Deutsche Bank: ‘The Limit Is Near’

Jul 16, 2017

Jeremy Parkinson

Finance

On Thursday, in “The Hurdle Is Lower And The Risk Of A Central Bank F***kup Is Higher – Sound Good?,” we said the following about the rapid rise in DM yields we’ve seen since Mario Draghi tipped the first domino in Sintra late last month: To be sure, there’s something comical about the juxtaposition between […]

Weighing The Week Ahead: Have You “Missed” The Rally?

Jul 16, 2017

Jeremy Parkinson

Finance

There was something of a change in tone last week. There is more recognition of improving conditions. With a tailwind from improving earnings, more will be wondering: What if you have missed the rally? Last Week Recap Last week began with stories about revised targets for the market and ended with Fed speculation. The market […]

Upcoming Earnings Reports To Watch: NFLX, GS, QCOM, MSFT

Jul 16, 2017

Jeremy Parkinson

Finance

Q2 earnings season is finally here, and the next few weeks promise to be extremely busy throughout the global markets. As always, these earnings reports will give us a better picture of the latest consumer trends and the overall state of the economy, which means it’s incredibly important for investors to stay tuned in right […]

Emerging Markets & Basic Materials Breaking Out Together

Jul 15, 2017

Jeremy Parkinson

Finance

While most members are focused on the precious metals, I’ve been waiting patiently for two other sectors to setup a long term buy signal which I believe happened last week. I know you are well aware of my mantra that big consolidation patterns lead to big impulse moves. What’s pretty amazing is these two sectors have […]

Real Estate And Housing News – Saturday, July 15

Jul 15, 2017

Jeremy Parkinson

Finance

We discuss the poor performance of Mortgage Applications (Bad Yearly Comps – remember where the 30-Year Bond was after the Brexit Vote) some good and bad news for Houston Real Estate, and the return of the securitization market for subprime residential mortgages in this market video. There is too much capital sloshing around the […]

U.S. Fed Speaks, Markets Disconnect. What’s Wrong?

Jul 15, 2017

Jeremy Parkinson

Finance

The U.S. Fed talks, markets move. That’s how it has always gone in the past. The question is: what to make out of it? Or, stated differently, does it make sense to even try to make something out of it? First, let’s see what exactly the message of the U.S. Fed was, specifically on Thursday […]

US Restaurant Industry Stuck In Worst Collapse Since 2009

Jul 15, 2017

Jeremy Parkinson

Finance

One month after we reported that the “restaurant industry hasn’t reported a positive month since February 2016”, we can add one more month to the running total: according to the latest update from Black Box Intelligence’s TDn2K research, in June both same-store sales and foot traffic “growth” declined once more, dropping by -1% and -3%, respectively, […]

Sunny Outlook For Solar

Jul 15, 2017

Jeremy Parkinson

Finance

Equity markets roared this week, led by the Nasdaq 100 (QQQ). The tech-laden index regained its footing, closing over 3% for the week, (its highest close since Goldman put out its hit job on semiconductors on June 9). The only big swoon last week occurred after Trump, Jr. released e-mails related to the Russian election […]

Building Confidence In Q2 Earnings: 4 Housing Stocks

Jul 15, 2017

Jeremy Parkinson

Finance

The Q2 earnings season is gathering steam with 15.4% of the construction companies having already released their numbers. And they’re unblemished with earnings as well as a revenue beat ratio of 100%. Major homebuilders such as KB Home (KBH – Free Report) , Lennar Corp. (LEN – Free Report) and Toll Brothers Inc. (TOL – Free Report) have outperformed the Zacks Consensus Estimate by 26.92%, 16.67% and […]

E

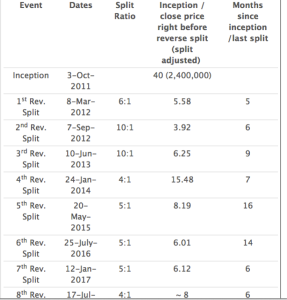

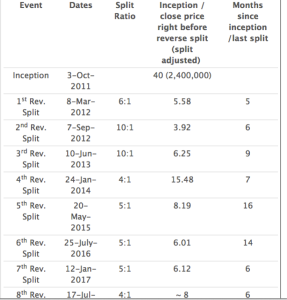

Managing VIX-Leveraged ETPs Through Earnings Season, Political Strife And A Frothy Market

Jul 15, 2017

Jeremy Parkinson

Finance

In 2015, I penned my first article on the subject matter surrounding VIX-leveraged ETF/ETNs. Back then, as if it were that long ago, there really weren’t too many well-articulated articles and practical insights for utilizing these instruments to help one boost their portfolio’s performance. Since I had some writing experience, understanding and grammar skills I […]