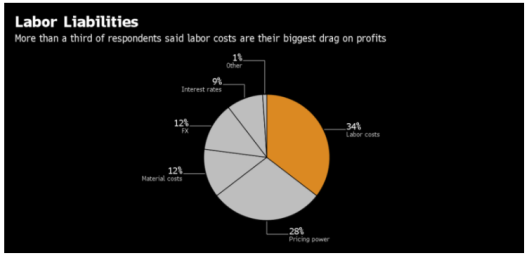

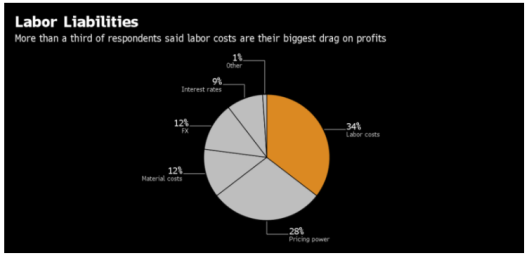

Since 2010, the highest year-over-year wage increase in any month for production and nonsupervisory employees is near 2.6%. For a two-year stretch between summer of 2011 and summer of 2013 wage increases less than 2% were the norm. Yet, firms complain about labor costs while simultaneously complaining about the lack of workers. Bloomberg reports Firms Under Pressure as […]

Chinese GDP Beats With 6.9% – AUD/USD Not Taking Advantage

Jul 17, 2017

Jeremy Parkinson

Finance

The world’s second-largest economy enjoyed solid economic growth at an annualized level of 6.9%, better than 6.8% expected. In addition, industrial output increased by 7.6%, much better than 6.5% expected. Australia exports metals to China, metals which are used in industry and in housing. In theory, the good news should help the Australian dollar. AUD/USD […]

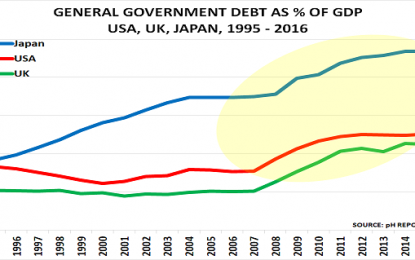

Would You Keep Lending To A Friend Who Proves To Have No Plan To Repay?

Jul 17, 2017

Jeremy Parkinson

Finance

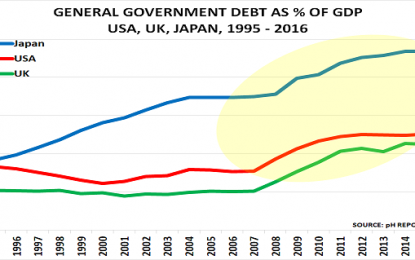

It was almost exactly 10 years ago that then Citibank boss, Chuck Prince, unintentionally highlighted the approach of the subprime crisis with his comment that: ‘We are not scared. We are not panicked. We are not rattled. Our team has been through this before.’ We are ’still dancing’.” On Friday JP Morgan’s CEO, Jamie Dimon, provided a new […]

Sensex Opens Marginally Up; Wipro Gains Over 3.3%

Jul 17, 2017

Jeremy Parkinson

Finance

Asian equities are trading mixed today as investors awaited the release of China’s second-quarter GDP. Hong Kong’s Hang Seng surged over 95 points. China’s Shanghai Composite which is trading at 3,182 has slipped 40 points. The US markets ended the week on a high note. The Dow and S&P 500 hit record highs on Friday after weak economic data dulled prospects of […]

Stocks Watchlist: NOW, NXST, CMCSA

Jul 17, 2017

Jeremy Parkinson

Finance

Today’s stock picks Long ServiceNow (NOW) Long Nexstar Media Group (NXST) Short Comcast (CMCSA)

Euro Waits For Draghi As ECB To Keep Rates Unchanged

Jul 17, 2017

Jeremy Parkinson

Finance

Fundamental Forecast for EUR/USD: Neutral – The ECB meets this week, but it is an off-cycle meeting for staff projections, so no change in policy is expected. ECB President Draghi’s press conference is in the spotlight. – Profit taking in the Euro is possible if the ECB takes issue with the rally in the exchange rate and […]