The Pullback That Never Was

Jul 25, 2017

Jeremy Parkinson

Finance

3 days of selling of less than one point per day That is what SPX has averaged over the course of the last three days when it finished lower each day – less than one measily point. For the bears that has to be infuriating. I don’t blame them – I would be too, if I […]

Top 5 Things Happening In The Market Today

Jul 25, 2017

Jeremy Parkinson

Finance

Top 5 Things to Know Before You Start Trading This Tuesday the market sees a higher JPY while the USD still struggles. Oil and gold are higher. 1 – USD Still Struggling The US dollar (USD) decline slowed yesterday but the overall picture for the US currency didn’t improve. Today’s eco data will probably only be of […]

Pound, Euro Suddenly Surge, Trump Tweets ‘Very Big, Exciting’ Trade Deal With UK

Jul 25, 2017

Jeremy Parkinson

Finance

After regaining its footing while bumping around at a 14-month low on Monday, the broad dollar is sliding hard despite rising Treasury yields as the pound and the euro soar. In fact, the dollar is now lower versus all of its G-10 peers except for the yen, which is trading as usual off Treasury yields. […]

Doc Copper: Breakout Of 6-Year Resistance In Play

Jul 25, 2017

Jeremy Parkinson

Finance

Below looks at Copper Futures on a monthly basis, since the late 1980’s. A good deal of the past 30-years, Doc Copper has remained inside of rising channel (1), reflecting that the long-term trend is up. The top of this channel was hit back in 2011 and since then, Doc Copper has created a series of lower […]

Stirring The Sentiment Tea Leaves Redux

Jul 25, 2017

Jeremy Parkinson

Finance

Despite the Volatility Index (VIX) currently operating at the low end of historical ranges (9.36), the equity markets operate on a perpetual volatility rollercoaster. This period of relative calm has not stopped participants from searching for the Holy Grail of indicators in hopes of determining whether the next large move in the markets is upwards […]

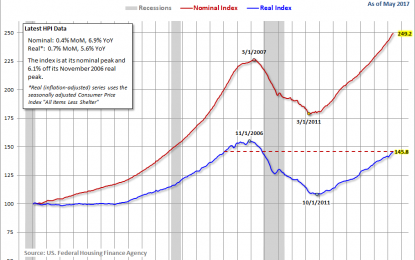

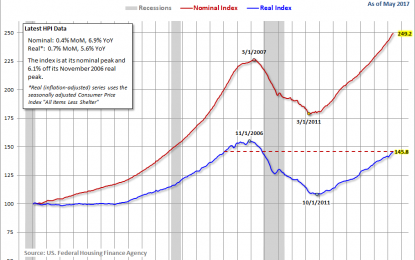

FHFA House Price Index: Real Index Level Last Seen In August 2007

Jul 25, 2017

Jeremy Parkinson

Finance

The Federal Housing Finance Agency (FHFA) has released its U.S. House Price Index (HPI) for May. Here is the opening of the report: Washington, DC – U.S. house prices rose in May, up 0.4 percent from the previous month, according to the Federal Housing Finance Agency (FHFA) seasonally adjusted monthly House Price Index (HPI). The previously reported 0.7 […]

Okta Delivers A Strong Quarter And A Strong IPO

Jul 25, 2017

Jeremy Parkinson

Finance

According to Stratistics MRC, the Global Identity & Access Management market is estimated to grow 15% annually from $7.94 billion in 2016 to $20.87 billion by 2022. Earlier this year, Identity and Access Management services provider Okta (Nasdaq:OKTA) went public. The listing of the San Francisco-based company appears to be doing well so far. Okta’s Financials […]

Another Turmoil In Trump Administration And Gold

Jul 25, 2017

Jeremy Parkinson

Finance

On Friday, Trump’s press secretary Sean Spicer resigned. What does it mean for the gold market? You can say a lot about Trump’s administration, but one thing is certain: it does not run too smoothly – on the contrary, it sees a high rate of staff turnover. As a reminder, as early as in February, […]

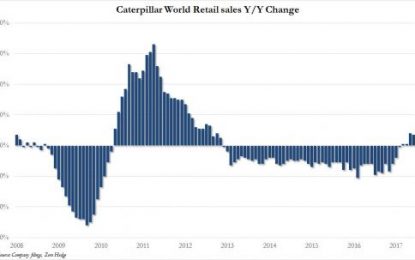

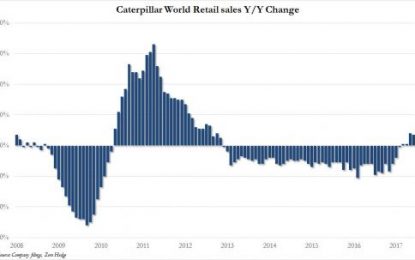

Caterpillar Hits All Time High After Raising Guidance On Chinese Construction Boom

Jul 25, 2017

Jeremy Parkinson

Finance

As is customary for the heavy-industrial equipment manufacturer, Caterpillar (CAT) yesterday reported its retail sales, one day ahead of earnings, and as we discussed, the number was solid with Caterpillar reporting the longest positive streak in retail sales going back 51 months. It was also a hint as to what the Dow-member would report today for its […]

Crude Oil: Extends Recovery, Eyes 47.71 Zone

Jul 25, 2017

Jeremy Parkinson

Finance

Crude oil: With the commodity taking back most of Friday losses on Monday and following through higher on Tuesday, a follow through higher is envisaged in the days ahead. On the downside, support resides at the 46.50 level where a break will expose the 46.00 level. A cut through here will set the stage for […]