(In)stability In One Chart

Jul 16, 2017

Jeremy Parkinson

Finance

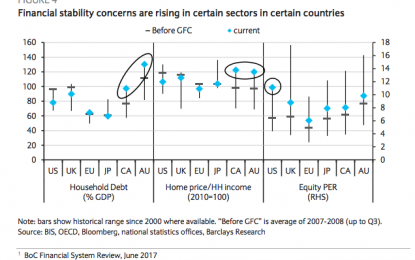

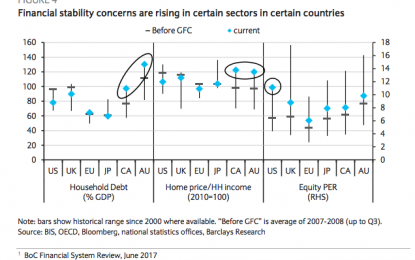

Some folks have begun to suspect that the coordinated hawkish rhetoric by DM central bankers which began to take on a new sense of urgency on June 27 in Sintra, Portugal might be tied to the pursuit of a “shadow” mandate. More colloquially, quite a few observers are convinced that the seemingly inexplicable hawkish tilt […]

Trading Support And Resistance – Sunday, July 16

Jul 16, 2017

Jeremy Parkinson

Finance

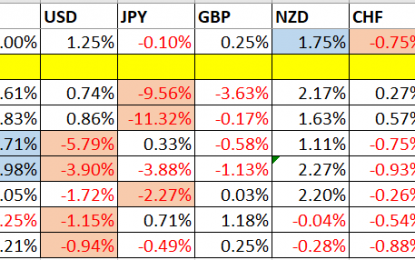

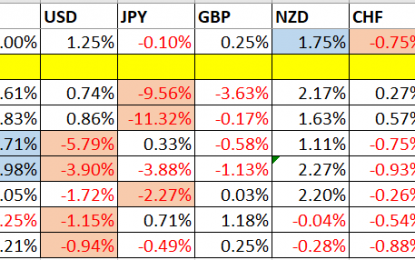

This week we’ll begin with our monthly and weekly forecasts of the currency pairs worth watching. The first part of our forecast is based upon our research of the past 11 years of Forex prices, which show that the following methodologies have all produced profitable results: ·Trading the two currencies that are trending the most strongly over […]

Forex Strength And Comparison Week 29 / 2017

Jul 16, 2017

Jeremy Parkinson

Finance

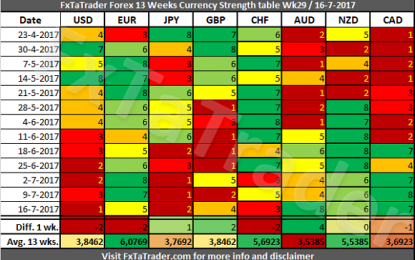

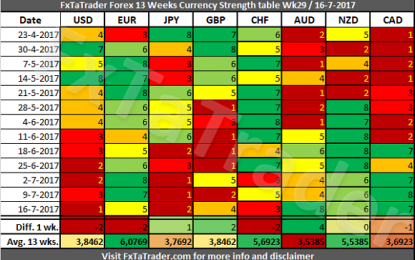

In the Currency Strength table, the AUD was the strongest currency while the USD was the weakest. There were some significant changes last week with the AUD gaining 4 points and the USD, EUR, CHF losing 2 points. The other currencies remained around the same level of last week with a maximum change in the strength of just 1 […]

The 3 Hottest Market Trends Of Summer 2017

Jul 16, 2017

Jeremy Parkinson

Finance

Although the focus of most financial sites and analysts is on banking stocks and all-time highs in the major U.S. indexes we are focused on different segments in the market. However, InvestingHaven readers know much better as they are informed of the hottest trends and breakouts as they arise (even before they arise). Our top 3 for summer […]

Next Target 2500

Jul 16, 2017

Jeremy Parkinson

Finance

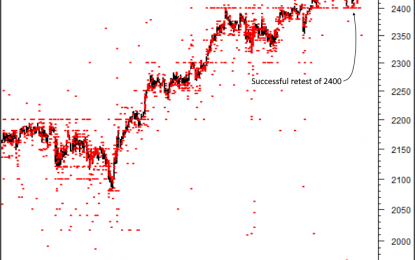

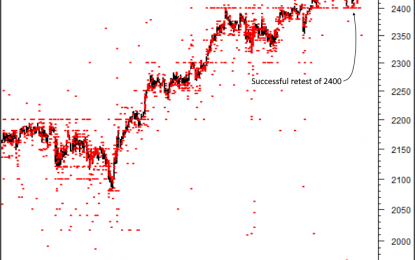

The S&P 500 Index (SPX) held the level everyone was watching and tweeting at 2400. Then it cleared the Twitter resistance level at 2450. Now, traders are tweeting 2500 as the next stop. Not only did SPX hold above support, it held above its uptrending sentiment line. This indicates we should continue to rally (probably […]

Wall Street & Yellen Finally Coming Around To Our Way Of Thinking

Jul 16, 2017

Jeremy Parkinson

Finance

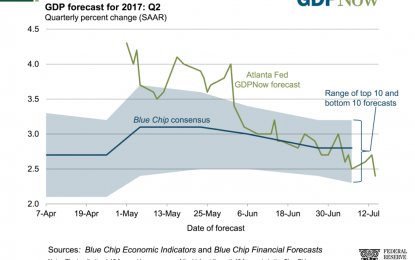

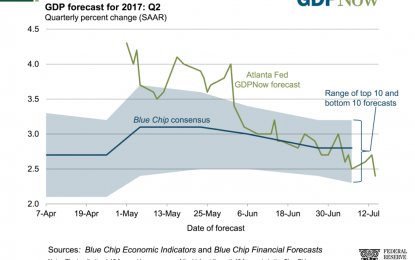

Well, among a host of data reports and political developments that came at us last week, among the most important was the fact that Fed Chairwoman Janet Yellen finally copped to the fact that the domestic economy is indeed moderating. It’s a drum we’ve been banging for some time here at Tematica Research, and like the […]

Our Fake Economy

Jul 16, 2017

Jeremy Parkinson

Finance

Video length 00:16:12. Dr. Mark Thornton joins Mises Weekends to explain the “business cycle” for what it really is: a series of booms (credit expansion) and busts (debt de-leveraging) engineered by central banks. There’s nothing natural, real, or sustainable about the current Yellen boom—so stay tuned for Mark’s explanation of how it can all unravel.

A Look At Gold And Silver Sentiment

Jul 16, 2017

Jeremy Parkinson

Finance

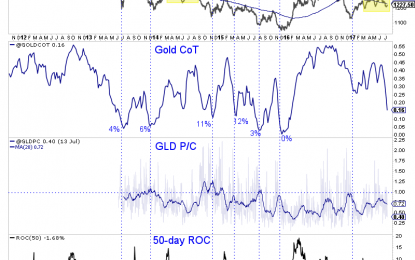

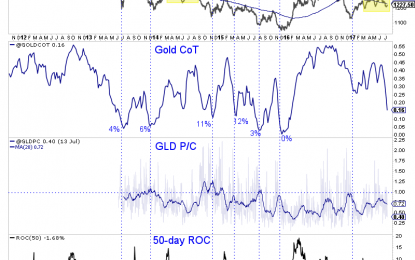

Disaster in precious metals land has been averted (for now) as the market unwinds what appears to be sudden excessive bearish sentiment. Surveys such as the daily sentiment index reached single digit levels for Gold and Silver (the previous week) while the net speculative position in Gold and Silver has declined dramatically in recent weeks. […]

Hedge Fund CIO: “We’ve Realized Roughly 3 Years Of Gains In The First 6 Months Of 2017”

Jul 16, 2017

Jeremy Parkinson

Finance

As part of the local Sunday ritual, here is Eric Peters with his latest Weekend Notes, providing some context on recent, and not so recent market moves. Weekend Notes “US stocks rise roughly 7% per year,” he said. “Same holds true for Australia; basically, for all economies uninterrupted by catastrophic war at home.” The 7% […]

‘The Impulses Turn Negative’: Goldman Warns On Emerging Markets

Jul 16, 2017

Jeremy Parkinson

Finance

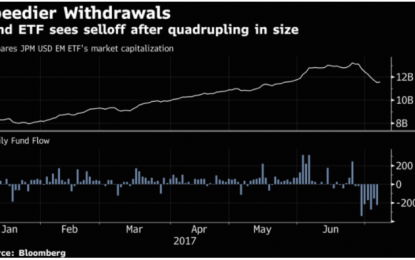

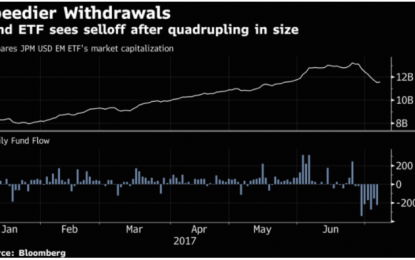

We’ve written a ton here lately about the exceedingly long-in-the-tooth rally in all things emerging markets. The space’s YTD outperformance makes sense on some levels but flies in the face of reason on others. Yes, the carry trader’s paradise created by DM central banks and the attendant global hunt for yield is in many respects […]